From a Summary by Lewis Freeman, Allegheny Blue Ridge Alliance, March 8, 2021

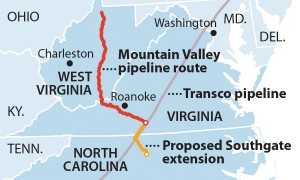

A report released March 8 by the Institute for Energy Economics and Financial Analysis (IEEFA) concludes that the Mountain Valley Pipeline (MVP), a 300-mile pipeline that would move natural gas from the Appalachian Basin to markets in the eastern and southern U.S., is in financial jeopardy because of reduced demand projections and legal challenges.

The IEEFA report found four primary reasons to be skeptical of the pipeline’s financial viability:

● Revised forecasts now predict lower natural gas demand than when the project was first proposed. The U.S. Energy Information Administration predicts gas demand will fall at least through 2030 in the Southeast and mid-Atlantic.

● The likely cancellation of the Southgate Extension, a spur meant to funnel gas from the Mountain Valley project to North Carolina, weakens the financial case for the pipeline. Public Service Company of North Carolina has signed up for 12.5 percent of the Mountain Valley capacity. But if a North Carolina permit denial is upheld in federal court, the extension can’t be built—and the utility can’t use the gas.

● Gas produced in the Appalachian Basin and shipped through the Mountain Valley Pipeline to an interstate connection known as the Transco Pipeline must now compete with cheaper sources of natural gas. Prospects for saving money with gas shipped through the Mountain Valley Pipeline are already on shaky ground; the construction costs of the project have soared 60 percent beyond original estimates, to roughly $6 billion.

● Liquified natural gas (LNG) exports to Asia and the Pacific may not offset declining domestic demand. Asian LNG demand is predicted to be lower than originally anticipated; lower-cost producers such as Qatar could undercut Appalachian gas; new U.S. LNG export terminals face financing challenges; and any new terminals also are likely to look for less-expensive alternatives to Appalachian Basin gas.

The report notes that the MVP was approved under a 21-year-old Federal Energy Regulatory Commission (FERC) policy that bases decisions entirely on the existence of commercial contracts to purchase gas, rather than the actual need for new sources of gas.

A copy of the full report is available for your reading.

>>> Lewis Freeman, Executive Director, Allegheny-Blue Ridge Alliance

https://www.abralliance.org/

{ 1 comment… read it below or add one }

Leading credit rating firm voices concerns about the MVP

From the Allegheny-Blue Ridge Alliance, January 28, 2021

Fitch Ratings, one of the leading firms that provides credit ratings, commentary and economic research, has voiced doubts about the viability of the Mountain Valley Pipeline. In a January 28 issue of its Fitch Wire, the firm stated:

President Joe Biden’s executive order that revoked Keystone XL’s Presidential Permit may be an indicator of his administration’s aversion to long-distance projects in US midstream energy, says Fitch Ratings. We believe Energy Transfer’s Dakota Access Pipeline (DAPL), Equitrans Midstream’s Mountain Valley Pipeline (MVP) and Enbridge’s Line 3 Replacement are at risk of interference. Interference could have credit implications for the midstream energy companies involved in these projects but would be considered on an individual issuer basis.

Equitrans’ operating subsidiary EQM Midstream (BB/Negative) continues to experience delays and cost overruns with MVP due to environmental and regulatory challenges, including securing permits, which has led to a Negative Outlook. The in-service date is now expected to be late 2021. EQM plans to modify MVP’s construction program because of the Fourth Circuit Court of Appeals ruling on a topic pertaining to the Army Corps of Engineers. Fitch remains concerned about execution of the project. EQM’s earnings growth and the strengthening of its balance-sheet metrics are largely dependent on the completion of MVP.

For the complete Fitch Wire commentary, see link below:

https://www.fitchratings.com/research/corporate-finance/keystone-executive-order-sets-precedent-for-na-midstream-energy-28-01-2021