From an Article by Chrissy Suttles, Ellwood City Ledger, March 9, 2020

Environmental groups and legislators from throughout the state gathered in Harrisburg on Monday (3/9/20) to rally against hefty tax breaks for some natural gas manufacturers.

Representatives from PennFuture, the Breathe Project and nearly three dozen other organizations spoke out against House Bill 1100 in the Capitol rotunda, urging Gov. Tom Wolf to veto the bill passed with bipartisan support last month.

HB 1100 would establish multi-million-dollar tax breaks for companies investing at least $450 million to build a manufacturing plant that creates a minimum of 800 combined temporary and permanent jobs. The incentive is similar to what Shell Chemicals received years ago to build its petrochemical complex in Potter Township.

The new program would cost $22 million annually per plant in missed taxes until the strategy ends in 2050. It encourages the use of natural gas across the board, roping in fertilizer manufacturers.

Speakers argued the subsidy’s return on investment would include health complications and environmental degradation related to natural gas extraction. Others said clean energy companies should be included in the tax breaks.

“No industry is entitled to an open-ended tax credit,” said PennFuture president Jacquelyn Bonomo. “The entitlement mindset of this industry is unacceptable to communities who refuse to be soaked in toxins in exchange for jobs. The days where Pennsylvanians must accept pollution in exchange for progress must come to an end.”

As part of a package of Republican-sponsored bills called Energize PA, the effort is just one of many established to help subsidize the natural gas and petrochemical industries. Although the bill passed through the state House and Senate with sweeping support, including from Beaver County’s state legislators, Gov. Tom Wolf plans to veto it.

Wolf believes the tax breaks should be considered on a case-by-case basis, but the General Assembly could override that veto if it so chooses. Because the bill includes language requiring companies to pay construction workers the prevailing wage rate and make “good-faith efforts” to employ local laborers, it has earned the support of state building trade unions.

Veronica Coptis, executive director of the Center for Coalfield Justice, said the billions of dollars in taxpayer subsidies offered in HB 1100 could be invested in schools, childcare, public safety and community development instead. Democratic representatives from Pittsburgh and elsewhere noted the investment’s uncertainty in an unpredictable market.

“This bill asks us to prop up corporate profit margins in an uncertain and volatile global market,” said state Rep. Sara Innamorato, a Democrat from Pittsburgh. “Courting petrochemical development with no plan to recoup that investment pits our public health, public dollars and public goods against private profits. We need coordination, clarity and transparency on the true costs of subsidizing these industries and operations.”

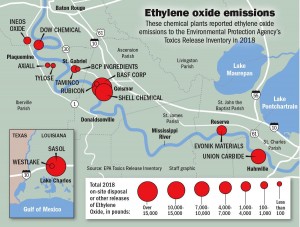

While supporters say petrochemical production will further strengthen the state’s economy, critics caution the industry’s risk to climate and public health. Environmentalists point to a region along the Mississippi River in Louisiana known as “cancer alley” due to a cluster of cancer patients living near petrochemical facilities. (See the graphic below.)

Additionally, Shell’s cracker alone is legally permitted to emit 2.2 million tons of carbon dioxide each year and more natural gas development could lead to increased methane leaks and pipeline spills.

Matt Mehalik, executive director of the Pittsburgh-based Breathe Project, said those concerned about the Ohio River Valley’s future have seen how heavy industrial development can wreak havoc on a region.

Larry Schweiger, chair of the Climate Reality Action Fund, said lawmakers should be instead promoting clean and renewable energy.

“If Pennsylvania lawmakers were serious about creating good paying jobs they would do what New York did by investing in clean energy,” he said. “For about $1.5 billion, New York spawned 40,000 renewable energy jobs where $1.6 billion in the cracker plant will create 300 to 600 jobs post construction.”

##################################

{ 3 comments… read them below or add one }

NOT ONLY IN PENNA., BUT IN W.V. TOO! (3/16/20)

One does not need to go to Pennsylvania to see this. Our own WV Legislature earlier this month passed HB 4001, which provides significant tax breaks and state support for any investment of $25 million that can not get private funding. If an investment is so risky that private banks won’t fund it, why should the State get involved? And why make it tax-exempt?

Meanwhile the Monongalia County Commission is considering another huge property tax break for a gas-fired power plant. The PILoT Agreement would also waive B&O taxes to the State.

Given the certainty of climate change and the need to eliminate greenhouse gas emissions, a tax break for renewables might make sense, but a tax break for fossil fuels is just plain dangerous.

Jim Kotcon, Monongalia County, WV

They want to catch-up with West Virginia. As Jay Hammond, then governor of Alaska, once said, “unlike Alaska, West Virginia has failed to ‘diaper the devil’ because it has inadequately taxed its extractive industries or put the revenue in a permanent fund to ensure future generations will benefit from the state’s natural wealth.”

Corporate Social Responsibility is really a hoax, for the simple reason that the vast majority of corporations have a single-minded focus on the short-term maximization of shareholder value, and that priority is baked into their DNA. We live in a marketocratic society, in which big business capitalism and democracy are incompatible.

They want to catch-up with West Virginia, really? As Jay Hammond, then governor of Alaska, once said, “unlike Alaska, West Virginia has failed to ‘diaper the devil’ because it has inadequately taxed its extractive industries or put the revenue in a permanent fund to ensure future generations will benefit from the state’s natural wealth.”

Corporate Social Responsibility is really a hoax, for the simple reason that the vast majority of corporations have a single-minded focus on the short-term maximization of shareholder value, and that priority is baked into their DNA. We live in a marketocratic society, in which big business capitalism and democracy are incompatible.

Tom Bond, Lewis County, WV