From an Article by Mike Tony, Charleston Gazette Mail, April 30, 2022

All is often not well when gas wells end.

In 2020, Carbon Tracker, a London-based think tank researching climate change impacts on financial markets, estimated the costs of plugging gas and oil wells that ceased production in West Virginia exceeded $7.6 billion — with bonds totaling just $28.7 million to cover that expense. That same year, a senior advisor to Carbon Tracker reflected on the business model behind thousands of those wells in West Virginia and across Appalachia in a conference call with the Capitol Forum, a corporate news analysis service. The advisor called that business model a “legal Ponzi scheme.” ~~~ “[I]t only works as long as there’s growth and the perception of profitability,” Greg Rogers said.

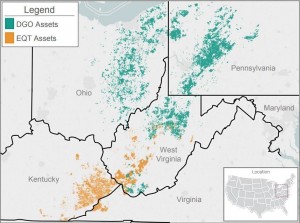

Headquartered in Alabama and led by Lumberport native and cofounder and CEO Rusty Hutson Jr., Diversified Energy has become the largest owner of oil and gas wells in the country. Most of the company’s nearly 70,000 wells are in Appalachia, acquired since 2018 from regional producers such as Pittsburgh-based EQT and Canonsburg, Pennsylvania-based CNX Resources.

“But … if your production is falling on those wells, especially if it’s falling faster than you think, then you’re going to need to continually acquire more and more wells,” Rogers said of Diversified’s business model. “The problem is you’re acquiring more and more liabilities as you do that, these liabilities for the closure.”

“[Diversified’s] business model is built around low decline assets paying out cash flow in the form of dividends to retail investors,” Tom Loughrey wrote in a June 2020 company analysis for Friezo Loughrey Oil Well Partners, an analytics firm serving investors in the oil and gas sector. “The problem with these structures, and why they always fail, is the valuations eventually exceed the future cash flows; the company must replace assets at an increasing rate until hitting the wall.”

States mandate that wells no longer producing gas or oil are plugged and abandoned and that well owners secure a bond or other financial assurance that helps cover the expense of closing wells that aren’t productive anymore. Two recently released reports suggest Diversified’s expanding well portfolio poses long-term risks both to West Virginia’s bottom line and its environmental safety.

The Ohio River Valley Institute, a Johnstown, Pennsylvania-based pro-clean energy nonprofit think tank, published a report April 12 predicting it is highly unlikely Diversified will have enough money to plug and abandon all its wells, citing Diversified company data and federal projections for natural gas prices. Plugging and abandoning costs will be higher than the revenue generated by Diversified’s current well inventory by 2056, the report projects.

The report finds 96% of the company’s producing wells in West Virginia, Pennsylvania, Kentucky and Ohio produce less than five barrels of oil equivalent per day. Wells producing less than that amount are considered financially distressed by the Colorado Oil and Gas Conservation Commission, the report notes. “The numbers just don’t add up,” report co-author and Ohio River Valley Institute research fellow Kathy Hipple said.

A week after that report was released, a Environmental Defense Fund study found low-production well sites like those dominating Diversified’s portfolio are a disproportionately large source of methane emissions. This study published in the peer-reviewed scientific journal Nature Communications found roughly half of all well site methane emissions nationwide come from low-production well sites, which emit six to 12 times as much methane as the average rate for all U.S. well sites.

Methane has a 100-year global warming potential 28 to 36 times that of carbon dioxide, according to the U.S. Environmental Protection Agency, making Diversified’s deepening well footprint across Appalachia a climate concern in addition to a threat to states’ bottom lines. “The percentage of methane emissions is disproportionately high,” said Karan May, senior campaign representative for the Sierra Club in West Virginia. “When I put that together with Diversified, it just scares me for what’s happening in Appalachia particularly.”

Diversified is only the 15th largest producer in Appalachia despite being its largest well owner, Ohio River Valley Institute researchers found, citing Capitol Forum data. “Diversified’s business model is based on harvesting cash flows from its wells and delaying P&A [plugging and abandoning] costs for as long as possible,” the Ohio River Valley Institute report concluded.

Diversified could have 60,000 wells to plug and abandon throughout Appalachia at the end of consent agreements reached with regulators in West Virginia, Pennsylvania, Kentucky and Ohio committing the company to decommissioning some 80 wells annually for the next 15 years.

“[T]hey’ve become too big to fail,” report co-author and Ohio River Valley Institute research fellow Ted Boettner said. The Ohio River Valley Institute report finds that Diversified has used unusual assumptions like implausibly long economic lives of wells though 2095 and an excessively long ramp-up timeline to start plugging and abandoning most of its wells to calculate the value of its asset retirement obligations, liabilities for well plugging and abandoning costs.

The report also says the company appears to be avoiding its obligations to report methane leakage from its wells, citing an analysis of emissions reporting submitted by Diversified for more than 20,000 active wells in Pennsylvania. Ohio River Valley Institute’s researchers and other industry experts anticipate a rapid decline in gas production. That would leave Appalachian states particularly vulnerable to being on the hook for cleaning up thousands of additional orphaned wells.

“[W]hen one company owns so many of these wells, that risk is just huge,” Boettner said. “Who’s going to be left holding that bag? It’s important that our state oil and gas regulators take a huge look at this company and figure out a way to ensure that they can cover these costs.”

West Virginia’s leaders have let the state’s inspection unit responsible for looking after wells statewide atrophy in recent years, declining to shore up funding for well regulators even amid a surge in production. The West Virginia Department of Environmental Protection has reported major manpower shortages in its Office of Oil and Gas, which manages the state’s abandoned well-plugging and reclamation program.

>>>>>>>……………………>>>>>>>>……………………>>>>>>>>