Push to Optimize Results During Downturn Led to Eclipse’s Behemoth Utica Well

From an Article by Jamison Cocklin, Natural Gas Intelligence, May 18, 2016

While the past two years have been marked by declining profits, drilling activity and workforces for the oil and gas industry, innovations have underscored the downturn as well, with producers relying on technology to help shore-up their balance sheets.

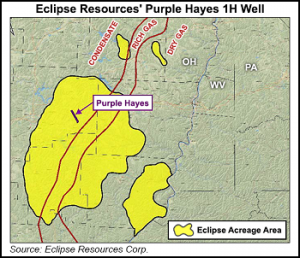

One example is Eclipse Resources Corp.’s Purple Hayes 1H well in Ohio’s Utica Shale, completed with an 18,544 foot lateral and 124 stages, setting what’s likely a record for the longest onshore lateral in the United States and possibly the world.

The Purple Hayes was drilled in the condensate window in Guernsey County, and at a cost of $15.8 million, it wasn’t cheap. According to Eclipse’s type curve summary, a 10,000-foot lateral in the condensate window costs about $9 million; the same length in the dry gas window has run the company about $10 million. Ultimately, Eclipse management believes it can drill even longer wells with a goal of reducing drilling and completion costs per foot and improving well economics.

Eclipse said the longer laterals should drive down finding and development costs by 20-30% in the condensate area and improve well returns by 35-70%.

“In the current low commodity environment, operators like Eclipse are targeting their core acreage and remain focused on optimizing development with longer laterals and shorter spacing,” said Nine Energy Service Inc. Vice President of Completions Technology Nick Pottmeyer. “Longer laterals are proving to be a more effective way to develop acreage. Increased well costs to drill [deeper] can be justified by the improved production ranges and return on revenue.”

Privately owned Nine Energy, an oilfield services company that offers completion, wireline and cementing solutions in North America, worked with Eclipse to design the plug and perforation system with well modeling software. The Purple Hayes was drilled in 18 days, and Nine said it took 23.5 days to complete without any unproductive time.

Eclipse Completions Manager Kyle Bradford said the company knew there would be a “number of challenges” for the well, but management said the goal was to enhance the return profile of the Utica by determining the technical limits of lateral length in the liquids portion of its acreage.

“It’s pretty neat. And really, the way you look at this is this is three laterals back-to-back in one well,” said Pennsylvania State University’s Terry Engelder, geosciences professor and Appalachian Basin expert. “If you have a rock that’s strong enough so that it doesn’t collapse on the drill rod as you’re drilling it, that probably is the major parameter that limits the length of these wells. They are in a rock in the Utica that has the kind of strength to remain open to allow that distance for drilling.”

Engelder pointed to ExxonMobil Corp.’s Sakhalin 1-Project offshore far east Russia, which is widely thought to be the world’s longest extended-reach well. An ExxonMobil subsidiary drilled the Odoptu OP-11 well to a total measured depth (TMD) of 40,502 feet, setting what it said was a world record in 2011 with a horizontal reach of 37,648 feet, or more than seven miles.

The Eclipse well had a TMD of 27,034 feet. By comparison, in the onshore closer to the Purple Hayes, Antero Resources Corp. set a company record in the fourth quarter with its Nova Unit 2H Marcellus Shale well in Doddridge County, WV, which was drilled with a lateral of 14,024 feet.

Engelder said there’s a trivial difference between the distance of the Antero and Eclipse wells, but noted that the Utica is likely more conducive to extended reach laterals. In the Marcellus, he said the folds of the Appalachian Plateau make longer wells more difficult. There are more faults and rock beds dip.

“I think the geological sweet spot, in terms of why it was done in Guernsey County, is that the rock is probably less faulted and more flat lying,” Engelder said. “In other words, you can aim the drill right straight forward and expect to stay in the same horizon all the way and you don’t have to worry about crossing faults. I don’t think this can be done in some of the Marcellus because of those geological complexities.”

