From the Blog of Housley Carr at RBN Energy, November 20, 2022

As we said in our Ain’t Wastin’ Time No More and Only Time Will (Sh)ell blogs six years ago, Shell received strong local support for its Shell Polymers Monaca project in Beaver County, as well as substantial financial incentives from the commonwealth of Pennsylvania. Under the Keystone State’s Local Resource Manufacturing Tax Credit (which was enacted to bolster Shell’s prospective cracker project), any company that develops an ethane-consuming ethylene plant valued at $1 billion or more and that creates at least 2,500 jobs during the construction phase would be eligible for a tax credit equal to 5 cents/gal (or $2.10/bbl) of ethane purchased and used to produce ethylene. (For perspective, the current price of ethane at Mont Belvieu is 41 cents/gal.)

The tax credit, which applies to ethane purchased between January 2017 and December 2042, can be used to reduce Shell’s overall tax liability to the state by up to 20%. Assuming that the cracker remains operational through December 2042 (20 years and two months in total) and consumes an average of 85 Mb/d (close to full capacity, that is), the tax credit’s value would total more than $1.3 billion ($2.10/b x 85,000 b/d x 365 days x 20.167 years). Separately, Shell reached “payments in lieu of taxes” agreements with the local government and school district.

State tax incentives helped, of course, but the primary drivers behind Shell’s decision to site a steam cracker and PE units in western Pennsylvania were — and are — (1) the ready availability of large volumes of favorably priced ethane from the NGLs-rich “wet” Marcellus/Utica shale play and (2) the complex site’s location, which by Shell’s figuring is within a 700-mile radius of about 80% of U.S. and Canadian polyethylene customers.

We’ve blogged extensively about the rapid increases in Marcellus/Utica natural gas and NGL production through the 2010s and early 2020s and — just as important — the build-out of an extraordinary network of gathering pipelines, gas processing plants, de-ethanization units, fractionators, new and repurposed gas pipelines, and NGL pipelines. (Part 1, Part 2 and Part 3 of our Keep On Growing series provide a good summary.)

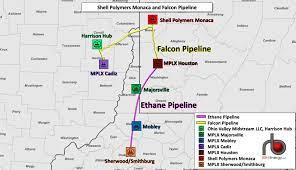

Which brings us to the spanking-new Shell Polymers Monaca facility (red icon in Figure 1). As we said in Building the Perfect Beast, the petchem complex consists of:

>> A 3.3-billion-pound-per-year steam cracker that at full capacity will consume about 95 Mb/d of Marcellus/Utica-sourced ethane to produce ethylene, propylene, and other petchem byproducts. Typically, ethylene accounts for about 78% of the output of an ethane-only cracker, with propylene accounting for 3% and a variety of other products — butadiene, benzene, fuel gas (hydrogen, methane), etc. — making up the rest.

>> Three PE units capable of producing a total of up to 3.5 billion pounds per year.

>> A 250-megawatt (MW) cogeneration plant powered by the region’s vast supply of natural gas.

>> Extensive facilities for loading PE pellets into barges, railcars and trucks.

To feed the new steam cracker, Shell has entered into a number of 10-to-20-year ethane supply contracts with area producers. The ethane — the vast majority of it supplied from MPLX fractionators and de-ethanization plants — is transported to Monaca via Shell’s new Falcon Pipeline, a 97-mile, 100-Mb/d system (yellow lines in Figure 2) with two primary legs. One leg runs from MPLX’s Houston, PA, gas processing/fractionation hub (brown icon), which also receives ethane via an MPLX pipeline from four MPLX gas-processing/fractionation complexes located south of Houston (magenta line and dark-green, blue and orange icons). The other leg of the Falcon Pipeline runs from MPLX’s Cadiz, OH, gas processing & fractionation facility (blue icon) and Ohio Valley Midstream LLC’s Harrison Hub (light-green icon) in northern Harrison County, OH. (Ohio Valley Midstream is a 65/35 joint venture of the Canadian Pension Plan Investment Board and Williams.)

Before we discuss the impact of this new, in-region consumer of ethane on the broader market, we need to explain — as we have in a number of blogs about the Marcellus/Utica — that producers and midstreamers in western Pennsylvania, northern West Virginia and eastern Ohio face special challenges when it comes to dealing with the NGLs produced there.

Unlike other major U.S. shale plays, there are no mixed NGL (y-grade) pipelines in place to transport y-grade to the major NGL storage and fractionation centers in Mont Belvieu, TX, and Conway, KS. That has had a number of effects. For one, the lack of mixed-NGLs takeaway capacity created the opportunity — and the necessity — for midstream players to build a lot of de-ethanization and fractionation capacity within the Marcellus/Utica.

That, in turn, provided producers and marketers the option to sell barrels of NGL “purity products” (such as propane and normal butane) locally or to transport them to distant markets, primarily via new purity-product pipelines but in some cases by rail. The lack of y-grade takeaway capacity — and, often, the poor economics of producing (rather than rejecting) ethane — also has resulted in the rejection of most of the region’s ethane into natural gas.

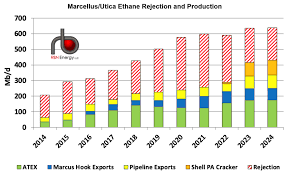

RBN estimates that of the roughly 600 Mb/d of potential ethane production in the Marcellus/Utica, about 50% — or 300 Mb/d — was being rejected into natural gas (red-and-white-striped bar segments in Figure 2) before the new Shell cracker came online this fall. The rest was — and is — piped away on either Enterprise Products Partners’ Appalachia-to-Texas Express (ATEX) ethane pipeline to Mont Belvieu, whose capacity was recently expanded by 30 Mb/d (green bar segments); Energy Transfer’s multi-product Mariner East pipeline system to Marcus Hook, PA, for export by ship (blue bar segments); and Energy Transfer’s Mariner West and Kinder Morgan’s Utopia ethane pipelines to Ontario (yellow bar segments).

Now, with Shell Polymers Monaca up and running, the up-to-95-Mb/d of ethane being supplied to the new cracker (orange bar segments in Figure 2) will be coming out of previously rejected volumes, as will the increased flows on the recently expanded ATEX pipeline. Going forward, flows on the ethane pipelines to Ontario will also increase to serve NOVA Chemicals’ recently expanded steam cracker there, further reducing how much Marcellus/Utica ethane is rejected.

By 2024 (multicolored bar to far right), we expect rejected volumes to decline to about 200 Mb/d. Put another way, the new Shell cracker isn’t really competing with existing ethane consumers in Canada, the Gulf Coast and overseas for a share of the ethane being produced in the region. Instead, Shell’s ethane suppliers only need to reduce how much ethane they are rejecting into gas, thus increasing their ethane production by the same volume.

We should note, finally, that Shell’s new Pennsylvania steam cracker is but one of a number of developments on the U.S. ethane and ethylene fronts. On November 16, a 51/49 joint venture of Chevron Phillips Chemical Co. and QatarEnergy said it plans to build an $8.5 billion ethylene-and-PE complex in Orange, TX, that will come online in 2026. We’ll look at that and other ethane- and ethylene-related developments in an upcoming blog.

Q.E.D.