Press Release from Chevron Corporation, February 7, 2019

SAN RAMON, CA — Chevron Corporation (NYSE: CVX) today published an update to its March 2018 report describing the company’s approach to managing climate change risks and its resilience under a low carbon scenario. The update supplements Climate Change Resilience: A Framework for Decision Making with new information on the company’s governance framework and climate change related actions and investments.

“This update highlights work we are doing to address climate change risks to our business and new opportunities we’re pursuing. It incorporates responses to some of the thoughtful insights stockholders have shared with us during our engagements,” said Michael Wirth, Chevron’s chairman and chief executive officer. “We look forward to ongoing conversations on how we are managing climate risks to our business and taking on new opportunities to reduce greenhouse gas emissions and develop lower carbon energy.”

In response to discussions with investors and other stakeholders, Chevron is providing more insight on climate change governance. This includes information about how the Board of Directors and executive leadership exercise their oversight responsibilities with respect to climate change.

The Board established greenhouse gas emissions performance measures that will be a factor in determining compensation for executives and nearly all other employees beginning in 2019. The metrics aim to reduce methane emissions intensity by 20 to 25 percent and flaring intensity by 25 to 30 percent from 2016 – 2023, aligned with the timing of milestones in the Paris Agreement. The intensity will be measured based on Chevron’s equity ownership of oil and gas assets, not just the projects over which Chevron has operational control. Chevron will report on annual achievement of methane and flaring performance measures as part of its Annual Proxy Statement in 2020.

The company has also created an Environmental, Social and Governance (ESG) team which regularly engages with investors and other key stakeholders to understand and respond to ESG reporting preferences. Chevron continues to align its reporting with the framework outlined by the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD).

“We take our corporate responsibility seriously. I am pleased that Chevron is providing this update to its previous reports on climate risks. In prior engagements with stockholders, I have reinforced the important role the Board plays in overseeing Chevron’s management of climate change risks and its assessment of opportunities,” said Dr. Ronald Sugar, lead independent director for Chevron’s Board of Directors.

Additionally, in 2018, the company joined the Oil and Gas Climate Initiative, a global collaboration focused on industry’s efforts to address climate change issues. Chevron continues to invest in companies and technology designed to lower emissions and advance lower-carbon business opportunities.

Chevron Corporation is one of the world’s leading integrated energy companies. Through its subsidiaries that conduct business worldwide, the company is involved in virtually every facet of the energy industry. Chevron explores for, produces and transports crude oil and natural gas; refines, markets and distributes transportation fuels and lubricants; manufactures and sells petrochemicals and additives; generates power; and develops and deploys technologies that enhance business value in every aspect of the company’s operations. Chevron is based in San Ramon, Calif. More information about Chevron is available at www.chevron.com.

############################

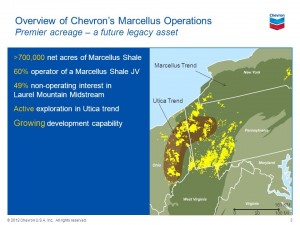

A supplement to Chevron’s 2017 annual report states that the company’s onshore North American operations include some 873,000 combined net acres in the Marcellus and Utica shale plays in Ohio, Pennsylvania and West Virginia.

The Dogbone Project in Fayette County (Pennsylvania) involves multiple one million gallon storage tanks for water from the Monongahela River for fracking Marcellus gas wells in Luzerne Township.

Concerns linger over gas well impact on livestock, Fayette County, PA| Uniontown Herald – Tribune

{ 2 comments… read them below or add one }

Centre Daily Times

CARBON BILL WOULD BUOY ECONOMY, HEALTH

Congratulations to Patton Township supervisors for passing a resolution earlier this month urging the U.S. House of Representatives to pass the Energy Innovation and Carbon Dividend Act.

This bill — House Resolution 763— is effective, good for people, good for the economy, bipartisan and revenue-neutral. As the township’s resolution says, it would “… not economically burden Patton Township nor its citizens.”

The act places a fee of $15 per ton on carbon to be collected by the Treasury Department at the first point of sale: mines, refineries and gas wells. The fee rises by $10 per ton per year. But the government does not keep the money. The funds will be distributed to each U.S. household in equal monthly per-person dividends.

This will drive down carbon pollution because the powerful price mechanism will move energy companies, all industries that use fossil fuels, and consumers to seek cleaner, less expensive options. It is a market-based solution.

Passage would reduce America’s carbon emissions by at least 40 percent within 12 years. It would improve health by reducing the pollution that Americans breathe. And it would put money directly into people’s pockets every month to spend as they see fit, helping low-and middle-income Americans.

This legislation is a major first step in slowing global warming. I commend Patton Township for supporting its passage.

Richard W. Jones, State College

###############################

MEMO TO LAWMAKERS: PASS A SEVERANCE TAX

Seriously, folks, to me a Marcellus Shale tax is a no-brainer, unless of course you’re a Republican or Democrat accepting mucho money from the natural gas industry.

As stated on the front page of the Centre Daily Times on February 1, 2019, “Pennsylvania is the only major natural gas state that does not tax the product.”

So come on, Pennsylvania lawmakers: Approve a severance tax on Marcellus Shale natural gas production! These drillers aren’t going to leave the state and go somewhere else. These companies will only leave after taking all they want. “All mining exhausts the deposit.”

Then and only then will they leave, and when they do, they’ll leave scars that will take years to heal.

Betsy Green, Spring Mills

Read more here: https://www.centredaily.com/latest-news/article226918394.html#storylink=cpy

Subject: Chevron Update as of September 30, 2019

SAN RAMON, Calif.–(BUSINESS WIRE)–Nov. 1, 2019– Chevron Corporation (NYSE: CVX) today reported earnings of $2.6 billion($1.36 per share – diluted) for third quarter 2019, compared with $4.0 billion ($2.11 per share – diluted) in the third quarter 2018. Included in the current quarter was a tax charge of $430 million related to a cash repatriation. Foreign currency effects increased earnings in the third quarter 2019 by $74 million.

“Global demand for energy continues to grow, and we are committed to meet this demand with less environmental impact. We recently announced new goals to reduce net greenhouse gas emission intensity from upstream oil and natural gas production.”

“During the third quarter, we began capturing and storing carbon dioxide at our Gorgon LNG facility in Australia, one of the world’s largest greenhouse gas mitigation projects. Also, construction is underway on a new solar farm, which will supply low-carbon electricity to the Lost Hills Oil Field in California.”

“Global demand for energy continues to grow, and we are committed to meet this demand with less environmental impact. We recently announced new goals to reduce net greenhouse gas emission intensity from upstream oil and natural gas production,” Wirth continued. “During the third quarter, we began capturing and storing carbon dioxide at our Gorgon LNG facility in Australia, one of the world’s largest greenhouse gas mitigation projects. Also, construction is underway on a new solar farm, which will supply low-carbon electricity to the Lost Hills Oil Field in California.”

U. S. UPSTREAM — The company’s average sales price per barrel of crude oil and natural gas liquids was $47 in third quarter 2019, down from $62 a year earlier. The average sales price of natural gas was $0.95 per thousand cubic feet in third quarter 2019, down from $1.80 in last year’s third quarter.

INTERNATIONAL UPSTREAM — The average sales price for crude oil and natural gas liquids in third quarter 2019 was $56 per barrel, down from $69 a year earlier. The average sales price of natural gas was $5.62 per thousand cubic feet in the quarter, compared with $6.73 in last year’s third quarter.