Velocys Postpones Northeast Ohio GTL Facility, Citing Project Financing Challenges

From an Article by Jamison Cocklin, NGI News, July 7, 2016

United Kingdom-based Velocys plc said Thursday that it would postpone the development of its small-scale 5,000 b/d gas-to-liquids (GTL) plant in Northeast Ohio, citing the commodities downturn and the effects it’s had on the company’s ability to raise capital for the project.

“Given the challenges in raising equity for capital projects of this nature at present, and in order to defer costs, Velocys has put its development of Ashtabula on hold, pending reassessment as part of the broad review of the strategy of the business that the company is currently undertaking,” Velocys said.

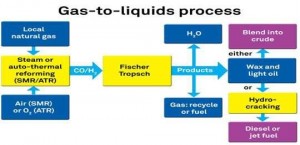

The company acquired Houston-based Pinto Energy LLC in an all-stock deal in 2014. Pinto first announced the GTL facility in Ashtabula, OH, in 2013. The facility would be located on an 80-acre site near ports and refineries on Lake Erie and would convert Marcellus and Utica shale natural gas into specialty products such as solvents, lubricants, waxes and transportation fuels.

Velocys, which develops, licenses and supplies small-scale GTL technology, had said early last year that it would soon make a final investment decision on the project. The company said an analysis of the wax market conducted in the first half of this year showed that the plant still remains economically viable, but didn’t say when it might consider moving forward with development.

Velocys formed a joint venture in 2014 with Waste Management Inc., NRG Energy Inc. and Ventech Engineers International LLC to develop GTL facilities in the United States, Canada, the UK and China. The JV broke ground last year for the Envia Energy GTL plant in Oklahoma City at Waste Management’s East Oak Landfill. That plant will use landfill gas to produce clean diesel fuel, synthetic waxes and naphtha.

Velocys said Thursday that construction at the site is ongoing. All modular process units, cooling towers and other major equipment have been installed. Velocys has sent a team of its engineers to the site to aid Ventech, the engineer, in the plant’s start-up and commissioning. Velocys added that it continues to pursue other opportunities in the United States and said it has completed its part of an engineering study for a national gas company in Central Asia for a project there.

Velocys technology is in the early stages of commercialization.Its equipment is significantly smaller, which enables the modular plants to be deployed more cost-effectively in remote regions that wouldn’t otherwise be able to accommodate larger refinery-sized GTL facilities that have been built on coastlines overseas. Just a handful of the larger, conventional GTL plants are operating globally, with capacities ranging up to 140,000 b/d. Those facilities can cost billions of dollars to construct, while smaller-scale facilities cost about $100 million, according to an estimate provided last year by Velocys.

Other GTL plants have been proposed for the Appalachian Basin in recent years, but none have been completed. They include Marcellus GTL LLC’s 84,000 gallon/d facility in Blair County that was announced in 2013; EmberClear Corp.’s 500,000 gallon/d plant in Southeast Pennsylvania that was announced in 2014, and Primus Green Energy Inc.’s proposal this year to build a small-scale GTL plant somewhere in the basin that would use Marcellus Shale gas to make methanol.

EmberClear dropped its plans last year for its Southeast Pennsylvania plant, citing administrative concerns and local opposition. Marcellus GTL’s facility is expected to be complete this year, according to the company’s website.

See also: www.FrackCheckWV.net

{ 1 comment… read it below or add one }

Doubtless a good move.

Buying into it to begin with must look foolish now. The oil glut and the attendant inefficiency of such a conversion would make it expensive to produce product. The building is continuing because they have the money to build it. Paying the money back will be a problem for Velocys, but the bankers will win either way. They have the best racket.

Bet Pinto Energy, LLC is happy!