From an Article by Kallanish Energy News, June 7, 2019

Wells drilled horizontally into tight oil and shale gas plays continue to account for an increasing share of crude oil and natural gas production in the U.S., the Energy Information Administration said Thursday.

In 2004, horizontal wells accounted for roughly 15% of U.S. crude oil production in tight oil formations. By the end of 2018, that percentage had skyrocketed to 96%.

Similarly, horizontal wells comprised roughly 14% of U.S. natural gas production in shale plays in 2004, and jumped to 97% last year.

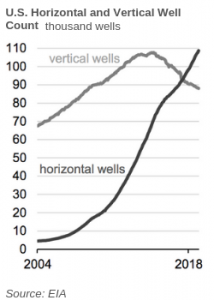

There were more vertical than horizontal wells until 2017!

Although horizontal wells have been the dominant source of production from U.S. shale gas and tight oil plays since 2008 and 2010, respectively, the number of horizontal wells did not surpass the number of vertical wells drilled in these plays until 2017.

Roughly 88,000 vertical wells in tight oil and shale gas plays in the U.S. still produced crude oil or natural gas at the end of 2018, but the volume produced by these wells was minor compared with the volume produced by horizontal wells, acording to EIA.

Many of these remaining vertical wells are considered marginal, or stripper, wells, which will continue to produce small volumes until they become uneconomic.

Drilling horizontally allows producers to access more of the oil- and natural gas-bearing rock than drilling vertically. This increased exposure allows additional hydraulic fracturing with greater water volumes and pounds of proppant.

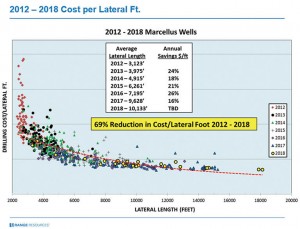

The lateral length of horizontal wells has also increased, allowing for more exposure to oil- and natural gas-producing rock from a single well.

The production history of horizontal vs. vertical wells varies by play, EIA said. For example, some tight formations in the Permian Basin have a long history of vertical well production. In 2004, vertical wells generated nearly all (96%) crude oil production from these formations.

As late as 2014, vertical wells accounted for as much as half of Permian production, but by 2018, vertical wells accounted for only 7% of that production. By contrast, modern production in the Marcellus Shale play in the Appalachian Basin is almost entirely from horizontal drilling.

While some of the first natural gas wells in the U.S. were drilled in Appalachia, production shifted to more economic areas and only resumed upon the development of horizontal drilling and hydraulic fracturing techniques.

Presently, essentially all (99%) hydrocarbon production from the Marcellus has been from horizontally drilled wells.

>>>>>>>>>>>>>>>>>>>>

See Also: Super Laterals: Going Really, Really Long In Appalachia | Hart Energy, July 2, 2018 ·

One horizontal well had an extended lateral length of 18,500 ft with a total depth of 27,048 feet. It was completed with 124 stages of fracturing. After the first 24 hours of flowback into sales, the well was producing approximately 5 MMcf of 1,300 Btu gas, with 1,200 bbl of condensate per day. To date, the company has drilled 15 super laterals with an average lateral length of 18,375 ft. Its longest lateral was 20,803 ft—Purple Hayes, which was drilled in 13 days.

>>>>>>>>>>>>>>>>>>>>>>>>>

See Also: JPT — Drilling for Miles in the Marcellus: Laterals Reach New Lengths, August 8, 2018

{ 3 comments… read them below or add one }

OIL DOWN AS US CRUDE SUPPLY SEEN RISING

By Bloomberg, November 18, 2019

(Bloomberg) — Oil dropped for a second day on indications American crude stockpiles and shale output will keep expanding, while investors wait for a breakthrough in U.S.-China trade talks. Futures declined as much as 0.6% in New York after falling 1.2% on Monday, the most since Nov. 6. U.S. inventories probably rose by 1.5 million barrels last week, according to a Bloomberg survey before government data on Wednesday, while shale output at major fields is expected to increase next month.

