From a Study by Dennis Wamsted, Institute for Energy Economics and Financial Analysis (IEEFA), 11/18/21

Gas-fired power plant cancellations and delays signal investor anxiety, changing economics. Financial concerns are likely to affect other PJM gas projects still in the planning phase.

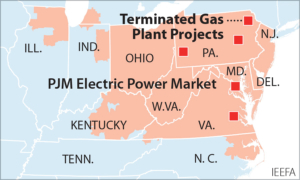

A recent decision to cancel the 1,000-megawatt Beech Hollow combined gas plant in Pennsylvania is the latest warning for investors considering funding new gas-fired power plants in the PJM Interconnection (PJM) region. According to a briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA), the reason is clear: The economics have changed, prompting three project cancellations this year and calling into question the future of 14 others.

“Low gas prices and high-capacity payments that helped drive a near-doubling of installed combined cycle gas capacity in the last decade have gone away,” said Dennis Wamsted, IEEFA energy analyst and the briefing note’s lead author.

Investors are facing myriad challenges, including:

>> Significant uncertainty about future capacity prices, particularly in light of the sharp drop in the region’s latest power auction. (See the note below.)

>> A decade-long downward trend in power prices.

>> Flat regional demand growth.

>> Major projected increases in battery storage and renewable energy generation, including thousands of megawatts from offshore wind capacity.

>> Financial market concerns about climate change and the likelihood of required fossil fuel plant closures by 2050.

IEEFA has identified 17 projects that remain undeveloped, three of which have officially been cancelled this year. More are likely to follow.

PJM, which serves 65 million customers in 13 states and the District of Columbia, uses an annual capacity auction to secure energy and reserves for the system three years into the future. Generators that clear the auction earn a capacity payment, measured in dollars per megawatt-day.

“This structure helped drive a boom in gas plant development, but the gold rush is coming to an end,” said Wamsted. “The increase in gas-fired capacity has levelled off over the last two years, and once the last batch of plants currently under construction are completed, there is significant uncertainty regarding the commercial viability of the projects remaining in the PJM development pipeline.”

Renewables and battery storage will be a particular challenge for the region’s planned gas plants. A record 1,512 megawatts (MW) of solar capacity cleared the last PJM auction, an increase of 942MW over the previous year. The amount of wind power also rose to 1,728MW. There also are thousands of megawatts of offshore wind capacity being developed and expected online before 2030.

While still a small portion of the region’s 150,000MW overall capacity, the growth highlights the growing cost-competitiveness of renewable resources and points to the trend that will define the 2020s.

“The future for planned gas-fired power plants appears bleak as the investment market leaves them behind and turns to cleaner, lower cost renewable options,” said Wamsted.

>>>>>>>…………………>>>>>>>…………………>>>>>>>

See Also ~ PJM Compliance Filing Proposes New Capacity Auction Timelines, January 24, 2022

PJM has proposed new timelines for capacity auctions associated with the next four delivery years and related pre-auction deadlines in a compliance filing submitted Friday to the Federal Energy Regulatory Commission. According to this proposal, the next PJM capacity auction would be held sometime in June of 2022.

{ 1 comment… read it below or add one }

Analysts forecast rise in oil and gas impact fees after prices rose in 2021

From Rachel McDevitt, StateImpact Pennsylvania, January 24, 2022

Analysts expect oil and gas impact fees in Pennsylvania will rebound for 2021 after hitting a low point in 2020.

The state’s Independent Fiscal Office (IFO) expects drillers to pay about $234 million dollars in impact fees for 2021, nearly $90 million more than 2020. If that figure is correct, it will be one of the highest payouts since the fee started a decade ago.

That’s mainly due to the increase in natural gas prices.

The IFO says the average price of natural gas on the New York Mercantile Exchange in 2021 was $3.84 per million metric British thermal units (MMBtu). Because the price was between $3-$5, the impact fee schedule increased by $10,000 per horizontal well compared to 2020 levels

The U.S. Energy Information Administration says gas prices rose from February to October last year, after falling in 2020 because of pandemic-related shutdowns. They’re expected to stay close to $4 per MMBtu this year. The EIA uses the U.S. benchmark Henry Hub in Louisiana to project prices.

The impact fee was designed to benefit the communities where drilling happens. Payments are due in April.

Under the fee structure, drillers pay for each operating well, not the amount of gas produced. The payment varies based on the price of gas and age of the well.

Chair of the Washington County Board of Commissioners Diana Irey Vaughan said counties like hers have come to rely on the impact fee.

“We have a low debt service in the county and we haven’t raised taxes in 12 years, so we’re very grateful to have this revenue stream and very grateful to see that it’s starting to return,” Vaughan said, adding the new money could help pay for a proposed public safety communication system in the county.

The IFO estimates the effective tax rate of the impact fee for wells in operation to be 1.3% for 2021, the lowest on record.

Pennsylvania is the only major gas-producing state without a severance tax, which would charge producers based on the amount of gas they take out of the ground. Gov. Tom Wolf has repeatedly proposed adding one on top of the impact fee, but the requests haven’t gained traction in the Republican-controlled legislature.

Gas industry groups have lobbied against an added severance tax, saying the impact fee has been successful.

The Marcellus Shale Coalition said the fee “empowers local leaders with the ability to target revenues to best meet their community needs, while creating a predictable, workable climate that’s key to attracting job-creating investment and growth.”

https://stateimpact.npr.org/pennsylvania/2022/01/24/analysts-forecast-rise-in-oil-and-gas-impact-fees-after-prices-rose-in-2021/