Antero To Acquire Marcellus Shale Acreage From Southwestern

From an Article of the Oil & Gas Financial Journal, June 10, 2016

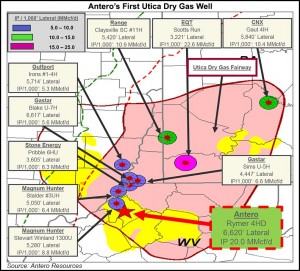

Antero Resources Corp. has agreed to acquire approximately 55,000 net acres of undeveloped Marcellus Shale leasehold, including deep rights on approximately 41,000 net acres prospective for the underlying dry Utica, and 14 MMcfe/d of net production for $450 million from Southwestern Energy. The acquisition includes undeveloped properties located primarily in Wetzel, Tyler, and Doddridge Counties in West Virginia.

Additionally, a third party has a 30-day tag along option to sell 13K net acres with 3 MMcfe/d of associated production under the same terms, bringing the potential acquisition price close to $560 million.

Commenting on Antero’s 2016 capital budget and development plans on the acquired acreage, Glen Warren, president and CFO of Antero, said the company expects to add an additional rig, focused primarily on Tyler County, in the second half of the year while maintaining its original drilling and completion budget of $1.3 billion.

The transaction looks positive for Antero, noted Seaport Global Securities analysts in a note Friday, “as the company meaningfully high-grades its inventory at a fair price ($7.3K/acre based on $3.5K/flowing Mcfepd), increases its 2017 outlook (~20%-25% YoY growth in 2017) and de-leverages its balance sheet (2016 net debt/EBITDA ~2.9x vs. 3.1x previously).”

The same day, Antero announced an equity offering of 26.75 million shares of common stock with a 4 million share overallotment, equating to 9.6% dilution (or 11.1% with the overallotment) with estimated gross proceeds of approximately $762 million (approximately $875 million with the overallotment).

Southwestern Energy

On the other side, despite acquiring the acreage from Chesapeake Energy at a higher price roughly 18 months ago, Southwestern’s sale of a portion is not surprising, said Brian Velie at Capital One Securities, as “carving out a piece of its 443K net acre Southwest Marcellus position had been widely discussed.”

“Considering the 12-month strip price for oil and natural gas have both declined by roughly 10% since the end of 2014, a haircut to the acreage price should be expected. However, also keep in mind that SWN has created considerable value on the acreage since the acquisition with a 40% improvement to well performance and a 33% decrease in days to drill,” Velie continued.

For Southwestern, “the acreage sold was worth less to SWN than the purchase price because the locations will come off the end of a 20+ year queue of Southwest Marcellus inventory,” Velie noted, and proceeds will go toward the principal balance of SWN’s $750 million term loan due in November of 2018.

The transaction is expected to close in the third quarter of 2016, subject to customary closing conditions, with an effective date of January 1, 2016.

See also: www.FrackCheckWV.net