Consider the Longview II PILOT Agreement for New Power Plant

Consider the Longview II PILOT Agreement for New Power Plant

By Kelly Allen, WV Center on Budget & Policy, December 10, 2019

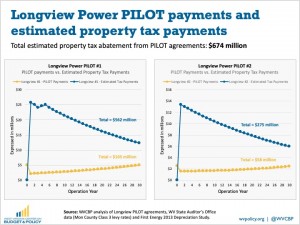

While local government agencies have not disclosed the forgone revenue estimates from the Longview I or II PILOT agreements, we can estimate the value of the tax expenditure by looking at what Longview would be paying if it paid the same tax rate as other businesses in Monongalia County.

PILOT Agreements in West Virginia Lack Transparency and Are Often Unnecessary —

-Neither the state nor the county report on how much property tax revenue is lost each year to PILOTs and other business tax incentives.

-There is no evaluation process for determining that PILOTs have provided a net good for residents and taxpayers.

-Research suggests that between 75-98% of the time, business tax incentives do not affect a business’ decision on where to locate.

-Even when they do tip a location decision, they rarely pay for themselves by providing net positive tax revenues.

-Poorly designed business tax incentives threaten public services, turning a tool said to promote growth into an economic disaster.

There are best practices for ensuring transparency and accountability when PILOTs are done —

✓ Disclose the forgone property tax revenue and require an evaluation of all PILOT agreements to ensure a net positive taxpayer benefit.

✓ Give school boards decision-making authority to approve all agreements as they are the most impacted by loss of property tax revenue (2/3 of property taxes go to local schools).

✓ Enlist a neutral or third-party to conduct a cost-benefit analysis to ensure that the deal is worthwhile over the short- and long-term life of the project. (Our only current analysis was paid for by Longview).

✓ Include local hiring provisions, pay and benefit standards, and clawback/recapture provisions if the developer fails to fulfill their obligations.

✓ Grant abatements only to areas in need of development and to those that maximize beneficial outcomes (infrastructure improvements, quality jobs, overall revenue gains).

✓ Limit the length of the abatement to the minimum necessary to attract the development sought.

At the very least, PILOT agreements in West Virginia, especially those where almost all of the economic impact happens during construction, like Longview Power, should require that the new tax revenue from the project exceeds the property tax abatement and that there are job creation and retention requirements.

>>>>>>>>>>>>>>>>>>>>>>>>>

See also: PILOT Agreements Cost State Millions in Tax Revenue: An In-Depth Look at Longview Power Plant, Ted Boettner, October 15,2019

{ 1 comment… read it below or add one }

Activists protest Longview Power’s plan to expand to natural gas

From an News Report by Larmie Sany, WBOY News 12, January 6, 2020

MORGANTOWN, W.Va. – In October, Longview Power announced plans to expand their facilities, but fast forward a few months and environmental activists want to make sure that doesn’t happen.

Activists gathered outside the Monongalia County Courthouse for a press conference and as a means to voice their complaints about Longview’s plans to expand by adding on natural gas and solar power to their clean coal operations.

They were angered by what they said would be very negative environmental impacts on the quality of air and life if the natural gas plant goes into operation.

James Kotcon, one of the event organizers, is the conservation chair of the West Virginia Chapter of the Sierra Club, an environmental organization. Kotcon, like the other speakers, said he didn’t want Longview to receive any county or state level tax breaks for their expansion because it wouldn’t be worth it.

“It already has far more fossil fuel capacity than it needs,” explained Kotcon. “Building additional fossil fuel capacity locks us in continued emissions and does not resolve the issue with climate change. We must be reducing our greenhouse gas emissions much faster than a simple transition from one fossil fuel to another. We need to get to zero emissions by 2050.”

Kotcon is using 2050 as a deadline because that is the date the United Nations climate scientists provided for Earth to be carbon neutral before there’s no turning back.

Carbon neutrality means having technology that captures all the carbon dioxide and other greenhouse gases or not producing any greenhouse gases, either way resulting in zero emissions.

One of the ways to head toward that future is through renewable energy production, like solar power. Although it is included in Longview’s plan, Kotcon and other activists said it was not enough.

“If you read the application carefully the plans for building the solar plant are very ambiguous,” Kotcon said. “As we pointed out, they don’t have a labor agreement and so on. The biggest issue is that the fossil fuel is supposed to generate 1200 megawatts, the solar farm will generate 20 megawatts. The solar farm is definitely a step in the right direction, the fossil fuel plant is not.”

He said they have asked the Monongalia County Commission to require some form of carbon capture technology for the natural gas plant if Longview is going to receive a tax break. At this point, Kotcon said, Longview has not included any greenhouse gas controls in its plans, leaving them completely unregulated.

Also, activists from the Greater Morgantown Sunrise Movement voiced their perspectives.

https://www.wboy.com/top-stories/activists-protest-longview-powers-plan-to-expand-to-natural-gas/