From a Letter to Editor by Frank Lasee, Former Wisconsin State Senator, February 25, 2023

Nearly 50 years ago in 1976, the US Congress authorized the Hydrogen Program managed by the National Science Foundation. Then in 1983, Bush and Congress threw more money at hydrogen as an alternative energy source.

Last year Congress and Biden, in their infrastructure bill, created a $9.5 billion dollar hydrogen slush fund. The Europeans have also authorized $5.2 billion euros for their hydrogen slush fund.

Since 1839, scientists have been working on hydrogen for energy and storage with little to show for it. The future of green hydrogen is just as dull. Brown and grey hydrogen, made from coal or natural gas (CH4), makes more reasonably priced hydrogen now.

Hydrogen is not a fuel. It must be created and is only a way of storing and transporting energy. All of which are difficult, expensive and there is no infrastructure to support it.

This $9.5 billion slush fund is a breeding ground for multiple Solyndras. (Solyndra was 1/3 of the 1.5 billion-dollar taxpayer loss on Obama’s solar revolution.)

The Biden administration has authorized a half billion loan guarantee for a green hydrogen hub in Delta, Utah. Never mind that green hydrogen requires huge volumes of water and Delta is on the edge of the desert, and the entire southwest is chronically short of water. Or that Utah today only gets 4% of its electricity from wind and solar. There is no “excess” wind and solar to create green hydrogen in Utah.

Building a green hydrogen hub in a very dry place with very little “renewable” energy is not wise; some would even call it stupid. The Biden administration needs a talking point to fix the recently admitted unreliability problem of wind and solar. So common sense and fiscal responsibility are unnecessary.

Our electric grids need full-time demand matching electricity, or we have blackouts. There is a dawning realization by the climate religion, there isn’t enough lithium in the world, over the next few decades, to build tens of millions of electric vehicles and industrial scale grid batteries too.

In addition, lithium batteries cannot store the abundant solar power California has in the sunny mild winter for use in hot July. The energy will have left those batteries long before July rolls around. Hence, the expensive talking point of green hydrogen was born.

Making green hydrogen takes a lot of energy. About 35% more energy than the created hydrogen stores. Then you lose another 30% when you transport and use it. Hydrogen yields only 35% of the energy input. It is a real energy loser.

Making green hydrogen requires 13 times more water, sea water has to be desalinated first, and additional water for cooling. Then heat the water to 2,000 degrees and electrocute it, freeing oxygen into the air and hydrogen into the factory. Then super chill to near-absolute zero. Then compress it to 10,000 psi, which is three times the psi of an average scuba tank. Super cold liquid hydrogen is born.

It can be used for fuel cells and burned in electric producing power plants instead of natural gas. We get far more bang for our buck with natural gas rather than create electricity to make green hydrogen, only to burn it again, to make electricity using a process that costs 65% of the energy.

The whole concept of using wind and solar to produce green hydrogen has an elephant-in-the-room type problem. The Industrial Four Step process of making hydrogen isn’t something that can be started on sunny mornings and stopped in the late afternoon. Or fired up when the wind starts blowing and then shut down when the wind stops. What will keep the hydrogen process flowing on dark windless nights?

Does a green dreamer care to answer that? Do the facts matter? Heck, it is only federal borrowed money anyway. Hydrogen is just another form of political greenwashing at the American people’s expense.

We need to stop the wasteful spending of taxpayer money — money we don’t have — on green boondoggles before it is too late.

Before the communist Chinese, who use more than half of the 8 billion tons of coal as their primary fuel source (60% of total energy), eat our lunch and rule the world, Americans need to wake up to the dangerous threats of the green energy nightmare and the rising threat of the Red Chinese Dragon before it is too late!

>>> Frank Lasee is a former Wisconsin state senator. The district he represented had two nuclear power plants, a biomass plant and numerous wind towers. He has experience with energy, the environment, and the climate. You can read more energy and climate information at www.truthinenergyandclimate.com which Frank leads.

{ 1 comment… read it below or add one }

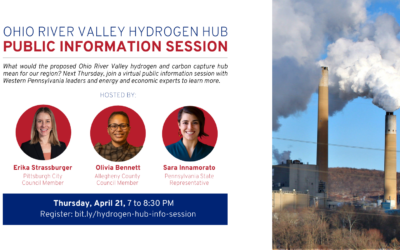

MEMO ~ OHIO RIVER VALLEY INSTITUTE

Source: Ben Hunkler, Communications Lead ~ ben@ohiorivervalleyinstitute.org

Appalachian States Should Proceed with Caution on CCUS, Hydrogen Hub Initiative

JOHNSTOWN, Pennsylvania —— A new initiative to develop a carbon capture and hydrogen hub in Ohio, Pennsylvania, and West Virginia is unlikely to create many permanent jobs, boost economic growth, or eectively decarbonize the regional economy, according to Ohio River Valley Institute research.

The initiative, launched today by a partnership of major oil and gas companies, would apply expensive and unproven carbon capture, use, and sequestration (CCUS) technology and hydrogen production to address greenhouse gas emissions. The envisioned hub would connect carbon-producing facilities like steel mills and factories to a network of pipelines and underground caverns where hydrogen and captured carbon dioxide would be stored.

But, while CCUS technology may be applicable and aordable in some sectors, such as steel and cement manufacturing, it is not an economic solution for coal and natural gas-fired power plants. And, without the involvement of the power sector, which is responsible for more than 80% of fixed-location carbon emissions in the region, the envisioned pipeline networks don’t make economic sense either.

This problem was examined in an ORVI report, which found that widespread adoption of CCUS in the nation’s power system would increase the cost of electricity by $100 billion annually – a 25% increase or about $300 for every U.S. household. The report went on to suggest the region should instead pursue less expensive, more eective methods of cutting power system greenhouse gas emissions, including generation from wind, solar, and hydro, as well as clean storage technologies.

“These options would also create far more jobs than CCUS would save in coal and natural gas,” ORVI Senior Researcher Sean O’Leary explained. “Renewable resources and energy eciency would also address the problem of local air and water pollution from electricity generation, which CCUS wouldn’t. And they would do it for a fraction of the cost of CCUS.”

Other jurisdictions are proceeding with appropriate caution with hydrogen and CCUS development. Colorado’s state-authorized CCUS task force recently concluded that, while CCUS can play a useful role in decarbonizing hard-to-electrify industries, its use should be sharply limited for electricity generation, where lower-cost and more reliable solutions are available.

“For more than forty years, residents of Appalachia have been teased with promises that technology could save jobs and local economies by making coal and other fossil fuels ‘clean’,” said Ohio River Valley Institute Executive Director Joanne Kilgour. “But we can’t keep building a future on false promises – we need to diversify our local economies and embrace a real clean energy transition.”

For more information on the economic viability of carbon capture and hydrogen development, visit:

https://ohiorivervalleyinstitute.org/

NOTE ~ The Ohio River Valley Institute is an independent, nonprofit think tank researching clean energy, shared prosperity, and equitable civic structures in the greater Ohio River Valley.