Large Natural Gas Transmission Pipelines in “Pipelinealachia”

>>> Commentary by S. Tom Bond, Retired Chemistry Professor & Resident Farmer, Lewis County, WV <<<

Pepe Escobar and others have referred to four countries whose names end in … -stan (Turkmenistan, Kyrgyzstan, Uzbekistan and Kazakhstan) as “Pipelineistan” because they are rich in oil and gas and ripe for the picking. I am going to call, from time to time, northern Appalachia as “Pipelinealachia” in analogy.

Of course, the gas over there is in conventional deposits and here it must be fracked at considerably greater expense and environmental damage. That’s “because the good stuff is gone” here. Much of it went into the atmosphere, let me remind you.

My attention was focused a few days ago by a lady who is in the unenviable position of having one of the big new pipelines go across her small property, and being within half mile of a second large pipeline. Unfortunately it is on the top of a ridge, and each of the pipelines is projecting a compressor station on that ridge within a mile of her home.

The pipeline bisects her property with a 125 foot right of way, but there is a high road bank where it enters, so they want an access road perpendicular to the pipeline, which will block off her house. To top it all, she is allergic to diesel fumes!

Over two decades ago she retired from Washington, where she had had worked as a technician in her husband’s legal practice, picking up a great deal of law knowledge, and familiarity with court procedure. She has considerable experience reading contracts and is not afraid to dive right in to reading them. As one might expect, the contracts offered to people take as much as possible, without consideration of present or future landowners.

If the pipeline doesn’t get built, the company owns the right of way after taking the lease, and the terms are vague enough that one can think of several other uses it covers. Assuming it is built, no provision is made for abandoning it. The rapid advance of other kinds of energy may make it obsolete (a “stranded asset,” the investors’ worst nightmare). If so, what happens? If it does continue for some projected lifespan, what happens then? Is whatever current landowner married to it “for time and eternity.” Or is it to become a public liability, like so much of the remains of the coal industry and chemical industry, to be cleaned up at public expense? The end of useful life certainly will come.

Some of the lady’s neighbors were glad to get a little cash. It is a poor neighborhood, and they are willing to endure the traffic, the dirt, the contamination for a modest payment. Or perhaps they had a limited concept of what was coming. The ones who bargained received second, even third offers, often with more money, but taking more land or changing the take somewhat. Of course the contracts had the standard “nondisclosure clause” to keep information, including both terms and price from the neighbors.

In such conditions people who refuse to sign are often told “Your neighbors have all signed” or “If you don’t sign, we are going to take it anyway,” even if the company has no right of eminent domain. Essentially, only interstate pipelines which have been vetted by FERC have eminent domain, although in many cases lease men may say a line which has not been vetted can use law to take the right of way.

Lease taking is an art in applied psychology which is well cultivated. They have tough guys, they have types that can charm, they have legalistic types and so on. Lease takers have been known to threaten old people, to claim the lease doesn’t say what it does, and even to make wild claims about what the law says when in fact it doesn’t.

You are supposed to be able to write-in additional provisions, which supersede the printed page, but I’ve also heard people claim the recorded lease is different from the one they signed. You can demand different terms on a printed page, requiring the land man to come back, too, if you hint you will then sign it. He likely would have to go back to get the boss’s permission to make a change anyway.

This is pretty serious business for the owners that reside on the land, the neighbors and those that follow, the “heirs and assigns,” as the law puts it. You need to cooperate with your neighbors, and get expert help. The land men do it every day and have a big organization behind them with experts of all kinds. You do it once or a few times in your life. You are just a daily hurdle that must be gotten over. Perhaps one of several for the day. Remember, it’s your interest against the company’s.

How long will this extraction boom last? Is it likely to play out? In the view of those playing the game, it can’t be interrupted. It will go on for decades. It can’t. First of all, there is much gas in the world that can be taken out of the ground cheaper. Some is in the Arabic states that are our nominal friends. Far more is in Russia, “pipelineistan,” allied with Russia, and Iran, all of which butt up against each other in the center of the Eurasian land mass, where gas can be piped to Europe and China without fracking or liquefaction.

Secondly, solar and other “renewable” sources of energy are poised for a rapid advance. Hydrocarbon advocates deny the chance of displacement, but it will happen quickly, because it eliminates much of the cause of global warming, provides more and better jobs and eliminates huge, long distance power lines.

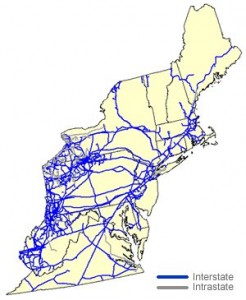

Third, the financial scenarios for fracking are uncertain. The price usually quoted for gas is the Henry Hub price. So what is that? It is a concentration point for gas moving east at Erath, Louisiana, where it interconnects with nine large transmission lines to pipe the gas on east. It serves as the source of figures used for gas price in the New York Stock Exchange and elsewhere. It is not the only transshipment point for gas, however. Marcellus gas is already in the East, and it goes through other hubs, being sold by one party to another.

It’s not just need to pay off debt that forces companies to keep drilling, see here.

Experts are saying the pipelines are needed for transport to markets, but the real objective is to export liquid natural gas. The cost of liquefaction, onloading and cross sea transport, with regasification is needed in addition to the higher cost of fracking. American businesses will have to compete with foreign countries for gas markets. Your cost may be the price in China, less what it takes to get it over there.

Then there is what I have referred to as the “White elephant in the room,’” i.e. global warming. Can economics drive us over the climate cliff, like in the movie “Thelma and Louise”?

The fact is that fracking is investment driven, not production drawn. Those who put the money together to capitalize the industry take theirs off the top, and they have the means to get publicity and influence legislation. Plenty of money is available to the producing companies, and they spread it around liberally to the benefit of their activities.

Like they said in pirate days, “Devil take the hindmost!”

See also: www.FrackCheckWV.net