Tax Cuts are Tied to Teacher Strike

Tax Cuts are Tied to Teacher Strike

From the WV Center for Budget & Policy, March 4, 2018

A recent Huffington Post piece shows how a decade of business tax cuts helped fuel the West Virginia teacher strike.

Since 2006, the state has cut millions in business tax cuts in a failed effort to boost economic activity. It has cost the state roughly $425 million annually and lead to nearly $600 million being carved out of the state budget.

State spending on teachers and service personnel is down $90 million since 2012. If legislators say they can’t afford a permanent revenue stream to address public workers’ concerns, it’s because the state prioritized business over education.

In the News for West Virginia

For the first time in the past several years, West Virginia is not going through a budget crisis. The multiple years of budget gaps reaching hundreds of millions of dollars have stopped, and the governor’s budget actually projects significant budget surpluses in the years ahead.

WVCBP senior policy analyst Sean O’Leary has taken a look at what investments the state could be making in its people instead of the special interest tax cuts proposed in SJR9.

WVCBP senior policy analyst Sean O’Leary tackles the questions of can West Virginia afford to not increase its natural gas severance tax.

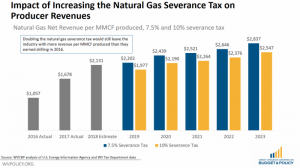

With the debate over teacher and other public employee pay and PEIA costs currently ongoing, proposals have been floated to address PEIA costs with an increase in the natural gas severance tax. The gas industry resists an increase, claiming it would destroy the industry, but the data shows otherwise.

Even a modest increase to 7.5 percent, while leaving plenty for the industry, would have a big impact on the state’s finances. Increasing the severance tax rate to 7.5 percent would increase severance tax revenue by $93 million in 2019, and at total $585 million from 2019 to 2023.

WVCBP communications director Caitlin Cook writes about a new and dangerous shift in West Virginia state policy – preemption – in this piece.

Senate Bill 458 would end the ability of local mayors, councils, and commissioners to represent their communities’ unique values, views, and needs. They would be powerless to impact local matters like wages, paid sick time, fair scheduling and employment history.

Contact Judiciary Chairman John Shott and respectfully ask that SB 458 be taken off the agenda.

This WVCBP blog cautions the legislature on the risk of tying teacher and public worker pay raises to a new revenue estimate that is on shaky ground.

The new revenue estimate included an additional $58 million in tax revenue and came a day after Gov. Justice announced a pay raise “deal” that would include a five percent raise for teachers and school service personnel, and a three percent raise for other state employees.

West Virginia would need around a $1.3 billion boost in economic activity to generate an additional $58 million in general revenue funds. This move could lead to mid-year budget cuts or Rainy Day Fund reductions if the revenue target isn’t met. A more sound approach would be a permanent revenue source for public employee pay and insurance.