From an Article by Mike Tony, Charleston Gazette, Charleston, WV, October 8, 2022

Landowners in Harrison, Nicholas, Preston and Wetzel counties has filed the lawsuit in the U.S. District Court for the Northern District of West Virginia in July against Diversified Energy and Pittsburgh-based EQT Corp. A 2018 agreement between the company and the WV DEP requires Diversified to summarize the actions taken to plug oil and gas wells or place them into production during the past year.

Diversified Energy, the largest owner of gas wells in the country, says it doesn’t have to plug wells that West Virginia landowners allege in federal court pose health and environmental hazards, arguing that state regulators relieved them of that responsibility. Diversified Energy Company says an agreement it made with the state Department of Environmental Protection to plug or place into production a set number of gas and oil wells annually shields it from the duty to plug and abandon the wells.

The company says the federal lawsuit from eight landowners in four West Virginia counties would “usurp” the authority of the Office of Oil and Gas, the DEP’s well-plugging and reclamation regulatory unit that state officials have acknowledged is understaffed. Diversified argues it has no duty to plug wells unless it identifies them as candidates for plugging in annual reports it is required to file with the Office of Oil and Gas through 2034.

The lawsuit alleges the two companies struck transfer deals in recent years for many more wells than Diversified can afford to plug and decommission. Industry experts have made similar observations, saying the company’s business model is based on acquiring a high number of low-producing wells that yield short-term dividends but present long-term liabilities mounting as the company puts off well decommissioning obligations.

The DEP estimates older wells that have been poorly maintained will likely total more than $100,000 in plugging costs. New wells that have been properly maintained cost a few tens of thousands of dollars, per the agency. Plugging typically entails using cement to seal wells that are no longer productive to keep toxic chemicals from polluting the air and aquifers.

The landowners’ lawsuit asks the court to make EQT liable for plugging and decommissioning the wells that Diversified took responsibility for in 2018 and 2020, contending that those transfers were fraudulent. The lawsuit petitions the court to award plaintiffs and class members damages from Diversified to compensate them for the cost of plugging, remediation of the abandoned wells.

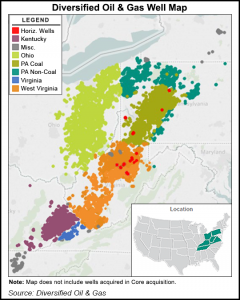

Most of Diversified’s roughly 70,000 wells are in Appalachia, acquired since 2018 from EQT and Canonsburg, Pennsylvania-based CNX Resources. Diversified acquired more than 12,000 gas wells from EQT in deals in 2018 and 2020 for roughly $700 million. In a response it filed last week to the landowners’ lawsuit, Diversified highlighted a passage of its 2018 agreement with the Office of Oil and Gas stating that the company “requires sufficient time to identify” which wells have a “bona fide future use” that merits them being placed back into production. “For the duration of that process, Diversified has no duty to plug its wells unless it identifies them as a plugging candidate in its reports, and then only on a set schedule,” Diversified’s response contends.

The DEP did not respond to a request for comment on Diversified’s filing. Per the agreement, Diversified must either place into production or plug at least 50 oil and gas wells for which no production was reported in 2017 every year from 2020 through 2034, of which at least 20 must be plugged each year. Diversified has similar consent agreements in Kentucky, Ohio and Pennsylvania. Combined, the company’s agreements in those states plus West Virginia commit the company to plugging at least 80 wells annually out of its tens of thousands of wells there.

The landowners’ lawsuit called those consent agreements a “smoke-screen” that doesn’t impact “private civil liberties that Diversified [and EQT] have to private citizens over private property rights.” The DEP has contracted with a Diversified subsidiary to plug wells. The agency has paid Diversified subsidiary Next LVL Energy LLC over $150,000 since October 2021 for well-plugging, according to West Virginia State Auditor’s Office data.

