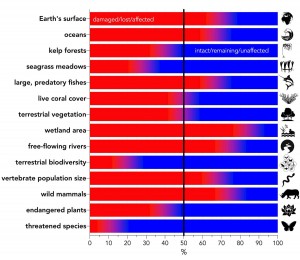

Major environmental-change categories expressed as a percentage relative to intact baseline. Red indicates percentage of category damaged, lost or otherwise affected; blue indicates percentage intact, remaining or unaffected

From an Article by Corey J. A. Bradshaw, Daniel T. Blumstein and Paul Ehrlich, The Conversation, January 13, 2021

Anyone with even a passing interest in the global environment knows all is not well. But just how bad is the situation? Our new paper shows the outlook for life on Earth is more dire than is generally understood.

The research published today reviews more than 150 studies to produce a stark summary of the state of the natural world. We outline the likely future trends in biodiversity decline, mass extinction, climate disruption and planetary toxification. We clarify the gravity of the human predicament and provide a timely snapshot of the crises that must be addressed now.

The problems, all tied to human consumption and population growth, will almost certainly worsen over coming decades. The damage will be felt for centuries and threatens the survival of all species, including our own.

Our paper was authored by 17 leading scientists, including those from Flinders University, Stanford University and the University of California, Los Angeles. Our message might not be popular, and indeed is frightening. But scientists must be candid and accurate if humanity is to understand the enormity of the challenges we face.

First, we reviewed the extent to which experts grasp the scale of the threats to the biosphere and its lifeforms, including humanity. Alarmingly, the research shows future environmental conditions will be far more dangerous than experts currently believe.

This is largely because academics tend to specialize in one discipline, which means they’re in many cases unfamiliar with the complex system in which planetary-scale problems—and their potential solutions—exist.

What’s more, positive change can be impeded by governments rejecting or ignoring scientific advice, and ignorance of human behavior by both technical experts and policymakers.

More broadly, the human optimism bias – thinking bad things are more likely to befall others than yourself—means many people underestimate the environmental crisis.

Our research also reviewed the current state of the global environment. While the problems are too numerous to cover in full here, they include:

>> A halving of vegetation biomass since the agricultural revolution around 11,000 years ago. Overall, humans have altered almost two-thirds of Earth’s land surface

>> About 1,300 documented species extinctions over the past 500 years, with many more unrecorded. More broadly, population sizes of animal species have declined by more than two-thirds over the last 50 years, suggesting more extinctions are imminent

>> About 1 million plant and animal species globally threatened with extinction. The combined mass of wild mammals today is less than one-quarter the mass before humans started colonizing the planet. Insects are also disappearing rapidly in many regions

>> Some 85% of the global wetland area lost in 300 years, and more than 65% of the oceans compromised to some extent by humans

>> A halving of live coral cover on reefs in less than 200 years and a decrease in seagrass extent by 10% per decade over the last century. About 40% of kelp forests have declined in abundance, and the number of large predatory fishes is fewer than 30% of that a century ago.

The human population has reached 7.8 billion – double what it was in 1970—and is set to reach about 10 billion by 2050. More people equals more food insecurity, soil degradation, plastic pollution and biodiversity loss.

High population densities make pandemics more likely. They also drive overcrowding, unemployment, housing shortages and deteriorating infrastructure, and can spark conflicts leading to insurrections, terrorism, and war.

Essentially, humans have created an ecological Ponzi scheme. Consumption, as a percentage of Earth’s capacity to regenerate itself, has grown from 73% in 1960 to more than 170% today.

High-consuming countries like Australia, Canada and the US use multiple units of fossil-fuel energy to produce one energy unit of food. Energy consumption will therefore increase in the near future, especially as the global middle class grows.

Then there’s climate change. Humanity has already exceeded global warming of 1°C this century, and will almost assuredly exceed 1.5 °C between 2030 and 2052. Even if all nations party to the Paris Agreement ratify their commitments, warming would still reach between 2.6°C and 3.1°C by 2100.

Our paper found global policymaking falls far short of addressing these existential threats. Securing Earth’s future requires prudent, long-term decisions. However this is impeded by short-term interests, and an economic system that concentrates wealth among a few individuals.

Right-wing populist leaders with anti-environment agendas are on the rise, and in many countries, environmental protest groups have been labeled “terrorists.” Environmentalism has become weaponised as a political ideology, rather than properly viewed as a universal mode of self-preservation.

