Supply-side (Trickle-down) economics and regulations unfairly favor oil & gas

Commentary by S. Tom Bond, Jane Lew, Lewis County, WV

Voodoo economics is famous as the economics of Ronald Regan. He was a sports announcer and then actor by training and experience. Regan was a liberal and union leader at first but became a “conservative” later. Doubtless he could have argued any position he wished.

George H. W. Bush famously used the term “voodoo economics” in his 1980 bid for presidential nomination, implying a policy that wouldn’t work – was cut loose from reality. Subsequent experience proved Bush right.

Economics is the theory of business finance, but unlike physical science, conducting controlled experiments is usually not possible. The economist must figure out causes from what happens in real life after it happens. Simple mathematical relations such as those of physical science are almost never proven, so economics has schools reminiscent of religions. Economics cut loose from reality is not rare.

For businessmen, the objective is to convince other people with money or power to let the story teller take some initiative. Such is the nature of the extractive industries, including shale drilling. In short, people judge on the basis of how good the story is, rather than going to the labor of finding out if that story is connected with reality. Some have the connection of a summer breeze to a forest – the breeze blows through with little effect. Afterwards such fine stories are seldom checked, because nothing can be done then. The practice is – if it “works,” use it. If it doesn’t, try something else.

So what about shale drilling? What is left out? Let’s begin with subsidies. These include tax breaks and giveaways, research for the energy production, certain regulations that are favorable, restrictions on exports or exemptions from restrictions on imports.

All fossil fuel industries in the U. S. are subsidized to the extent of $37.5 billion annually, according to one source. Even further subsidies have been proposed in Congress but voted down. Across the world the subsidy amounts to $775 billion to $1 trillion.

This includes the following:

>>> Expensing intangible drilling costs: Since 1913, this tax break has let oil companies write off some costs of exploring for oil and creating new wells. When it was created, drilling meant taking a gamble on what was below the earth without high-tech geological tools. But software-led advances in seismic analysis and drilling techniques have cut that risk down.

>>> Deducting percentage depletion for oil and natural gas wells: Since 1926, this has given companies tax breaks based on the amount of products extracted from its wells.

>>> The domestic manufacturing deduction for oil and natural gas companies: In 2004, American manufacturing was being ravaged by China’s entrance on the global scene. But, the refining process involves high-tech manufacturing, so there was never any danger that either drilling or refining was going to migrate overseas.

The expense on research and development of fracking was more than $100 million over a course of 20 years. A lot of it was done in Morgntown, WV, in the Eastern Gas Shales Project. Much of the experience of George Mitchell, who is given credit for the first successful well, is told by his geologist, Dan Steward. Details are here. (Note: The “Breakthrough.org” is a pro-industry site.)

The ultimate example of favorable regulation is the Energy Act of 2005, also known as the “Halliburton Loophole.” It was Dick Chaney’s baby, when he was able to exert undue influence on government while George Bush II was president. It exempted oil and gas from many regulations that restrict other industries although O&G are larger, with a vast number of locations dispersed over a significant part of the United States.

The O & G industry is exempt from: the Clean Water Act, the Safe drinking Water Act, the Clean Air Act, the National Environmental Policy Act, the Resource Conservation and Recovery Act, the Toxic Release Inventory under the Emergency Planning and Community, Right-to-Know Act, and the Comprehensive Environmental Response, Compensation, and Liability Act, otherwise known as the Superfund Act.

You just have to stand back and say ‘Wow!” to that list. Just where is the interest of the citizenry in that? Nowhere! Not now nor in the future. The oil and gas industry has set up some big long term problems, too, given the aging oil and gas pipelines all over the country.

Furthermore, federal regulation of fracking is forbidden. The individual states can regulate fracking, but are faced with limited know-how, limited funds to operate regulatory agencies, and the influence of lobbying by national and international corporations.

Then there is the big complaint of residents in shale areas of externalized damage – damage the industry doesn’t pay for. Property devaluation – what do you think a well pad, access road and attendant pipelines does to property value? It can ruin the small property owner, and hurts the large landowner.

Also, there are road damages, courthouse expenses, extra policing and other public expense. Then there are damages to citizen health. There are 16,719 entries on the List of the Harmed published by the Pennsylvania Alliance for Clean Water and Air, as of August, this year. Some of the entries involve as many as 30 individuals. One can be sure that is a minority of those harmed, most remain quiet. You have to do a search to understand the number and variety of health problems caused.

If water sources are destroyed, there is little accountability by many companies. For example, two public drinking water systems have been impacted and at least six private water supplies allegedly contaminated due to ongoing pollution being caused by a natural gas fracking operation of JKLM Energy in Potter County, Pennsylvania.

When water buffalos are put out after fracking destroys an aquifer, they are usually abandoned when the drilling company leaves.

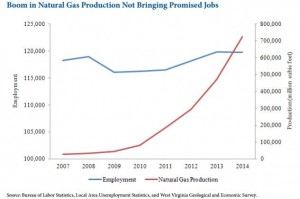

All those Jobs? “The development of the Marcellus Shale has led to a boom in West Virginia’s natural gas production. But aside from the increase in drilling activity and state and local tax revenue, the natural gas boom has not brought with it the jobs and economic growth that many predicted. While the state’s natural gas production has increased dramatically over the past several years, West Virginia has lagged behind the rest of the country in terms of job growth and fewer West Virginians are employed today than before the boom. Even in the counties where production has increased the most, job growth has been lackluster.”

Further economic news: “US shale producers lost more than $30 billion during the first half of 2015, as the prolonged slump in oil prices takes its toll. Bankruptcies and restructuring are on the rise as independent oil and gas companies do what they can to survive. Data company Factset reports that capital spending exceeded cash from operations by about $32 billion in the first six months of the year and is quickly approaching the deficit of $37.7 billion reported for the whole of 2014.

“Cutting the fat: A slump in oil prices is forcing the oil and gas services industry for the first time in 15 years to trim costs in a way that executives say will create a lasting change away from their usual lavish way of doing business. (9/12)

“Costly sales: Some U.S. oil producers are trying to sell parts of their lucrative saltwater disposal businesses in a sign that cheap crude is already forcing cash-starved companies to sell assets so oil can keep flowing.”