Courtesy of the Pittsburgh Post-Gazette, this article by Carl Romanos appeared in the blog PIPELINE on July 12th. This blog is “your source of Marcellus Shale coverage & community.” Please consult this blog for valuable information.

Recent data suggests that that the Marcellus Shale natural gas industry may have done a little too well for itself.

According to a recent news article from The Philadelphia Inquirer, the overall amount of Marcellus Shale rigs is falling based on conclusions drawn from more than one source:

“The number of drill rigs operating in the state is down 29 percent from its peak a year ago, according to Baker Hughes Inc., which tracks the industry nationwide. According to data from the Pennsylvania Department of Environmental Protection, the number of Marcellus Shale gas wells drilled in the first quarter declined 18 percent from the same period last year.”

A big part of the reason the number of drills is dropping is because of low natural gas commodity prices. According to a recent news article from The Beaver County Times, natural gas prices have been at an all time low because of the natural gas surplus as stated by the CEO of an affected company, Exxon Mobile:

“When the U.S. Energy Information Administration recently pinned the price of natural gas at a historic low of $2.74 per million BTU, the head of Exxon Mobile declared: ‘We are losing our shirts today.’

Speaking to the Council on Foreign Relations June 27, Rex Tillerson, Exxon’s chief executive officer, said, ‘We’re seeing these very low prices because the industry overshot when we had those $6, $7, $8, $9 prices, and we overdeveloped the supply.’”

Natural gas spot prices averaged $2.47 per MMBtu in June 2012 according to the U.S. Energy Information Administration’s latest update.

The industry may be seeing the consequences of being overzealous when commodity prices were high according to an op-ed in the WSJ’s MarketWatch:

“In 2008, natural gas sold at $13 per million BTUs. Two years ago, its price dropped 60%, to $5. And today, it sells for half again that amount: $2.50.”

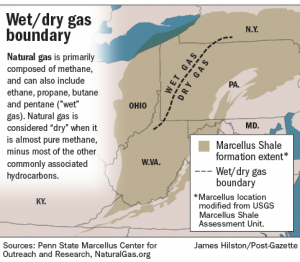

In the face of such a “decline,” the way companies choose to drill must necessarily change also. According to the same piece from The Beaver County Times, companies are shifting from dry gas to wet gas in light of the surplus:

“And there’s evidence of an increasing trend among drillers to migrate from the ‘dry’ gas of the northern Marcellus shale to the ‘wet’ gas of Marcellus formations in western Pennsylvania and the Utica shale, primarily in eastern Ohio.

Matt Kelso, an independent data analyst for Fractracker.org who has documented this trend since 2010, said, ‘Part of the appeal of the Utica in Ohio and Marcellus in western Pennsylvania is wet gas, which has heavier hydrocarbons, which is more valuable.’”

Another method for dealing with the surplus has been to simply halt production until prices rebound. According to the same Inquirer article some wells have been shut off due to the low natural gas prices in order to accommodate for the current supply and demand dynamics.

“Some completed wells are shut off because the operators don’t want to sell the natural gas at current prices, which are below $3 per thousand cubic feet.

“They’re holding gas back in anticipation of a better price, and if that happens, they can turn the wells back on very quickly,” said Terry Engelder, who is a professor of geosciences at Penn State.

These willing moratoriums on rigs are sometimes impossible to enact without losing expiring contracts- in many cases, leases are contingent upon actual production occurring. Another reason is that some companies are contractually obligated to continue drilling due to arrangements with other firms, especially foreign ones.

The bottom line is that there are still more wells producing natural gas than the market can support.

The op-ed from WSJ’s MarketWatch states that that demand will catch up because natural gas will find a larger niche in the economy soon enough:

“Remember that natural gas is preferable to coal and other fossil fuels because it is clean burning, easily transportable, and much more affordable. Over the next few years, the free market will turn natural gas into the answer for our country’s energy problems.”

Some hopeful applications for the excess reserves of natural gas in the near future include replacing diesel in trucking fleets, powering electrical utilities, powering new petrochemical plants and even exportation to foreign countries.