From an Article by Kristen Hays & Jacquelyn Melinek, S & P Global, September 1, 2020

Houston — More polymer producers have declared force majeure on polyethylene products in the aftermath of Hurricane Laura’s assault, according to customer letters obtained by S&P Global Platts.

Chevron Phillips Chemical on Sept. 1 and Westlake Polymers on Aug. 31 each declared force majeure on PE, which is used to make the world’s most-used plastics. Both companies have operations that were in the Category 4 storm’s path, knocking out electric power in far southeast Texas and southwest Louisiana.

“Unfortunately, it has become apparent that issues arising in connection with the hurricane and the associated outages have impacted our planned production and delivery of polyethylene products,” CP Chem said in its notice to customers.

Westlake Polymers said the company had begun to assess facility conditions and associated supply and distribution issues, and would have a better damage assessment and potential timing on restarts “in the forthcoming days.”

Those notices were in addition to a separate Westlake Chemical force majeure declaration on Aug. 31 for construction staple polyvinyl chloride and its precursor, vinyl chloride monomer. Sasol also on Aug. 31 declared force majeure for polyethylene.

Entergy, the power provider for much of the affected region, said on Sept. 1 that outages in Texas would be restored in early September. CP Chem’s southeast Texas operations include a cracker and a high density PE plant.

However, Entergy said Lake Charles — where Westlake and Sasol operate significant complexes — as well as other southwest Louisiana areas “face weeks without electrical power.”

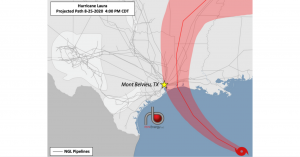

Hurricane Laura came ashore near the Texas-Louisiana state line early Aug. 27 packing 150 mph winds, just 7 mph less than a Category 5 storm. Overall, 19% of US ethylene capacity remained offline, down from 29% shortly after the storm.

Here are operations and pricing effects of Hurricane Laura’s aftermath:

FORCE MAJEURE

CP Chem: Force majeure declared Sept. 1 on US polyethylene.

Westlake Polymers: Force majeure declared Aug. 31 on US polyethylene.

Sasol: Force majeure declared Aug. 31 on all North American polyethylene, including all LLDPE and HDPE grades.

Westlake Chemical: Force majeure declared on Aug. 31 on all North American PVC and VCM.

INEOS Olefins & Polymers USA: Force majeure declared Aug. 26 on HDPE at 460,000 mt/year unit in La Porte, Texas; plant is a joint venture with Sasol.

Formosa Plastics USA: Force majeure declared Aug. 14 on PVC at its Texas and Louisiana operations; unrelated to Hurricane Laura.

SHUTDOWNS OF CHEMICAL OPERATIONS

Lake Charles

Sasol: 1.5 million mt/year and 439,000 mt/year crackers; 470,000 mt/year LLDPE; 380,000 mt/year ethylene oxide/monoethylene glycol; a new 420,000 mt/year LDPE plant slated to start up in September. Assessing damage; restart pending availability of power.

Westlake Chemical: Three chlor-alkali plants, combined capacity of 1.27 million mt/year of chlorine and 1.36 million mt/year of caustic soda; two vinyl chloride monomer plants, combined capacity of 952,543 mt/year; a 1.8 million mt/year ethylene dichloride plant; two crackers, combined capacity of 1.19 million mt/year; 200,000 mt/year LLDPE; 60,000 mt/year HDPE/LLDPE; 386,000 mt/year LDPE; 258,547 mt/year styrene. Assessing damage; restart pending availability of power.

Lotte Chemical: 1 million mt/year joint-venture cracker; 700,000 mt/year MEG plant. Assessing damage; awaiting restart pending availability of power.

LyondellBasell: 400,000 mt/year and 1 million mt/year PP plants. Assessing damage; awaiting restart pending damage assessment and availability of power.

