Year 2017 to bring peak in first wave of US ethane cracker construction

From the Editors, Petroleum World, January 20, 2017

New Orleans — Two thousand and seventeen will not only mark the peak of the first wave of U.S. ethane cracker construction, but will also be the year in which decisions are made on the anticipated second wave of construction.

Of eight projects that form the first wave, up to six will come online during 2017, adding more than 7 million tons per annum of ethylene capacity. Of another 10 projects being considered, at least two are due to reach final investment decisions early in the year, and a third – and the biggest of them all – is progressing quickly toward a decision.

>>> Ohio, Texas due for big decisions –

PTT Global Chemical is expected to make a final investment decision on Ohio’s first ethane cracker by the end of March, Belmont County Commissioner Mark Thomas told local newspaper the Wheeling Intelligencer recently. According to the report in the Intelligencer, site preparation for the planned cracker in Belmont County, Ohio (located on the other side of the Ohio River from Wheeling, West Virginia) is nearly complete, and all signs of the former R.E. Burger power plant are “nothing more than a memory”.

Thailand’s PTT and minority stakeholder Marubeni of Japan have spent more than a year evaluating the viability of the project. The project cleared a significant hurdle in the first week of January when the Ohio Environmental Protection Agency agreed to let the company discharge wastewater into the Ohio River. The Ohio EPA is still reviewing the air permit for the project, according to an agency spokesperson.

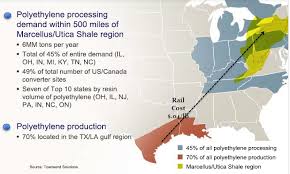

This would be the second ethane cracker in the U.S. Northeast, with Shell planning to begin construction on a cracker in Beaver County, Pennsylvania, in the final quarter of 2017, and to begin producing ethylene there by 2022. Braskem has also been considering a 1.1 mtpa cracker in Parkersburg, West Virginia, although multiple sources have told Petrochemical Update these plans are on hold.

On the Gulf Coast, Total intends to sanction its 1 mtpa Port Arthur, Texas cracker project in the coming months, Chairman and CEO Patrick Pouyanné revealed to investors late last year. FEED studies were completed in summer, and Total is now discussing “a very competitive cost”, he said. The Port Arthur site includes a 169,000 b/d-capacity refinery and an existing 1 mtpa steam cracker, the latter of which is a joint venture with BASF. In 2013, Total and BASF adapted the steam cracker to meet 80% of its feedstock needs with ethane, butane and propane from shale gas – as opposed to more-costly naphtha.

ExxonMobil and SABIC are in the final stages of buying land in Texas for the ethane cracker they are proposing to build in a joint venture, the San Antonio Express News reported on December 23, and SABIC later confirmed. The land is 1,400 acres of mostly open fields between the small cities of Portland and Gregory, and across Nueces Bay from Corpus Christi. According to the Express News, Portland’s City Council unanimously voted to urge the joint-venture partners to choose another location. However, they have no power to block the land being used for an ethane cracker as it falls outside the city limits.

>>> Several crackers close to finish line —

Joint-venture partners OxyChem and Mexichem are likely to be the first to the finish line in 2017, with their Ingleside ethylene plant on track for commissioning in January and to begin producing ethylene in the first quarter of 2017, according to OxyChem CFO Christopher Stavros. OxyChem will use the ethylene to manufacture vinyl chloride monomer, which will then be sent to Mexichem’s plants in Mexico and Colombia to produce polyvinyl chloride and PVC piping systems.

Two separate 1.5 mtpa crackers being constructed in Texas by Chevron Phillips (CPChem) and Dow Chemical are 85% complete, senior officials revealed recently, and both are on target to come online in mid-2017. Greg Garland, Chairman and CEO of Phillips 66, which owns a 50% share in CPChem’s project in Cedar Bayou, said the polyethylene business is on track to start by mid-2017, and the ethane cracker in the second half of the year.

ExxonMobil’s 1.5 mtpa cracker in Baytown, Texas is also expected to come online in 2017, with Formosa Plastic’s 1.59 mtpa cracker in Point Comfort, Texas to follow in 2017 or 2018 and Sasol’s cracker in Lake Charles, Louisiana in two phases in 2018 and 2019. Indorama also expects to this year complete the refurbishment of the 420,000 tpa Louisiana cracker it acquired in in 2014.

Source: http://www.petroleumworld.com

See also: www.FrackCheckWV.net

{ 1 comment… read it below or add one }

Saudi’s SABIC to acquire remaining 50 percent of Shell venture for $820 million

Reporting by Reem Shamseddine, Reuters News Service, January 22, 2017

Saudi Basic Industries Corp (SABIC) 2010.SE has signed an agreement to acquire the 50 percent that it does not already own in its petrochemical venture with Shell Arabia, a unit of Royal Dutch Shell for $820 million, SABIC said on Sunday.

“As per the partnership agreement between the two companies that stipulates the right of SABIC to renew or end the partnership by the end of 2020 … SABIC decided to acquire the full stake of Shell, which is 50 percent,” it said.

SABIC, one of the world’s largest petrochemical firms, said the $820 million figure was based on the net value of the venture’s assets. It said the acquisition was in line with a strategy to develop its successful investments.

The venture, known as SADAF, was established in 1980 and operates six petrochemical plants with total annual output of over 4 million tonnes year of chemicals. It makes products including ethylene, crude industrial ethanol and styrene at a complex in Jubail, on the Gulf coast of Saudi Arabia.

The acquisition agreement is expected to be carried out before the end of this year, SABIC said, adding that it signed another memorandum of understanding with Shell Arabia on Sunday to boost the companies’ cooperation in unspecified international and local investments.

“We will continue to explore potential future opportunities with SABIC,” Graham van’t Hoff, executive vice-president of chemicals at Shell, said in an emailed statement to Reuters.

In 2014, SABIC and Shell shelved plans to expand SADAF as the results of feasibility studies were not encouraging. The expansion was to have added production of polyols, propylene oxide and styrene monomer.

Shell is involved in other downstream activities in Saudi Arabia; it has a crude oil refinery with Saudi Aramco in Jubail.

Source: http://uk.reuters.com/article/us-sabic-shell-idUKKBN15609J

See also: http://www.FrackCheckWV.net