Financed disinformation campaigns against climate action and forest protection, for example, protect short-term profits and claim meaningful environmental action is too costly—while ignoring the broader cost of not acting. By and large, it appears unlikely business investments will shift at sufficient scale to avoid environmental catastrophe.

Fundamental change is required to avoid this ghastly future. Specifically, we and many others suggest:

>> Abolishing the goal of perpetual economic growth

>> Revealing the true cost of products and activities by forcing those who damage the environment to pay for its restoration, such as through carbon pricing

>> Rapidly eliminating fossil fuels

>> Regulating markets by curtailing monopolisation and limiting undue corporate influence on policy

>> Reining in corporate lobbying of political representatives

>> Educating and empowering women around the globe, including giving them control over family planning.

Many organizations and individuals are devoted to achieving these aims. However their messages have not sufficiently penetrated the policy, economic, political and academic realms to make much difference.

Failing to acknowledge the magnitude and gravity of problems facing humanity is not just naïve, it’s dangerous. And science has a big role to play here.

Scientists must not sugarcoat the overwhelming challenges ahead. Instead, they should tell it like it is. Anything else is at best misleading, and at worst potentially lethal for the human enterprise.

>>>>>…..>>>>>…..>>>>>…..>>>>>…..>>>>>

See also: What is a ‘mass extinction’ and are we in one now?Frédérik Saltré & Corey Bradshaw, The Conversation, November 12, 2019

For more than 3.5 billion years, living organisms have thrived, multiplied and diversified to occupy every ecosystem on Earth. The flip side to this explosion of new species is that species extinctions have also always been part of the evolutionary life cycle.

But these two processes are not always in step. When the loss of species rapidly outpaces the formation of new species, this balance can be tipped enough to elicit what are known as “mass extinction” events. Five major mass extinctions have been identified in the geological record, and the sixth extinction is now evident.

{ 2 comments… read them below or add one }

Estimated economic impact for $240 million ExxonMobil investment

By Kristen Mosbrucker, The Advocate, Baton Rouge, LA, January 26, 2021

ExxonMobil’s proposed modernization of its Baton Rouge refinery would have an economic impact of at least $277 million spent with businesses in Louisiana, of which $226 million would be spent in Baton Rouge, the company says.

The company said it is carving out at least $3.5 million with diverse suppliers and $1 million for suppliers in north Baton Rouge.

If the project is approved, ExxonMobil would invest several hundred million dollars in the modernization, but is only revealing about $240 million of its proposed investment, based on what’s potentially eligible for tax breaks.

The state Board of Commerce and Industry is expected on Friday to vote on whether the project’s Industrial Tax Exemption program request should move forward.

The East Baton Rouge Parish school board, metropolitan council and the sheriff’s office will then decide in coming months on whether to approve up to 80% property tax abatement for 10 years worth $20 million in exchange for $230.5 million in upgrades at the refinery.

A final investment decision by the company is expected this year and is partially dependent upon tax breaks being approved. Construction could begin about halfway through the year.

The oil giant hired Stephen Barnes, economist and director of the Kathleen Blanco Public Policy Center at the University of Louisiana at Lafayette, to conduct an economic impact study about the proposed site modernization, released on Tuesday.

The project would generate $6.7 million for the Sheriff’s Office, $20 million in property taxes for East Baton Rouge Parish and $21.9 million for the East Baton Rouge School District if approved, the report said. ExxonMobil also is expected to use the state’s workforce development training program FastStart.

ExxonMobil expects to spend several hundred million dollars at the refinery to make it more competitive and position it for a potential major expansion in the future.

The projects would enable the processing of new types of crude oil while reducing environmental emissions at the site.

The company expects to pay $4 million in sales taxes from construction and another $2.7 million in sales taxes during operations. Over a 20-year period, the company expects to pay $21.8 million in property taxes.

More than 1,200 construction jobs would be supported through 2023. There are no new permanent jobs tied to the proposed project but the company says that since the industry as a whole has been shedding jobs in recent years the investment will help protect existing jobs.