Eclipse has more than 100,000 acres in Noble, Guernsey, Monroe, Belmont and Harrison counties. Analysts have noted that it could face liquidity strains next year if natural gas prices don’t improve. After the Purple Hayes, the company said it would again idle its drilling program until late summer and it is currently curtailing volumes as it waits for better prices, factors that make well optimization an even higher priority for a company in its situation.

Beyond reduced drilling activity, workforce reductions and other cost-cutting measures, operators across the Appalachian Basin are finding more ways to manage through the downturn. Most of the basin’s leading producers have retreated almost exclusively to their dry gas acreage where low breakeven prices and prolific wells are being used to defend against low prices. Some operators are also reverting back to wider spacing to either save on land costs or pair longer laterals with more efficiently spaced wells to boost estimated ultimate recoveries and reduce interference.

Footage drilled in the Utica has grown exponentially since unconventional drilling began in the play about six years ago. In 2010, the average footage drilled per well was 3,883 feet, according to the Ohio Oil and Gas Association’s Debrosse Memorial Report, an annual analysis of drilling operations in the state. By last year, that number had increased to 12,336 feet, boosting the average initial production of gas for each well from 50 Mcf/d to 5.4 MMcf/d.

While the Utica might be a top candidate for extended reach wells like the Purple Hayes, Engelder said similar techniques could be on the horizon for other operators across the basin and around the country.

> > > > > > > > > >

CONSOL puts focus on dry Utica play as wet-gas prices decline

From an Article by Paul Gough, Pittsburgh Business Journal, June 22, 2016

Consol Energy Inc.’s strategy is going to include a lot more dry-gas development in the Utica Shale as some of the economics of the basin have shifted away from the wet-gas areas of the Marcellus Shale.

“We believe the Utica will make up a larger portion of Consol’s development plans in the future,” COO Timothy Dugan told a crowd of industry executives at the DUG East natural gas conference in downtown Pittsburgh.

Consol halted its drilling program in 2015 as commodity prices declined. It has yet to resume drilling in Pennsylvania, Ohio or West Virginia, where it has one of the largest acreages among exploration and production companies in the Appalachian Basin. Consol has signaled that it is close to making a decision as to when it will resume drilling, perhaps as early as the second half of this year. But no announcement was made today, and Dugan declined to say when drilling might resume or whether a rig would first go into the Utica or Marcellus shales.

“The Utica is certainly a big part of those considerations,” Dugan said.

Dugan’s DUG East presentation was about Consol’s growth in the Utica, where he said the company was well-positioned. According to the latest production data available, Consol owned five of the top 10 producing wells drilled to date in the Utica. It has 28 Utica wells in production between eastern Ohio, southwestern Pennsylvania and northern West Virginia.

But he also described an initiative in the Utica — and an economic climate — where Consol couldn’t take the same deliberate approach to the Utica as it did with the Marcellus.

Consol has already reduced drilling costs and number of days to drill a well by double-digits since it began exploration. But it isn’t able to wait for flowing natural gas wells to make adjustments, Dugan said. Instead, it’s using a lot of mathematical modeling, geological knowledge and other technical know-how to determine the best places to drill in the Utica.

That’s really important in a place like the Utica Shale, which spans several states, as does the Marcellus Shale. Even though the locations are only between 100 and 200 miles apart, the Utica’s depth, pressures and geological attributes vary not only from the Marcellus but depending on location.

“The Utica is a different animal,” Dugan said. “It presents a unique, a different type of challenges.” Consol’s strategy also has different tactics even within the tri-state area. “What is the best practice on a well in Belmont County, [Ohio] may not be the best practice in Greene County, Pennsylvania, or Westmoreland County, Pennsylvania, or Tyler County, West Virginia,” he said.

{ 1 comment… read it below or add one }

Producers have forced suppliers to take less for their services and material. They have leases ready and waiting. A three and a half mile lateral takes no more of the gas in place. They are drilling in sweet spots, where the gas is easy and abundant. The return to investment is helped, but not the gas supply. It is just the faster and faster syndrome.

Opposition continues to build up, just as global warming does. The sillies on Capital Hill may deny global warming, but the physical world is behooven to no man. If we are to survive gas has gotta go.

Tom Bond, Resident Farmer, Lewis County, WV