The DEP awarded Next LVL Energy two contracts to plug and reclaim orphaned gas and oil wells under the federally funded Infrastructure Investment and Jobs Act passed by Congress last year. Next LVL Energy was the low bidder on the two DEP contracts, bidding a combined $10.2 million. The DEP is requiring contractors to identify, inspect and prioritize what documented or undocumented wells to plug, in addition to plugging them and reclaiming the well sites. Under the terms of state-posted contracts, contractors will have the exclusive right to plugging orphaned, abandoned wells within the contract region.

Diversified acquired Next LVL Energy, a Pittsburgh area-based well-plugging company, in February.

Diversified also argued in its response to the lawsuit that their claims are time-barred under a two-year state statute of limitations for trespass, nuisance and negligence claims, citing past statute of limitations-focused judicial decisions. The company contends the two years the landowners had to file claims began when the wells on their properties stopped producing gas in a two-year window from 2017 through 2019.

The landowners allege that Diversified’s acquisition of thousands of wells from EQT was completed with intent to defraud creditors, including the plaintiffs, in a business model designed to push off decommissioning liabilities for decades. They say Diversified has left them with unplugged, abandoned wells that pose health risks, degrade the environment and hurt their property values.

Much of the lawsuit is based on a report published in April by the Ohio River Valley Institute, a Johnstown, Pennsylvania-based pro-renewable energy nonprofit think tank. That report predicted it was highly unlikely that Diversified will have enough money to plug and abandon all its wells. The lawsuit cites the report to allege that if Diversified had used industry norms to calculate its plugging and decommissioning obligations, then its liabilities would exceed $2 billion instead of the company’s self-reported figure of roughly $520 million, making Diversified insolvent. The report cited Diversified company data and federal projections for natural gas prices. The Ohio River Valley Institute report found that Diversified has used unusual assumptions like implausibly long economic lives of wells though 2095 and an excessively long ramp-up timeline to start plugging and abandoning most of its wells to calculate the value of its asset retirement obligations, liabilities for well plugging and abandoning costs.

In 2020, Greg Rogers, a senior advisor to Carbon Tracker, a London-based think tank researching climate change impacts on financial markets, called Diversified’s business model “a legal Ponzi scheme” in a conference call with the Capitol Forum, a corporate news analysis service. “[I]t only works as long as there’s growth and the perception of profitability,” Rogers said. States mandate that wells no longer producing gas or oil are plugged and abandoned, and that well owners secure a bond or other financial assurance that helps cover the expense of closing wells that aren’t productive anymore.

But Diversified’s critics say its business model could leave West Virginia taxpayers footing the bill for remediating many of the company’s wells. “[I]t is clear Diversified Energy’s economic model is built to fail and could leave residents of West Virginia with billions of dollars in clean up costs,” Ohio River Valley Institute senior researcher Ted Boettner said in an email.

The Office of Oil and Gas, whose authority Diversified emphasized in its lawsuit, has been beset by low inspector staff numbers. The state’s well inspection staff dwindling from 17 to nine in the past two years on the Legislature’s watch has concerned not just environmentalists but royalty owner advocates. The office has faced a $1.3 million shortfall, with officials attributing the budget crunch to permit fees having dried up amid oil and gas industry struggles. Bills that would have restored office staffing levels to what they were before they were slashed in 2020 through annual $100 oversight fees on unplugged wells failed in the Legislature amid opposition from the Gas and Oil Association of West Virginia. The industry group said the fees would be too onerous for operators.

A recent study found that low-production well sites like those dominating Diversified’s portfolio are a disproportionately large source of methane emissions. The April report published in the peer-reviewed scientific journal Nature Communications found roughly half of all well site methane emissions nationwide come from low-production well sites like Diversified’s, which emit six to 12 times as much methane as the average rate for all U.S. well sites. Methane has a 100-year global warming potential 28 to 36 times that of carbon dioxide, according to the U.S. Environmental Protection Agency, making Diversified’s deepening well footprint across Appalachia a climate concern.