From an Article by Mike Tony, Charleston Gazette Mail, April 30, 2022

The WV well inspection staff dwindling from 18 to nine in the past two years on the Legislature’s watch has concerned not just environmentalists but royalty owners who see a corrosive connection between the state’s well inspector shortage and a growing orphaned well problem.

“[Inspectors] may spot problems that can be fixed to keep the well from becoming essentially uneconomic or they could spot a well that needs to be plugged,” West Virginia Royalty Owners Association President Tom Huber said. “As these wells grow older and older and older, that’s when they become orphaned, and then there’s no one to go after to get to plug the well.”

The Ohio River Valley Institute cited an analysis of more than 20,000 Diversified wells in Pennsylvania in observing a sharp decline in company-reported methane emissions post-acquisition.

Diversified reported a well was inaccessible for testing for leakage more than 3,200 times after wells associated with those reports were reported accessible by previous well owners more than 2,000 times the previous year. “Interestingly, [previous ownership] could get to the wellhead,” report author and Cornell University engineering professor emeritus Anthony Ingraffea said. “So I guess the trees grew up very, very quickly after Diversified acquired the wells.” Last year, Bloomberg Green reported it found methane leaks at most of 44 Diversified well sites it visited, including eight in West Virginia.

Diversified reported retiring 136 wells in 2021, exceeding its requirements of plugging 80 wells in West Virginia, Pennsylvania, Kentucky and Ohio and moving the company closer to a stated goal of plugging 200 wells across Appalachia by 2023, according to its 2021 annual report.

In a statement, Paul Espenan, vice president of environmental health and safety at Diversified, defended the company’s environmental record. Espenan said the company has invested in pursuing opportunities to use excess plugging capacity to support other operator retirements. Espenan said recent company efforts to equip well tenders with handheld methane detection devices, deploy aerial leak surveys and upgrade equipment resulted in year-over-year reductions in methane intensity as the company works toward a target of net-zero greenhouse gas emissions by 2040. “Sustainability is core to our unique approach as a responsible operator that unlocks value, delivers free cash flow and is committed to asset stewardship through the full life of acquired, low-decline producing assets,” Espenan said.

The 136 wells retired last year represent less than half of 1% of all the wells in Diversified’s portfolio. The company said in its 2021 annual report that it established an in-house plugging team in West Virginia last year.

Diversified and its subsidiaries have 22,876 non-plugged wells in West Virginia, DEP spokesman Terry Fletcher said. Diversified-owned companies have plugged roughly 130 wells in the state since 2018, Fletcher said. The DEP estimates that older wells that have been poorly maintained will likely total over $100,000 in plugging costs. New wells that have been properly maintained cost a few tens of thousands of dollars, per the agency.

The state’s Oil and Gas Abandoned Well Plugging Fund, created in 2020 by House Bill 4090 to pay for reclaiming abandoned wells without a responsible operator, has a balance of $1.86 million, Fletcher said – a fraction of Carbon Tracker’s $7.6 billion estimate of the cost to plug wells that ceased production in West Virginia.

The Office of Oil and Gas reports about 6,300 documented orphaned wells and estimates an additional 9,000 undocumented orphan wells statewide. The plugging workload for even a small portion of Diversified wells would be unlike anything the state has ever tackled before. A study last year by the Interstate Oil & Gas Compact Commission noted that West Virginia funded plugging of three orphan wells in the state from 2018 to 2020.

A total of 472 wells have been plugged under the state’s program, according to the report by the Interstate Oil & Gas Compact Commission, a multistate governmental entity that promotes what it calls efficient recovery of oil and gas resources and environmental health. Fletcher said DEP records indicate that state-funded well plugging has been occurring since at least 1993.

The DEP expects to plug 160 orphaned wells — roughly 1% of its statewide orphaned well estimate — in the initial grant phase of the Infrastructure Investment and Jobs Act enacted in November, under which states are eligible to receive up to $25 million for cleaning up orphaned oil and gas wells. Fletcher has said the DEP is identifying all areas where staff can be increased given the Office of Oil and Gas’ personnel shortage.

