Essay by S. Tom Bond, Retired Chemist & Resident Farmer, Lewis County, WV

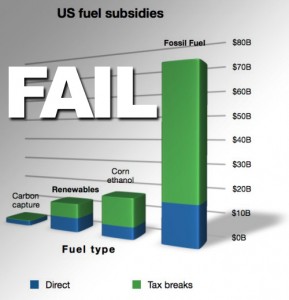

Subsidies, where the government provides funds to advance the interests of some industry, are the best thing the petroleum and coal industries have going for them. They are, in fact, payments to increase profits, the motivation for business. The fossil fuel industry gets $20 billion a year. Sounds like a lot of motivation!

That figure comes from Dirty Energy Dominance: Dependant on Denial. The global warming we are experiencing is being subsidized by our government. The result of a second study published by the Stokholm Environmental Institute in a peer reviewed journal includes this in the abstract:

“This study finds that, at recent oil prices of USD 50 per barrel, tax preferences and other subsidies push nearly half of new, yet-to-be-developed oil investments into profitability, potentially increasing U.S. oil production by 17 billion barrels over the next few decades.

“This oil, equivalent to 6 billion [long tons] of CO2, could make up as much as 20% of U.S. oil production through 2050 under a carbon budget aimed at limiting warming to 2 °C. Our findings show that removal of tax incentives and other fossil fuel support policies could both fulfil G20 commitments and yield climate benefits.

The abstract is available here.

It’s a really good investment for the companies, too. A few hundred million dollars in lobbying and candidate support, and the return is $20 billion. That’s a many-fold return.

It is clear that the big pipelines are not about helping Americans (most of us, that is). Adequate shipping capacity is in place to meet present demand. On the one hand, they are intended to allow more gas to be used for electrical generation when cleaner and cheaper renewables are just around the corner, and to provide liquid natural gas for export. The former not only screws up the atmosphere, but the economy, too. Oil and gas extraction are a mature industry, capital intensive and high return to capital.

For each dollar spent, solar and wind energy projects create twice as many jobs as coal or natural gas, economists at the University of Massachusetts, Amherst, calculated in 2009. That includes more jobs in manufacturing and construction, and more jobs at an average hourly wage of $24.50.

On the other hand, the intention is shown by the fact roughly 60 percent of the new L.N.G. export capacity worldwide is being built in the United States, which only began exporting large supplies last year, giving Washington a new tool for its foreign policy toolbox and raising the country to the top tier of exporters, which includes Qatar, Australia and Russia.

What the U. S. oil and gas industry plans is to crowd Russia especially, but also Qatar and Australia oil and gas companies. Russia has vast supplies of conventional gas that can be shipped through pipelines as gas. They are doing it now through the Nordstrom pipelines which go from Russia to Germany through two parallel 48 inch pipes with 1.5 inch walls and working at about twice the pressure in the proposed ACP and MVP pipelines.

American gas companies intend to frack their gas, which involves manufactured chemicals, involves all that trucking of water and chemicals, and takes new pipelines to carry it to the ocean, where it will be liquefied, then transported on special ships with pressurized containers, and finally converted back to gas at the destination. Huge costs to produce and carry. How can they compete with Russian gas just pumped out of the ground and sent to the customers through pipelines? Subsidies! And pipelines paid for by U. S. gas customers!

The energy return on energy invested, commonly called EROI is lower, too. Manufacturing the chemicals for fracking, the extra pipe needed by the whole scheme off fracking for export and carting all the materials too and from the actual drilling site pushed the EROI ratio lower. At some point it becomes uneconomical.

A recent study, “Long-Term Estimates of the Eneregy-Return-on-Energy-Invested of Coal, Oil, and Gas Global Productions” points out that when the historic EROI’s are calculated, it shows since the early 20th century we are using more energy to produce each fuel.

The aggregate of all fossil fuels maxed in the 1960’s and has declined since. Other studies show that the decline in fossil fuels has played a part in the world slowdown of economic growth and national debt to gross domestic product ratios.

It’s time for society to change to another form of energy.

{ 3 comments… read them below or add one }

I think maybe one fact here isn’t true–that gas companies get hefty returns.

The new technologies are expensive–not only environmentally, which isn’t a problem since they can offload that to the communities, but even in money terms. And there is so much gas being produced that prices are relatively low.

Most of the companies are in debt. Which is why lobbying for all these subsidies is critical to them.

Fortunately for them bribing legislatures to give them fat subsidies is easy, reliable and straight forward, an investment with astronomical returns.