As a result, it’s estimated that 84 jobs at the refinery would not be lost over the next decade. ExxonMobil has 1,300 existing jobs, which include engineers, operators and technicians working at the refinery.

https://www.theadvocate.com/baton_rouge/news/business/article_44b3a40e-5ffe-11eb-98c0-4f5b8965d4b1.html

Pandemic pushes Exxon to historic annual loss, $20 billion cut in shale value

From Jennifer Hiller, Reuters News Service, February 2, 2021

HOUSTON (Reuters) -Exxon Mobil Corp on Tuesday posted a historic annual loss after the COVID-19 pandemic hammered energy prices and the company reduced the value of shale gas properties by more than $20 billion.

Exxon last year slashed spending on new projects by nearly a third, outlined plans to cut up to 15% of its workforce while adding $21 billion to its debt to cover spending and restructuring.

The changes come amid “the most challenging market conditions Exxon has ever experienced,” said Chief Executive Darren Woods, and over time will cut costs by $6 billion a year compared to 2019.

The company reported a net annual loss of $22.4 billion for 2020, on the writedown and losses in oil production and refining, compared with a full-year profit of $14.34 billion in 2019.

Exxon declined to comment if it has ever had an annual loss, but the company churned out profits since Exxon merged with Mobil in 1999 and through the 1980s oil bust.

OILMAN JOINS BOARD

The company remains under fire from environmentalists and activist investors pushing for a board overhaul and a strategy that would transition to cleaner fuels. Exxon pushed back against their calls for clean energy expertise, naming the former head of Malaysia’s state oil company, Tan Sri Wan Zulkiflee Wan Ariffin, to its board. It is in discussions with other candidates, the company added.

Other oil majors posted losses for the year as pandemic-related travel restrictions cut fuel demand and triggered huge writedowns. Rivals BP Plc and Chevron Corp posted annual losses.

Royal Dutch Shell Plc reports financial results Thursday.

Exxon posted a net loss of $20.2 billion, or $4.70 per share, in the fourth-quarter ended Dec. 31, compared with a profit of $5.69 billion, or $1.33 per share, a year ago. Excluding the impairment and other charges, the company earned 3 cents per share, beating analysts’ average expectation of a one-cent gain, according to Refinitiv IBES data.

Exxon shares, which have lost a quarter of their value in the past 12 months, rose 1.6% to $45.62 on Tuesday.

“The turnaround story will take some time,” said Biraj Borkhataria, analyst with RBC Capital Markets, noting that the company is not yet covering its dividend and capital spending with cash from operations.

But with oil prices recovering, Exxon can start to cover dividend and begin paying down the $68 billion in debt on its balance sheet, Woods said. Oil is up 11% so far this year, and trading at pre-pandemic levels.

Exxon still has “plenty of wood to chop” but the willingness to cut costs to pay the dividend will play well with investors, said Mark Stoeckle, senior portfolio manager at Adams Funds.

Project spending fell nearly a third last year and this year will near the bottom of the company’s $16 billion to $19 billion forecast, Woods said. Spending will rise to as much as $25 billion from 2022 through 2025, he said.

LOWER OUTPUT IN OIL AND REFINING

Exxon’s oil and gas output was 3.7 million barrels of oil and gas per day in the fourth quarter, down 8% compared with a year earlier.

It projects a doubling of Permian Basin output to 700,000 barrels per day by 2025, down from the million-barrel target it previously had expected to hit by 2024 in the top U.S. shale field, Woods said.

Exploration and production, Exxon’s largest business, lost $18.5 billion in the fourth quarter on the natural gas asset impairments, compared with a profit of $6.1 billion the year prior.

Its chemicals business earned $691 million on better margins in part from lower oil prices, up from a loss of $355 million a year ago. Refining lost $1.2 billion, compared with a profit of $898 million last year, on weak margins and lower output as the pandemic limited global travel.

The writedown lays bare the size of the miscalculation that the company made in 2010 when it paid $30 billion for U.S. shale oil and gas producer XTO Energy.

The move to shake up its board comes as Exxon faces a proxy fight with hedge fund Engine No. 1, which has proposed four candidates and wants the board to include clean-energy experience.

“Exxon Mobil shareholders deserve a board that works proactively to create long-term value, not defensively in the face of deteriorating returns and the threat of losing their seats,” Engine No.1 said in a statement.

On Monday, Exxon said it would invest $3 billion on lower emission solutions through 2025 and that it has created a business that will focus on commercializing its carbon capture technology.

https://www.reuters.com/article/us-exxon-mobil-results/pandemic-pushes-exxon-to-historic-annual-loss-20-billion-cut-in-shale-value-idUSKBN2A21LN