The state Legislature has failed to adopt bills that would restore the Office of Oil and Gas to its previous personnel level despite pressure from environmental, surface and royalty owner advocates to shore up the office’s funding.

The Governor’s Office did not respond to a request for comment on why the office did not add any measures addressing the inspector shortage to the agenda of last week’s special legislative session despite the office’s previously stated support for bills that would have increased funding for state oil and gas inspectors. The governor announces the convening of a special session through a written proclamation referred to as a “call” because it calls the Legislature into session. The Legislature cannot take up items outside the call during a special session.

“We want to make sure that these wells, the gas, the oil that is produced, is sold so the royalty owners can be paid royalties on those products and [that the gas and oil] are not wasted through leakage or broken tanks that seep the oil out into the ground,” Huber said. “So we support any effort to add inspectors.”

Burd argued a proposed $100 annual oversight fee for unplugged wells would have been onerous for operators. It would have applied to wells producing 10,000 cubic feet or more of gas daily. The bill stalled in the House after passing the Senate.

“It speaks to a kind of lax regulatory culture in West Virginia, I guess,” May said. The Ohio River Valley Institute has proposed a production fee ranging 3 to 7 cents per thousand cubic feet in West Virginia, Pennsylvania and Ohio over the next 25 years to provide enough funds to decommission most of the states’ unplugged well inventories.

But West Virginia regulators are left to make the most of sweeping federal investments in well reclamation and contend with a projected rise in gas production without strength in numbers. The big numbers are on Diversified’s side — at least for now. “I think more inspectors would mean less orphaned wells, which is a good thing in the long run,” Huber said.

#######+++++++#######+++++++#######

Diversified Set to Track Appalachia Oil, Gas Methane Leaks with Aerial Scans

From an Article by Matthew Veazey, Natural Gas Intelligence, December 8, 2021

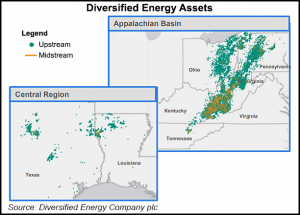

Methane leak detection provider Bridger Photonics has been selected to perform multi-year aerial scans of Diversified Energy Co. plc’s natural gas production and distribution assets, initially in Appalachia.

Bridger plans to deploy its laser imaging, detection and ranging (LiDAR) equipment to track the emissions. “Our Gas Mapping LiDAR technology will efficiently detect, pinpoint and quantify typically more than 90% of basin emissions to inform and streamline Diversified’s repair and maintenance activities,” said Bridger CEO Pete Roos.

Diversified, whose Central Region holdings include the Haynesville and Barnett shales and assets in the Midcontinent, said the LiDAR program would be extended to those assets as well. The company noted that early 2021 field trials of Bridger’s LiDAR technology on a “large segment” of Appalachia pipeline detected fugitive natural gas emissions “well below” 500 parts per million, which is the U.S. Environmental Protection Agency (EPA) leak definition threshold.

Diversified said it would spend $3 million annually over the next three years on LiDAR aerial emissions scanning activities. The total $9 million commitment “supports our near-term goal to reduce our 2020 level methane emissions by 30% by 2026 on the way to net-zero by 2040,” said Diversified CEO Rusty Hutson Jr. “Adding aerial emissions detection to the handheld devices we’ve placed in the hands of our skilled well tenders further enhances our ability to detect and repair fugitive emissions across our asset base.”

By way of proposed changes to the U.S. Clean Air Act, the EPA is seeking to broadly limit methane emissions across oil and gas operations. The new mandate would add covered methane sources at well sites, natural gas gathering and boosting compressor stations, gas processing equipment, as well as transmission and storage equipment.

The Biden administration wants to curb methane emissions from oil and gas operations beyond U.S. territory as well. In November, President Biden hosted his counterparts from Canada and Mexico for a trilateral summit, which featured a pledge to develop a “‘North American strategy on methane and black carbon.’” Also, the Biden administration and the European Union have endorsed a target to cut methane emissions 30% worldwide by 2030.