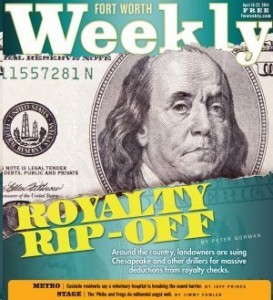

Around the country, landowners are suing Chesapeake Energy and other drillers for massive deductions from royalty checks

From an Article by Peter Gorman, Fort Worth Weekly, April 16, 2014

Donald Feusner used to be a dairy farmer. His 370 acres of land in northeast Pennsylvania border New York state in a gloriously lush area. In 2011, when his farm was no longer profitable, he sold off his herd and retired to what he thought would be the life of a gentleman farmer, living off the proceeds of the gas wells Chesapeake Energy had drilled on his land. And in December 2012, when the wells came in, it looked as though he’d made a safe bet: Royalty income from the first month’s production alone totaled more than $8,500.

But five months later, with the wells still producing the same amount of gas, his royalty check suddenly shrank by more than 80 percent, to just under $1,700, eaten away by what Chesapeake called “post-production costs.” In the following months, his checks dwindled even further, to almost nothing.

“In October 2013, I got a check that said my royalty was $6,000,” said Feusner, “but after one set of deductions it was reduced to $115; after another adjustment it dropped further. They wound up taking 99.3 percent of my royalty. I got $46.”

Harold Moyer, an accountant with the Pennsylvania Farm Bureau who represents Feusner and 150 other royalty owners in northern Pennsylvania, said that Feusner’s lease agreement was bad from top to bottom: It not only let Chesapeake put a large well pad on the property for no extra money, but it allowed the company to deduct post-production costs.

Those costs covered every aspect of getting the gas from the well to market: separating out water moisture and other gases, compressing it, sending it through gathering lines, even a fee for selling it. And the deductions weren’t made just from Feusner’s checks. Across Pennsylvania tens of thousands of people who leased their mineral rights saw their post-production costs — which are legal under the terms of most leases — jump from pennies on the dollar to most of that dollar in the beginning of 2013.

Jerry Simmons, executive director of the National Association of Royalty Owners, said the situation in Pennsylvania is the worst case of royalty rip-off he’s ever seen. It’s so bad there, he said, that Gov. Tom Corbett recently asked his attorney general to start an investigation.

Rules vary from state to state on post-production costs and other methods that drillers use to reduce the amount of royalties they pay. But one version or another of the problem seems to be happening all over the country, from shale drilling plays in Ohio to South Texas to the Rockies.

The worst offender is Chesapeake Energy, by several accounts. “There is no question that Chesapeake is the bad actor all over the country, and its actions are being imitated,” said Jackie Root, president of the Pennsylvania NARO chapter. “They’re taking deductions from leases that have ‘no deduction’ clauses, and then they sometimes take deductions that are not legal at all.”

NOTE: The original article is quite long and detailed. Please read this printed Article in the Fort Worth Weekly.