From an Article by David Bradley, Natural Gas Intelligence, October 17, 2017

Henry Hub natural gas spot prices this year and next will be lower than previously forecast, according to the Energy Information Administration (EIA), which now predicting an average of $3.03/MMBtu for 2017 and $3.19/MMBtu next year.

Those price forecasts, included in EIA’s latest Short-Term Energy and Winter Fuels Outlook, are both down from last month, when EIA was forecasting prices would average $3.05/MMBtu this year and $3.29/MMBtu in 2018.

Expected growth in natural gas exports and domestic consumption next year contribute to the forecast increase between 2017 and 2018 Henry Hub natural gas spot prices, EIA said.

In September, the average Henry Hub natural gas spot price was $2.98/MMBtu, up 8 cents/MMBtu from the August level.

New York Mercantile Exchange contract values for January 2018 delivery traded during the five-day period ending Oct. 6 suggest a price range of $2.28-4.63/MMBtu, encompassing the market expectation of Henry Hub prices in January at the 95% confidence level, EIA said.

“Futures prices declined in early September, largely because of reduced demand related to Hurricane Irma in Florida,” EIA said. “Most electricity generation in Florida is natural gas-fired, and electricity generation in Florida on Sept. 11 was 41% lower than the average of the first seven days of September.

“Injections of working natural gas into underground storage exceeded market expectations and historical averages for the first three weeks in September, which further contributed to lower prices.”

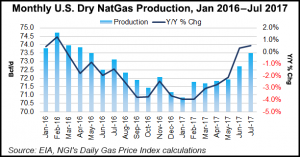

EIA expects domestic dry natural gas production to average 73.6 Bcf/d this year, a 0.8 Bcf/d increase from 2016, and is forecasting 2018 production to reach a record 78.5 Bcf/d.

“As rising natural gas production keeps pace with increasing consumption and demand for exports — particularly for liquefied natural gas (LNG) — EIA projects a balanced market from the last quarter of 2017 through 2018,” the agency said. “LNG export capacity is expected to increase, with LNG exports projected to exceed 3 Bcf/d in 2018, 66% higher than in 2017. Increased takeaway capacity out of the Marcellus and Utica shale plays is expected to help boost production.

The United States was a net importer of natural gas last year, averaging 0.6 Bcf/d, but it is expected to be a net importer this winter.

Increased pipeline capacity to Mexico and LNG export capacity on the Gulf Coast will help push net exports to an average 1.4 Bcf/d through the winter, EIA said.

Earlier this month, the EIA released its Natural Gas Monthly report that revealed that U.S. dry natural gas production increased year/year in July to 2.28 Tcf, a 0.5% increase from July 2016.

The July data also revealed that the largest importer of natural gas from the United States was Mexico via vessel at 14.4 Bcf.

Turning to storage, the government agency said inventories should total 3.8 Tcf at the end of October.

“During the first three months of the 2017 injection season, which starts in April, the rate of natural gas inventory builds was lower than the five-year average,” the agency said. “However, cooler-than-average temperatures in August reduced the use of natural gas for electricity generation, which contributed to builds that were above the five-year average during August 2017 and September 2017.”

{ 1 comment… read it below or add one }

Appalachian gas production cannot continue to ramp up rapidly

Pittsburgh Conference Report (Platts)–October 23, 2017

Despite improved drilling and completion techniques such as the drilling of longer horizontal laterals, natural gas production from the Appalachian Basin cannot continue on its current rapid upward trajectory indefinitely, a speaker at the Platts Appalachian Oil and Gas Conference in Pittsburgh said Monday.

Appalachian producers will eventually experience “sweet spot exhaustion,” Alan Farquharson, senior vice president of Range Resources, said on the sidelines of the conference.

“As you drill longer and longer laterals, it minimizes the number of wells it takes to develop that core position,” Farquharson said. “As a result, the core of the acreage gets drilled up, you have to step out to tier one, tier two and tier three wells, which means you get lower productivity per well.”

Forecasts from Platts Analytics’ Bentek Energy unit call for production from the US Northeast to grow from an average 24.9 Bcf/d in September to a winter-ending average of 27.3 Bcf/d in March 2018.

In recent months, producers in Appalachia and other producing basins have been experimenting with the drilling of extended lateral wells, which have recorded higher per-well production. However, that per-well production growth comes at a cost when it is measure against an operator’s production across the company’s entire acreage, Farquharson said.

“The best thing that people need to look at is not individual well productivity, but productivity on a normalized basis,” Farquharson said. “If you normalize everything under a common denominator, you will see if well productivity is remaining constant or not.”

The Appalachian Basin is similar to other producing basins, in that there are core areas where well productivity is the highest, as well as non-core area, where output tends to be less prolific.

In the case of the Appalachian Basin, there are two distinct core regions, the dry gas Marcellus region in northeastern Pennsylvania and the wet gas region around southwestern Pennsylvania, West Virginia and Ohio, which is highly prospective for both the Marcellus and Utica shale plays.

“With the growth profile that maybe a lot of people have, they think the core goes on forever. They think technology can make tier-one acreage core acreage, but it can’t,” Farquharson said. “Because if it could … there would be a lot of rigs running in the Barnett (Shale).”

In the near term, the pipeline capacity being built to carry Marcellus and Utica gas out of Appalachia should provide producers in the region with an incentive to continue to pursue high levels of production.

Platts Analytics estimates pipeline projects will add 12.8 Bcf/d of capacity to the region over the course of 2018.

Platts Analytics forecasts production will grow by about 2.6 Bcf/d over that period. However, even at this rate of growth, Platts Analytics forecasts the pipeline capacity coming online will be underutilized.

Farquharson said he agrees with that assessment.

Based on the current level of regional activity and the amount of capital that would have to be deployed to increase production to the point where it fills up all the capacity coming online, “we don’t think there’s going to be enough near-term supply to fill all the capacity,” he said.

“It’s going to come down primarily to commodity prices, to what netback is, for producers to decide whether to fill that capacity or not,” he added.

In this respect, the development of the Appalachian Basin is similar to that of basins developed in prior years, Farquharson said.

“Historically, every play gets overbuilt. Pipelines always get bigger, because companies at any given point in time predict certain growth, but things change,” he said.

“Whether it’s commodity price, whether it’s [the discovery of] new basins, whether it’s a whole bunch of other things, it changes. Activity levels are going to be lower than probably most people expect,” he added.

NOTE: Note the prediction of excess pipeline capacity from a producer (Range)…….