Natural Gas Pipeline Costs Higher than Ever Expected

“GAS PIPELINE COSTS RUN HIGHER” by Andrew Bradford, BTU Analytics, September 7, 2018

Gas pipeline costs are running higher and higher partially due to rising material and labor costs but also now protracted regulatory battles running legal bills higher. Before 2010, once a pipeline company secured necessary FERC certificates, it was all but guaranteed pipeline construction would begin with an in-service date (ISD) to follow shortly behind. Now, due to grassroots resistance, just because a pipeline gets a FERC certificate does not mean the pipeline in-service date is imminent. Atlantic Coast Pipeline (ACP) and Mountain Valley Pipeline (MVP) are the latest examples of the potential state and federal flip-flopping that can go on during construction. In this energy market commentary, we will look at how and why gas pipeline costs run higher.

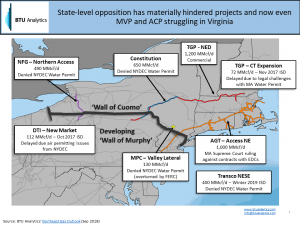

As shown above, pipelines trying to bridge low cost natural gas supply in Northeast Pennsylvania with premium demand markets in New England and the New York City is fraught with regulatory risk. Many of these projects have been held up by state permits which can be used by state governors to drive forward an anti-fossil fuel agenda for political gain. For example, BTU Analytics nicknamed the New York-Pennsylvania border the ‘Wall of Cuomo’, which has held up many a proposed pipeline project including Constitution pipeline in 2016. And now with the Governor Murphy in New Jersey taking office in January 2018 and using similar tactics as Cuomo on gas pipeline development, we are watching the potential for the ‘Wall of Murphy’.

Here is a table that shows mostly greenfield pipelines that are aiming to debottleneck Appalachia with ISDs in 2018 to 2020. For reference, we have added regulatory hold up/cancelled pipelines such as William’s Constitution pipeline and Kinder Morgan’s Northeast Energy Direct respectively, as well as in-service pipes in other regions such as Rockies Express (REX) which went into service in 2009, Sabal Trail which went into service in 2017, and new projects moving towards construction in Oklahoma and the Permian such as Midship and Gulf Coast Express.

What is impressive looking at the current Appalachian greenfield pipes is 1) every pipeline requires at minimum $1 billion or more of invested capital, 2) the combination of Rover, Atlantic Sunrise, Nexus, ACP, MVP, PennEast represents $18.7 billion of investment at an average cost of $9.9 million per mile. REX was a bargain at the time at just $3 million per mile in 2009 despite it being one of the most expensive projects as measured by total costs.

Terrain and level of urbanization, also, play a significant role in pipeline development costs. In Appalachia, hilly and forested terrain drives costs higher versus the flatter terrain of the Great Plains, Midwest, and Texas. Additionally, pipelines in Appalachia, New England, Atlantic Seaboard must contend with rivers and population centers that heighten the regulatory risk and costs for a pipeline. For comparison, the new Gulf Coast Express pipeline originating in the Permian and crossing the mostly flat, arid and unpopulated Southwest corner of Texas is only 18% more expensive on a cost per mile basis than REX even though it will go into service over ten plus years later. Midship pipeline in Oklahoma is similarly lower cost on a cost per mile basis. Meanwhile comparing Constitution estimated costs in 2014 to current Appalachian greenfields, we see Atlantic Sunrise running on a cost per mile basis at 139% more than Constitution. Additionally, comparing the Appalachian projects to Sabal pipeline in Florida, that also had to contend with population centers and regulatory scrutiny, all of the Appalachian pipes are nearly equal to or above Sabal’s development costs on a per mile basis.

How much regulatory delay costs is hard to quantify. In the case of some pipelines, the expense may be the ultimate in that the pipeline never gets built. For other pipelines, we will have to watch how cost overruns come in as these Appalachian greenfields go into service – some may revise higher significantly. To follow midstream development more closely, request more information on BTU Analytics’ Northeast Gas Outlook or Upstream Outlook reports.

>>> Submitted by Lorne Stockman, Senior Research Analyst, Oil Change International, 540-679-1097, www.priceofoil.org

{ 2 comments… read them below or add one }

From Mary Wildfire, September 15, 2018

Comment on BTU ANALYTICS article:

But what do the pipeline companies care? Don’t they get a typical 14% guaranteed profit… so the more it costs, the more money they make?

What I wonder is whether the costs of fines and of policing protesters also earns them that 114%.

What strikes me is mentioning an “Appalachian bottleneck” after accusing NY & NJ governors of blocking pipelines “for political gain” (in other words, merely because the people don’t want these pipelines).

But if their states and New England are high demand markets as is here claimed, then why would these governors and the people of their states be blocking pipelines? Must be because they’d rather develop offshore wind and solar and the gas companies don’t want to hear that.

REFERENCE: HTTPS://BTUANALYTICS.COM/GAS-PIPELINE-COSTS-RUN-HIGHER/

Absolutely right, Mary. And the more they cost, the more the banks get to loan in one spot, minimum paperwork. Don’t think about the huge national debt (which will never be repaid), the huge consumer debt, and the fear of a new recession. Pour it on! Let the good times (for a few) roll!

And most of all, don’t think about the CO2 resulting from this course, which would be avoided by going to renewables.

And then there are our politicians – “I believe our natural energy resources really do hold the key for success for West Virginia for many decades to come,” Morrisey said on August 7, 2018.

Tom Bond, Lewis County, WV