Part 1, Limits of Shale Drilling & Fracking

Original Article by S. Tom Bond, Retired Chemistry Professor and Resident Farmer, Lewis County, WV

Shale drilling has been hailed as the answer to the United States’ problems, sort of an “only the sky is the limit” occurrence at a time when the country is being de-industrialized. Much of this is hype needed to gather the investment needed for this large scale industry, spread over hundreds of thousands of square miles in much of rural America. But limits are in view and this first article of a series is to point out some of them.

A huge limitation is the low rate of recovery from shale wells. An article in the Oil and Gas Journal published in 2010 which states the following: “The recovery efficiency for the 5 major [shale gas] plays averages 6.5% … This contrasts significantly with recovery efficiencies of 75-80% for conventional gas fields.”

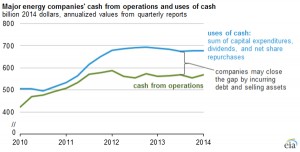

All the major shale plays in North America have been staked out, and leases taken on much of it. There is no other Marcellus-like shale field waiting to be discovered. This reference has an interesting graph of “free cash flow,” defined as earnings and depreciation minus what cash a company needs to operate and capital expenditures for the accounting period. This is what the company has that time period to give to those who have made investment in the company. Not a very happy picture, long on future expectations. The author is optimistic, but he neglects other limitations, apparently expecting shale wells to continue for a long time, when it is know that production falls off rapidly, resulting in the need to drill a replacement well in a few years. And then another, and then another.

The graph “Production by Rig by Play” is a bit misleading, since production is by wells, and the rigs are simply utilized more efficiently. The claim ” the industry should be a Free Cash Flow machine for the next 5-10 years,” is the claim of someone trying to sell investment.

An article in the Telegraph of July 9, 2013 is titled “Fossil industry is the subprime danger of this cycle” begins, ” The cumulative blitz on energy exploration and production over the past six years has been $5.4 trillion, yet little has come of it. That includes oil, gas and coal. Further, “This is where investors have been throwing the most good money after bad.”

Concerning oil and gas it says, “Data from the Bank of America show that oil and gas investment in the US has soared to $200 billion a year. It has reached 20 % of total US private fixed investment, the same share as home building. This has never happened before in US history, even during the Second World War when oil production was a strategic imperative.”

“A large chunk of US investment is going into shale gas ventures that are either underwater or barely breaking even, victims of their own success in creating a supply glut. One chief executive acidly told the TPH Global Shale conference that the only time his shale company ever had cash-flow above zero was the day he sold it – to a gullible foreigner.”

This industry hates environmentalism and finances the global warming deniers. Why? Here is the Telegraph’s thinking: “Under a global climate deal consistent with a two degrees centigrade world, we estimate that the fossil fuel industry would stand to lose $28 trillion of gross revenues over the next two decades, compared with business as usual,” said Mr. Lewis. “The oil industry alone would face stranded assets of $19 trillion, concentrated on deepwater fields, tar sands and shale.”

Another striking statistic comes from this article: “… the average Capex (capital expenditure) spending of the 35 companies analyzed to serve as a guide to the industry has amounted to a staggering $50 per barrel of oil equivalent (energy equivalent to a barrel of oil) over the last five years, at a time when their revenue per BOE has averaged $51.5.”

The article goes on to say, “the companies have had to take on increasing levels of debt” and this is dangerous in a business environment which makes them vulnerable to over supply of their product. How vulnerable may be gauged from an article in the Wheeling Intelligencer. The approximate composition of one of Chesapeake Energy”s Marcellus gas stream is: 70% dry methane gas; 18% natural gas liquids, such as ethane, propane, butane and pentane; and 12% oil. The liquid product is what is carrying many companies.

To end this list of limitations, let’s consider exporting LNG. If the plans for export go through, the price of gas will go up, and so will the electricity made from it, and the chemicals made from the gas (nitrogen fertilizer being one of the foremost of these). Will it protect Europe from Russia, their present source of natural gas? Not at all according to this article: “Exports of liquefied natural gas from the US won’t solve the EU’s energy security problems, European Commission President José Manuel Barroso said after the G7 meeting in Brussels.” Yes, the reference is to an article in Russia Times, but it is a direct quote. Europe gets 50% of its gas from Russia through the Ukraine, so there is the distinct possibility it could be cut off by Russia or by Ukraine. Another factor is that facilities do not exist in the U. S. or in Europe to ship it, and won’t be for years, while the problem is immediate.

Russia has vast conventional oil and gas reserves, and also shale oil and gas. Far more than the U. S. So the more we export, the more the future belongs to them. Of course the international companies Exxon and Shell are working right along with Russia, planning development, regardless of the politics of the Ukraine.

The value of reserves of the coal, oil and gas companies is estimated at $71T (current money), about four times the U. S. National Debt. That’s a lot of money! The industries know the end is coming, and they are making investments to prolong it. Principal among them is a campaign to raise the capital, because extreme energy extraction is a vast capital sink and more and more effort will be needed to raise what is needed.

Secondly, the industries actually disparage care for the surface of the earth, which they cannot use for extreme extraction without destroying the biological productivity, such as food production, forests, wildlife, clean water collection, and so forth. Chief among these disparagements is sowing confusion about global warming-climate change. It is a complex issue and it is not difficult for a multimillion dollar industry to confuse people who have limited background and interest in science.

Watch for Part 2, coming soon!