Marcellus ethane increasingly important in Canada

Marcellus ethane increasingly important in Canada

From an Article by Stephanie Novak, Pittsburgh Business Times, March 14, 2014

Ethane was initially viewed as a problem for Marcellus gas, making it too rich to pass through normal pipelines, said Pace Markowitz, director of communications at Nova chemicals, with offices in Pittsburgh.

Nova announced in December of last year it would begin converting Marcellus ethane into ethylene or polyethylene for petrochemical use. The company plans to complete the upgrades to facilities early next quarter, Markowitz said. When facilities are complete, pipeline capacity will accommodate 50,000 barrels of ethane per day, NOVA said. The plastics company said it would consume 37,000 barrels of the product at their Sarnia, Ontario petrochemical facility.

If production rates continue as expected, Marcellus production will exceed that of Canada this year, according to the U.S. Energy Information Administration’s monthly drilling productivity report. Range Resources supplies Nova with a significant portion of its ethane. When ethane is converted for petrochemical use, much of it comes back to the United States as polyethylene, which many manufacturing companies use in plastics products throughout the country. Roughly 60 percent of ethylene is converted to polyethylene, said Markowitz, of Nova.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

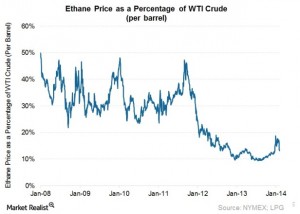

Low ethane prices have persisted in the U.S. (See graph above)

From the Article by Ingrid Pan, Market Realist, March 17, 2014

Ethane prices have experienced a steep decline over the past few years, due to a flush supply from active drilling in the U.S. Ethane prices (as priced at the natural gas liquids hub of Mont Belvieu) were mostly above $1.00 per gallon in early 2008, before the financial crisis later in the year. During the period of depressed commodity prices in late 2008 and 2009, ethane prices were ~$0.40 to ~$0.60 per gallon, in correlation with most other natural gas liquids and crude oil.

After that, the price of ethane per gallon traded mostly within the range of $0.60 to $1.00 per gallon through 2010 and 2011, as other NGLs and crude also traded up. However, from 2012 through now, ethane prices have remained very low, on both absolute and relative bases. Over the past two years, ethane prices have remained mostly below $0.40 per gallon. Plus, where ethane historically traded at prices of around 30% to 50% of WTI crude (per barrel), in 2012, it began to average at 10% to 20% of WTI crude.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Middle East petchem industry switching from ethane to heavier feedstocks

From an Article of ICIS News, March 11, 2014

LONDON (ICIS)–The Middle East petrochemicals industry is increasingly shifting from using ethane as a primary feedstock to heavier slates, according to the CEO of Petrochemical Industries Co., a subsidiary of Kuwait Petroleum Corp.

Asaad Ahmad Alsaad said heavier slates including condensate, butane and propane were being looked at more and more as feedstocks to prepare for a potential ethane shortage in coming years.

Alsaad – whose remarks will be explored at the World Refining Association’s (WRA’s) Abu Dhabi International Downstream Conference in May – also observed that the Middle Eastern petrochemicals industry was moving to full integration with refineries that would bring bigger balance sheets and new technology allowing for more feedstock flexibility.

{ 1 comment… read it below or add one }

WV DE-ETHANIZER to separate ethane from propane & butane & higher hydrocarbons. Thirty mile journey at 5 mph on 48 wheels. 125 feet long at 150,000 pounds. Those hilly and curvy Country Roads in Marshall County are a real “bear.” (Journey of 2nd De-Ethanizer starts Sunday, March 23rd, for Williams Energy separation facility of WV Route 86.)