Orange, Texas

Dow Chemical: 882,000 mt/year cracker; 236,000 mt/year LDPE; no major damage found, awaiting restart pending restoration of external infrastructure, including power.

CP Chem: 420,000 mt/year HDPE; limited visible damage found, assessment continuing, awaiting restart pending restoration of power.

Port Neches, Texas

Indorama Ventures: 235,867 mt/year cracker; 1 million mt/year EO/MEG; 238,135 mt/year propylene oxide; 988,000 mt/year MTBE. Minimal damage assessed, awaiting restart pending restoration of power.

Port Arthur, Texas

CP Chem: 855,000 mt/year cracker; limited visible damage found, assessments continuing; awaiting restart pending restoration of power.

Total/BASF: joint-venture 1 million mt/year cracker, was shut for maintenance pre-Hurricane Laura.

RESTARTS OF CHEMICAL OPERATIONS

Beaumont, Texas

ExxonMobil: 826,000 mt/year cracker; 650,000 mt/year and 325,000 mt/year LLDPE; 225,000 mt/year HDPE; 220,000 mt/year HDPE/LLDPE; minor repairs needed, restarts began Aug. 28.

Port Arthur, Texas

Motiva Enterprises: 635,000 mt/year cracker; restart began Aug. 27, flaring expected to last through Sept. 1, per regulatory filing.

Pasadena, Texas

CP Chem: Three HDPE units, combined capacity of 998,000 mt/year; working to resume normal operations.

Houston

TPC Group: 544,000 mt/year butadiene; restart began Aug. 29.

Fairway Methanol: 1.3 million mt/year Fairway methanol facility in Clear Lake shut Aug. 26, restart began Aug. 28.

Baytown, Texas

CP Chem: 1.7 million mt/year and 837,000 mt/year crackers; working to resume normal operations.

ExxonMobil: Had reduced rates at 1.25 million mt/year, 962,000 mt/year and 1.59 mt/year crackers; resumed normal rates Aug. 28.

Bayport, Texas

INEOS Styrolution: 779,000 mt/year styrene monomer. Restart began Aug. 31, per company notice on community hotline.

LyondellBasell: 1.16 million mt/year, 455,000 mt/year, 235,000 mt/year PP; restarted Aug. 28.

Baystar: 400,000 mt/year joint-venture HDPE; assessing damage, began restarting Aug. 28.

Alvin, Texas

LyondellBasell: 180,000 mt/year HDPE; restart began Aug. 29-30.

PRICES FOR PETROCHEMICALS

US spot ethylene prices rose $2.5 cents/lb to an 11-month high of 26.5 cents/lb FD Mont Belvieu on Sept. 1; the FD Choctaw marker rose 4.5 cents/lb to 27 cents/lb, an all-time high since S&P Global Platts began assessing Choctaw; 19% of US ethylene capacity remained offline.

US spot export LDPE, HDPE prices reached their highest levels in months on Sept. 1 amid multiple producer having declared force majeure in the aftermath of Hurricane Laura. LDPE prices rose $110/mt, LLDPE butene prices increased $99/mt and HDPE blowmolding rose $88/mt.

A deal for September export PVC was done Sept. 1, up $165/mt since Aug. 26 after Westlake Chemical’s force majeure declared Aug. 31 on PVC and VCM and Formosa Plastics USA’s force majeure on PVC still in place after its Aug. 14 declaration.

PORTS AND RAILROADS

Houston Ship Channel: Closed Aug. 26, reopened Aug. 27.

Sabine-Neches Waterway, channel closed Aug. 26; on Aug. 31 parts open with restriction; status unchanged on Sept. 1.

Port of Lake Charles closed Aug. 25; resumed movements Sept. 1 for vessels with a 30-foot or less draft.

Union Pacific: On Sept. 1, service restored to mainline network affected by Hurricane Laura, including a segment linking Lake Charles, Louisiana, to Beaumont, Texas; generators will continue to be used throughout the Lake Charles area until commercial power is restored; embargoes remain in place at southwest Louisiana locations.