We’re not on the ‘sucker circuit’ in Mesquite, Nevada

By Al Litman (Mayor), The Spectrum, February 8, 2017

At one time, Mesquite was on what I term the “sucker circuit.” Just a bunch of country bumpkins waiting to be taken, or at least that’s what some outsiders thought. Sound harsh? I guess but, sadly, true.

Well, in the case I’m writing about now, we were fortunate and survived in good shape. It might have been just luck, or the solid thinking of a past mayor and city council. I’m still trying to put all the pieces together.

What brings this up goes back to last fall when Southwest Gas came to Mesquite to make a presentation on the feasibility of bringing natural gas to Mesquite. I was happy to introduce them and hear what they might be able to offer to Mesquite.

Midway through the presentation, their speaker was interrupted by a someone later identified as Carl Palmer of St. George, Utah. Mr. Palmer ranted about a study Mesquite had done regarding a proposal to establish Mesquite City Gas. I asked Mr. Palmer to please sit down. He refused until approached by one of our police officers. I asked Mr. Palmer when this study was done. He replied 1996, or there about.

Mr. Palmer says that I welcomed Southwest Gas with “outstretched arms into Mesquite without a vote of the citizens.” Untrue. Southwest Gas arrived to make a simple informational presentation and nothing more.

Mr. Palmer goes on to talk about an engineering/feasibility study that was commissioned by Mesquite to give city leaders future direction for gas service. Again, untrue. No study was ever done. The city did send out a request for proposal to have gas companies come to Mesquite to make a presentation. No money was spent in this process. However, Mr. Palmer offered to do a preliminary study for us for $35,000, plus some expenses. I have that unfunded proposal.

Early in 1997, our city council decided they wanted natural gas and elected to go with Southwest Gas. Or at least, that’s how they voted. I don’t know what happened after that, as we still don’t have natural gas some 20 years later. The one thing I do know from the official minutes of a council meeting is that they decided it was not in our best interest to have our own gas utility.

By the way, Mr. Palmer was involved with bringing natural gas to Nephi, Utah. Check their commercial rates. They are 28 percent higher than the national average.

Back to Mr. Palmer and his original proposal to do a study for us back in 1996. At that time, Mr. Palmer and Associates had a very interesting associate, Mr. Laird Dyer, the director of integrated solutions for ENRON Capital and Trade Resources. His resume says he structures custom-designed natural gas energy packages for municipal and investor owned utilities, using the full scope of Enron’s capabilities.

Remember what happened to ENRON and those associated with them? Many lives ruined, many companies that failed, many individuals that went to prison. By the way, Palmer said, and I quote from his proposal, “Mr. Dyer is experienced and seasoned in gas deregulation issues and Creative financing for new municipal gas systems.” Just what we needed. I know nothing of Mr. Dyer, just what is public record.

Back to Mr. Palmer. He feels that I neither have the talent nor vision to pull together a team of Mesquite “pioneer blood” to set up Mesquite City Gas. Mr. Palmer, I believe you are talking about the pioneer families that established Mesquite. I have too much respect for them to ask them to invest in your outdated scheme.

So, Mr. Palmer, let me pubically state, I have no agenda with Southwest Gas or any other company, period. I have no intention of having a public debate on a Mesquite City Gas Company or Southwest Gas with you or anyone else. It’s not what a mayor does.

At your age, you should be enjoying retirement in your beautiful state of Utah, and not trying to sell your outdated concept to Mesquite. We might have been on the “sucker circuit” in the past. Not any more.

Al Litman is mayor of Mesquite, Nevada

Source: http://www.thespectrum.com/story/opinion/mesquite/2017/02/08/were-not-sucker-circuit/97652022/

US SHALE OIL WILL DOMINATE THE MARKET IN COMING YEARS, BUT THE TABLES WILL TURN, OPEC SAYS

Written by Tom DiChristopher at CNBC

U.S. shale oil will drive global production growth in the years to come, OPEC forecasts.

However, global shale oil will peak in 2025, and OPEC’s output will then surge through 2040, the cartel projects in its annual World Oil Outlook.

OPEC raised its medium-term forecast through 2022 by 2.2 million barrels a day.

The American shale drillers that have upended the energy industry will capture much of the growth in oil demand in the coming years, OPEC forecasts in a new report.

But after years of booming U.S. production and flat output from OPEC, the tables will turn, the producer group says.

The forecast, released Tuesday, signals that OPEC believes its battle for oil-market share against U.S. shale will persist for years to come.

The U.S. shale revolution paved the way for a three-year oil price downturn that sent crude spiraling from more than $100 a barrel in 2014 to about $60 today. That has piled pressure on the oil-dependent economies of OPEC nations and forced a round of production cuts this year.