What’s going on with oil and gas in the short range –

Commentary by S. Tom Bond, Retired Chemistry Professor & Resident Farmer, Lewis County, WV

The long range prospects for oil and gas were discussed in my last article, posted on February 13th. This time I want to present an overview of what is going on in the short time-range.

One aspect is a dramatic cut in what is called “capex” – capital expenditures. These are required for expanding production both to get more production and to compensate for the unavoidable depletion that occurs with any kind of mineral recovery. New expansion is always more expensive than what has gone on before, because the “easy stuff’ is taken out first. You can read about capex reduction in everything from company statements to industry news reports.

This article is interesting because CONSOL Energy has recently jumped into gas hand over foot, having moved a major part of its capital out of coal. They are doing what everybody is doing, emphasizing current production. The problem is the structure of the industry has produced huge excess production, and there is little way to raise cash except by further production.

Company after company is cutting expansion (capex) but plans to increase production while cutting cost. The problem is, there is nowhere for the gas to go. Until the recent snow storms in the Northeast, consumption of natural gas was low and the storage fields were full. That hasn’t changed significantly.

The slowdown in central West Virginia is quite conspicuous. Water trucks are off the main roads because of the completion of the fresh water pipelines from the Ohio River to the West Fork River, between Jane Lew and Good Hope. Little companies seem to be shut out, with most water trucks now belonging to larger companies.

Flow back must be hauled away from wells that are producing. Sand trucks are much less common than before Christmas. They arrive just in time for fracking, which shows fracking must be down. The permits on Sky Truth Alert are way down, too. If you locate them on Google Earth or other satellite maps, they tend to be on well pads previously completed, rather than out in a new area.

Happy talk abounds in the gas field. A good article, now a year old, is an example. One author has compared gas prices to the movie Ground Hog Day, in which Bill Murray plays a news reporter caught in a time loop – repeating the same day over and over again. In the case of gas prices, they ratchet lower and lower, reaching $2.43 per thousand on February 6th.

It is hard to keep investors convinced in this climate. If they fly away, company value declines, and it is harder to attract investors and harder to borrow from bankers. Cutting costs on production means paying less to labor, holding onto royalty longer, and shaving off more for “expenses.” Then, moving faster in drilling work that must be done, making jobs less safe and cutting down time for things like letting cement harden when sealing in tubing. This will damage more ground water, of course.

It puts pressure on building pipelines for the happy anticipated day when gas replaces coal for generating electricity. It will encourage building liquid natural gas facilities, although U. S. reserves are small compared to what is available overseas, as we saw in my last article.

The situation in oil is much the same, but lacks the element of crowding coal out of its traditional market. Most of petroleum is used for transportation. The low cost of gasoline is the result of the fact that no effective long term storage is available. Around 30,000 layoffs have been announced.

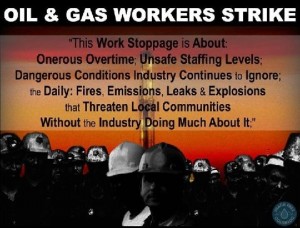

The oil workers strike, which is expanding, helps hold gasoline and diesel fuel up. (Or is getting blamed for it.) It is the first strike in the industry in 35 years. As of February 9, it involved over 5000. The issues were safety related, not finances. The issues were “Hundreds of refineries dot US coasts, and many have been running full-tilt to keep up with the boom in Tar Sands bitumen from Canada and Bakken crude from North Dakota.

With increased throughput and lower margins, oil companies like Tesoro, Shell, Chevron and Exxon have increased the risks of injuries, safety hazards and death for workers and communities alike. Confronted with longer hours, more shifts, the same number of staff, and no significant effort by oil companies to increase plant safety, workers are faced with much higher chances of getting sick or being injured or killed on the job.”

Resistance to fracking grows apace. Bans are everywhere. In the UK (the now reduced Great Britain), this is the situation: Fracking banned in Ireland and Wales, also on two fifths of the land offered for shale exploration because it is in the national parks, Areas of Outstanding Natural Beauty and Sites of Special Scientific Interest and groundwater special protection zones.. The fight is tough elsewhere, except in the Marcellus, where the natives are considered “passive” by drillers and the governments with “eyes wide shut” do all that they can to export whatever is saleable.

Research on health and environmental effects of fracking move on. Research takes money, and since the companies donate to universities, many of them throttle interest by their faculty. Cornell and certain others are notable exceptions, so some progress is being made. Public awareness is gradually increasing. The movement to divest from hydrocarbon production companies is in full swing, with worldwide divestment days on February 13 & 14.

Photovoltaic and wind energy gets cheaper and cheaper. Georgia makes it illegal to loan for such development, and Germany, which lies between 47 and 55 degrees North and has cloudy weather much of the time has 80% of its electrical energy from non-hydrocarbon sources.

Damages to the land and to other industries, demands on local governments, and the removal of the mineral resources without any compensation to local interests are largely ignored. Like the guy at the carnival says, “Round and round she goes, and where she stops, nobody knows.”

{ 1 comment… read it below or add one }

From today’s news: Friday’s Wall Street Journal (Is the Exxon Tiger Ready To Pounce?), suggested that Exxon Mobil could make a bid for BP, which has lost many billions from the Deepwater Horizon oil spill.

BP has a current value of $127 billion, and debt of $22.6 billion. A takeover of BP might cost Exxon $175-$200 billion in stock. While the company has bought back enough shares over the last 15 years – roughly $346 billion – to issue equity for such a deal (as they did with XTO).

But, it’s not clear how that will benefit ordinary shareholders. The XTO (shale drilling) purchase certainly has not. If the XTO takeover is any indication, after Exxon paid for the deal with stock, they then went back to putting a big priority on share buybacks over the dividend.

This is a long-survival tactic by a company desperate for reserves. Investors are not it’s first concern.