Global markets are in a holding pattern, sensitive to any developments on trade after months of closely followed negotiations. The ebb and flow of trade talks between Washington and Beijing has weighed on oil prices, which have fallen around 14% from an April peak. While negotiators held “constructive discussions” over the weekend, CNBC reported Monday that China is pessimistic about a deal due to President Donald Trump’s reluctance to roll back existing tariffs. The market is “still very vulnerable to headline risk around the trade dispute, whether positive or negative,” said Michael McCarthy, chief market strategist at CMC Markets in Sydney. Oil prices will remain under pressure while the market waits for an agreement on trade, he said. West Texas Intermediate for December delivery fell 30 cents, or 0.5%, to $56.75 a barrel on the New York Mercantile Exchange as of 7:06 a.m. in London. The contract slid 1.2% to settle at $57.05 on Monday, dropping from the highest close in almost eight weeks. The front-month contract will expire Wednesday. Brent for January settlement slipped 19 cents to $62.25 on the London-based ICE Futures Europe Exchange. The contract lost 1.4% to close at $62.44 on Monday. The global benchmark crude traded at a $5.42 premium to WTI for the same month.

U.S. crude stockpiles are at the highest level in four months. If official government data confirms the forecast increase in inventories, it would be the fourth weekly advance.

Output at major American shale fields will climb by 49,000 barrels a day to 9.13 million barrels a day in December, according to a drilling report from the Energy Information Administration.

Word that the White House would extend a license to allow U.S. companies to do business with Chinese firm Huawei Technologies Co. competed with reports suggested Beijing was skeptical about reaching a broad trade deal anytime soon. Economic expansion in Japan and China is floundering, while Germany barely dodged a recession, according to data released last week, as trade conflicts took a toll.

US CRUDE EXPORTS EXPECTED TO DOUBLE BY 2022

Written by Valerie Jones at Rigzone

The U.S. could see its crude oil exports nearly double by 2022, according to energy research firm Rystad Energy. Rystad forecasts that U.S. crude exports could increase from current levels of 2.9 million barrels per day (bpd) to nearly six million bpd by 2022. This is based off the nation’s expected production increase of 1.2 million bpd year-over-year in 2020 and domestic refineries at capacity to absorb shale growth.

“Crude exports will grow on the back of new infrastructure coming online in Corpus Christi, Texas, and as international crude buyers ramp up efforts to diversify their import sources after the attacks on oil facilities in Saudi Arabia and overall rising tensions in the Middle East,” said Paola Rodriguez-Masiu, a senior analyst on Rystad’s oil market team.

Rystad also noted the recent slowdown of U.S. crude exports in third quarter of 2019, due in part to the narrowing of the Brent-WTI price spread and effects from the five percent tariff imposed on U.S. crude by China. Despite that slowdown, Rystad expects an export rebound to 3.7 million bpd in fourth quarter 2019 before climbing to even higher levels.

“This surge in crude shipments from the U.S. will be made possible by a flurry of new pipeline and export terminal infrastructure coming online in the coming years,” Rodriguez-Masiu said.

Olympus Energy completes record-breaking natural gas well, WPXI News 11, Paul Gough, Pittsburgh, December 23, 2020

Allegheny County, PA — When Olympus Energy began work on its Midas 6M well in Plum Borough earlier this year, it didn’t plan on a record-breaking lateral length. But that’s exactly what the Canonsburg-based driller accomplished.

The privately-held Olympus Energy — the 10th-largest natural gas producer in southwestern Pennsylvania, according to the 2020 Pittsburgh Business Times Book of Lists — completed the Midas 6M with a lateral length of 20,060 feet. That’s a record in the Marcellus Shale among completed and producing wells, according to Olympus Energy and Pennsylvania Department of Environmental Protection data.

That’s about 4 miles in length.

https://www.wpxi.com/news/business/olympus-energy-completes-record-breaking-natural-gas-well/ANQUQQBNUFG3BBZ6XXEWBF7C44/