Here is something for you to worry about, as I am –

Here is something for you to worry about, as I am –

Commentary by S. Tom Bond, Jane Lew, Lewis County, WV

The current dust-up in Iraq is more than an insult to the nation whose leader proudly proclaimed “Mission Accomplished” on May 1, 2003. It wasn’t the end of major combat operations, which dragged on for years, with troops still in Iraq in an advisory capacity, many of them within the walls of the huge embassy constructed in Bagdad, the largest in the world. The unrealistic goals and incompetent subsequent management continue today.

The group calling itself the “Islamic State of Iraq and Greater Syria,” represents the Sunni faction of Islam in a war against the Shiite branch. The United States deposed Saddam Hussein, who controlled the Sunni branch which subdued the numerically larger Shiite segment of the Iraq population. What the United States did was set up a Shiite government in Iraq, reversing the historical arrangement. Iran, much larger and next door, is also Shiite, and this brought Iraq and Iran much closer together. Then the Iraq duly elected parliament voted in 2011 to have the United States leave.

Both Iraq and Iran are considered an oil and gas powerhouse. Lots of very high grade petroleum. Iran is a current hate object not only for Israel and the United States, but also for the other Gulf States, which are Sunni.

It occurs to many observers that the Islamic State of Iraq and Greater Syria is no longer conducting a terrorist attack, but a full scale war. The group has the reputation of being too violent even for al-Qaeda, which kicked it out.

Who pays? According to this article in The Economist, in Mosul ” The jihadists seized huge stores of American-supplied arms, ammunition and vehicles, apparently including six Black Hawk helicopters and 500 billion dinars ($430m) in freshly printed cash.” (Incidentally this Economist article is great for events leading up to its publication on June 14th.)

Labor is cheap. Part of the supply is from Saddam’s underground resistance still fighting, and part is from Islamic idealists streaming in from all over the Mid-east. At one time war was largely a matter of courage, but today war is industrialized and it takes money. Where does it come from? Some would have you believe it just grew.

This looks more reasonable to me. “Supporters in the region, including those based in Jordan, Syria, and Saudi Arabia, are believed to have provided the bulk of past funding.” You have to read the original paragraph carefully – it does not included Iran, which supported al-Qaeda in Iraq, although that crosses sectarian lines. (This is another very helpful article.)

In short, this is our payments to the Mid-east for oil coming back to us from the oil sheiks.

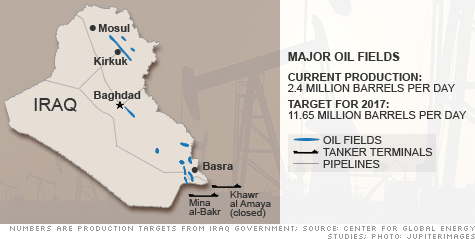

Now, back to the oil supply. For this section I am indebted to the Energy and Capital Newsletter. Iraq has huge proved oil reserves, 143.1 billion barrels according to the U. S. Energy Information Administration. Iraq is currently pumping out 2.9 million barrels a day. (E&C) Production is falling. If the ISIGS continues, production will fall further, causing a world wide price shock. This is because the world supply is delicately balanced, and decreased supply will increase the price sharply because more can’t be produced to meet demand. Lybia’s output has fallen because of disruption there. Mexican oil is running out.

The North Sea (between the United Kingdom and Denmark) will fall by 22% this year. Nigerian and Venezuelan production is declining. Sanctions cut off Iran, and Russia is a big question mark. Demand is rising.

OPEC (the Organization of Petroleum Exporting Countries) appears willing to keep its production constant, at least this year. So an oil price shock seems to depend in part on the advance and control of the Islamic State of Iraq and Greater Syria fighters. The “inelastic” nature of supply and demand for oil suggests one should be prepared for a substantial increase in price if supply goes down.

How will this affect natural gas prices? If oil goes up, where ever possible energy demand will be shifted to natural gas. This is especially important in the US Northeast, rapidly shifting to natural gas anyway, and in industry and electrical generation. This will tend to increase the price of natural gas, even if it is being over produced. And, more fracking means much more environmental impacts in our Region.

World conditions will particularly boost the worth of the “wet” part of wet gas, because the ethane, propane and butane extracted from wet gas can serve as a source of olefins, used to make plastics, i.e. petrochemicals. Much of this also comes from the lowest boiling fraction of oil, called naphtha. Less oil, particularly the light oil from the Mideast, less naphtha. It appears then the environmental impacts will almost certainly continue for years to come, as continued reliance on fossil fuels means more greenhouse gases, more global warming and more climate change.

>> Tom Bond is a retired chemistry professor and resident farmer in central West Virginia, and a member of the Guardians of the West Fork and the Monongalia Area Watersheds Compact <<