Analysis by Tom Brown, Independent Commodity Intelligence Service (ICIS), April 9, 2021

LONDON (ICIS)–The political will to decarbonise energy-intensive industries is there, the funding is there and, increasingly, the rhetoric of multinational chemicals producer executives is there.

The chemicals sector has traditionally had a difficult time with facing the public, with a campaign by European trade group Cefic in the early 2010s for the sector to become more open and transparent quickly forgotten.

Largely upstream of the industries that the public is aware of, the sector has had little need to present a public face, and the several scandals that tend to emerge every decade, such as the DuPont/Chemours US water contamination lawsuit, encourage a low profile.

The level of attention given to plastic waste and the circular economy has centred the spotlight more firmly on the sector, and large firms seem to be becoming more comfortable with a higher public profile, and the potential for chemicals producers to be perceived as a positive force.

Firms like Germany’s major BASF are also using the ambivalent-to-positive public attention to advocate for support for the sector to help with the dual pressures to decarbonise and to carry out the most radical reworking of production processes since the invention of steam crackers.

ONCE IN A CENTURY SHIFT

The extent that sustainability issues are dominating the agenda for management boards at present was exemplified by BASF’s recent capital markets day, which was overwhelmingly devoted to the company’s decarbonisation plans.

CEO Martin Brudermuller termed the current transition a “once in a century” shift for the sector, and called upon governments to provide financial support for companies to develop and scale the technologies that will allow the sector to decarbonise.

The Germany-based producer has committed to cut its emissions by 60%, compared to 1990 levels, by 2030 but the chemicals production process is a difficult one to decarbonise – steam cracking is not easy to achieve via hydrogen or electricity power.

This is to be achieved by new technologies, bio-based feedstocks and shifting to sustainable power sources but, as the International Energy Agency (IEA) has noted, the tight timeframes for decarbonisation have come about before many systems to cut emissions for energy-intensive sectors have been commercialised.

BASE CHEMICALS THE KEY EMITTER

A key factor will be the expense of decarbonising production processes for lower-margin but widely-used basic chemicals, which make up the lion’s share of BASF’s production emissions.

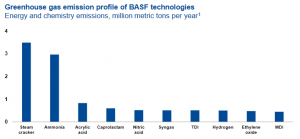

According to the company, processes for steam cracking, and the production of ammonia, arylic acid, caprolactam, syngas, nitric acid, methyl-diphenyl diisocyanate (MDI), toluene diisocyanate (TDI), hydrogren and ethylene oxide (EO) account for the bulk of its carbon dioxide emissions.

CARBON PRICING STATUS

The difficulty and expense in decarbonising large-scale but lower-margin value chains raises the multi-billion dollar question: will consumers’ interest in sustainability translate to them paying more for basic rather than premium products?

Brudermuller believes so, at least in public. Even US industry trade groups, which tend to be redder in tooth and claw than European bodies on climate issues, have started to endorse carbon pricing mechanisms: “We are convinced that ultimately all players involved will work together to make this once-in-a-century transformation economically successful,” he said, speaking at the company’s capital markets day.

“This also includes consumers accepting higher prices for CO2-free products throughout the value chain to offset higher operating costs and additional investments,” he added.

The company projects that capital expenditure on CO2 reduction technologies will be €1bn in 2021-25, €2bn-3bn in the latter half of the decade, and around €10bn in the 2030s as the innovations reach commercial scale.

Although the most substantial investments are expected down the line, the company is looking for government support in the earlier stages to help de-risk the technology development process, according to Brudermuller. “For very early stage higher-risk technology, you get a higher share of support than you do later, we don’t expect so much support when building world-scale plants, but I think it is fair now when there is such immense pressure to decarbonise,” he said.

PARIS TARGETS, INSUFFICIENT AND UNMET

Governments worldwide are also developing their decarbonisation roadmaps, from hydrogen and renewable energy as a power source to carbon capture for heavy industry to bio-based jet fuel.

With the accession of President Joseph Biden, the US is expected to return at the upcoming UN Climate Change Conference (COP26) in Glasgow, UK, this November. With China also setting out plans to reach net zero by 2060, most of the globe is pushing in the same direction, although the pace of progress remains a cause celebre between governments.

“The Earth’s temperature would still rise about 3.7 degrees [Fahrenheit, or 1.5 degrees Celsius] if we did everything we promised to do in Paris, and we’re not,” said John Kerry, the US’ envoy for climate, speaking at a recent IEA summit.

CRUCIAL DECADE AHEAD

This underscores a key issue with climate abatement measures: that the tipping point of public attention and governmental action is substantial but may have coalesced too late for the technological and structural changes necessary to mitigate the impact of climate change.

The next 10 years may be the most crucial but, as shown by BASF’s projected capex (capital expenditure) schedule, the real substantial work may not begin until the 2030s.

“Do we respect that there are differentiated responsibilities [between countries]? Yes, but we cannot just willy-nilly ignore the next 10 years,” Kerry said. “If we do not do enough in these 10 years, we cannot keep the earth’s temperature [rise] at 1.5 degrees [Celsius].”

Raj Kumar Singh, India’s minister of power, new and renewable energy, was less circumspect on long-term goals, calling the idea of 2060 targets “pie in the sky” when speaking at the IEA event. “When you talk about the challenges before us together… that is something which we need to consider very honestly. We can obfuscate but that is not going to make the problem go away,” he said.

“2060 is a long time away, what are you going to do in the next five years, what are you going to do in the next 10 years? The world wants to know,” he added. “I want to know how many countries have actually accomplished the Kyoto targets.”

NECESSARY INDUSTRIALISATION

Singh also criticised developed world goals that assume that all nations are on track to begin cutting carbon emissions, or for emissions to peak and start to decline in the near future, at a point when advanced economies have already developed, and account for 80% of CO2 emissions.

Some 600 million people in Africa are currently without access to power, according to the African Union.The implications of this, according to Singh, are that advanced economies should be setting their sights on becoming carbon negative, not carbon neutral, to allow for emissions levels from low-income developing countries to increase far enough into the future to achieve widespread industrialisation.

The scale of industrialisation still needed in low-income developing countries provides an opportunity for those societies to leapfrog fossil-based growth entirely, according to John Kerry and a fellow first-world minister on the panel, European Commission Green Deal vice-president Frans Timmermans. “We need to show this can be a just transition, to remove coal, but do it in a way to allow those regions to grasp the opportunities of the new economy,” Timmermans said.

An issue with the leapfrogging concept is that development of coal power is market-driven and installation of new renewable energy capacity is still largely policy-driven, according to BP’s world energy report.

When the need remains to connect more citizens to electrical grids and internet connections, it is easy to see why the cheapest, quickest to set up sources of power remain attractive, however dirty.

The fact that, according to the IMF, the lowest income countries are set to suffer the largest per capita falls in income from the coronavirus pandemic could also drive increased coal power take-up. In the rush to vaccinate populations, there has been little global cooperation between countries, with governments largely looking inward.

Hopefully, after the dust settles, governments will recognise that their fortunes are also tied to helping developing countries rebuild, after largely leaving them to their own fortunes during the pandemic.