Part 4. The future expense(s) to investors, to drillers, to government, and to you!

Original Article by S. Tom Bond, Retired Professor of Chemistry and Resident Farmer, Lewis County, WV

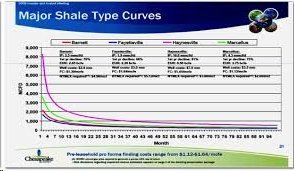

The drilling treadmill. This is a name given to the result of rapid decline in production of shale wells. Most shale wells produce substantially for a year, then rapidly decline thereafter. Thus if a field is to maintain production, another well must be drilled in three to five years, then another, then another.

The “drilling treadmill” was first recognized by David Hughes, a prominant geologist in Canada after studying 65,000 different wells from 31 different unconventional shale rock formations. He “warned that shale gas and tight oil operations shared four big challenges: escalating capital costs, uneven performance and a growing environmental footprint, all followed by rapid depletion.” And “Shale gas can continue to grow, but only at higher prices and that growth will require an ever escalating drilling treadmill with associated collateral financial and environmental costs — and its long term sustainability is highly questionable…” This study was done in 2012.

Geological consultant Arthur Berman has seconded that analysis and expanded it. In an article published in March of this year he says ” On the gas side, all shale gas plays except the Marcellus are in decline or flat. The growth of US supply rests solely on the Marcellus and it is unlikely that its growth can continue at present rates.”

On oil, ” The idea that Texas shales will produce one-third of global oil supply is preposterous.” He also says, “Oil companies have to make a big deal about shale plays because that is all that is left in the world. Let’s face it: these are truly awful reservoir rocks and that is why we waited until all more attractive opportunities were exhausted before developing them. It is completely unreasonable to expect better performance from bad reservoirs than from better reservoirs.” And “None of this is meant to be negative. I’m all for shale plays but let’s be honest about things, after all! Production from shale is not a revolution; it’s a retirement party.”

The Telegraph of London Calls the fossil fuel industry the “subprime danger of this cycle. The article begins ” The epicentre of irrational behaviour across global markets has moved to the fossil fuel complex of oil, gas and coal. This is where investors have been throwing the most good money after bad.” Then “Data from Bank of America show that oil and gas investment in the US has soared to $200 billion a year. It has reached 20 % of total US private fixed investment, the same share as home building. This has never happened before in US history, even during the Second World War when oil production was a strategic imperative.”

One of the world’s premiere financial newspapers, it says, “A large chunk of US investment is going into shale gas ventures that are either underwater or barely breaking even, victims of their own success in creating a supply glut. One chief executive acidly told the TPH Global Shale conference that the only time his shale company ever had cash-flow above zero was the day he sold it – to a gullible foreigner.”

Energy Aspects, a consulting firm which also publishes material on the web at www.energyaspects.com, in an article entitled “The other tale of shale” has this to say about shale: “The very nature of shale wells, which exhibit high decline rates, results in the need to constantly allocate capital towards exploration drilling in order to maintain and grow production volumes. As a result, the average capital expenditure spending of the 35 companies analyzed to serve as a guide to the industry has amounted to a staggering $50 per barrel of oil equivalent (BOE) over the last five years, at a time when their revenue per BOE has averaged $51.5. For these same companies, free cash flow has been negative in almost every quarter since Q2 07.” (Free cash flow is the money a company has to distribute to investors, assuming they don’t want to use it to grow.)

This sort of explains why your friends who have royalties haven’t been getting them lately – in effect they have been making a forced loan to the driller that doesn’t cost him interest, and one he can take out without going to the bank. I know of one family suing for retained royalties in the amount of $8,000,000! And others.

Continuing damage. As long as wells are drilled more damage is going to be done. Land use will be converted, roads broken, people made sick, future production of food and timber prevented, out door recreation destroyed, retirement possibilities for out of state couples denied, and living in the drilling field made unpleasant to impossible.

Pennsylvania state inspection records, no less, show compromised cement and/or casing integrity in up to 9.1% of the active oil and gas wells drilled since 2000, with up to a 2.7-fold higher risk in un-conventional wells drilled since 2009 relative to conventional well types. Hazard modeling suggests that the cumulative loss of structural integrity in wells across the state may actually be slightly higher than this, and upward of 12% for unconventional wells drilled since January 2009.

A recent investigative report of water contamination cases confirmed PA-DEP determination letters and enforcement orders indicating that at least 90 private water supplies across the state were damaged due to subsurface gas migration between 2008 and 2012.

Keep in mind that water in an aquifer may move very slowly. It may take years or decades for contamination to reach some water wells. Hydraulic cement decays over time. So it is not unreasonable to expect water wells will continue to be contaminated by shale drilling for a long indefinite time.

There is no formal provision for plugging shale wells. The permits only cost $25,000 and plugging is not in the leases. Plugging would cost something like $100,000. West Virginia has 51,000 abandoned wells. Can you expect history to repeat itself? I am predicting here that most shale wells that will be plugged in the next 100 years will be done at public expense. Mark Twain is supposed to have said “History doesn’t repeat itself, but it rhymes.” I think we can anticipate this, unless we can get our citizens to intervene.