From an Article of the Pittsburgh Post Gazette, December 11, 2019

California-based energy company Chevron Corp. is putting its Appalachian oil and gas business up for sale, the company reported this week.

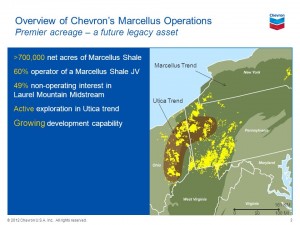

It has about 400 employees in the unit and a regional office in Coraopolis. Chevron controls about 890,000 acres in the Marcellus and Utica shales across Pennsylvania, West Virginia and Ohio.

The Appalachian shale operations contributed to more than half of a massive impairment charge that the company revealed for the fourth quarter. That charge, which writes down the value of assets on Chevron’s books, will be between $10 billion and $11 billion, the company disclosed Tuesday.

Chevron burst onto the scene in Appalachia in 2011 with a $4.3 billion acquisition of shale gas firm Atlas Energy Inc. Two years later, it paid $17 million for a stretch of land in Moon Township where the company planned to build a new regional headquarters.

In 2014, those plans were put on indefinite hold and never materialized. The following year, the energy giant cut more than 150 positions from its Appalachian division as natural gas prices slumped.

In leaving the region, Chevron follows in the footsteps of other multinationals that tried out the Marcellus and Utica shale regions but moved on in favor of other projects around the globe.

Indian conglomerate Reliance Industries Ltd bought Pennsylvania Marcellus assets in 2010 only to sell them off for a third of the price in 2017.

Noble Energy Inc., a Texas-based firm that also has projects in West Africa and Israel, made a bet on Appalachia with its $3.4 billion joint venture with CNX Resources in 2011. Six years later, it sold its stake in the venture and left this region.

Royal Dutch Shell, the Dutch giant whose chemicals subsidiary is building a massive ethane cracker plant in Beaver County, shelled out $4.7 billion for Warrendale-based East Resources in 2010. For years now, its drilling activity in Pennsylvania has been pared down significantly after underwhelming results and asset sales.

Yet smaller oil and gas firms are instead going all in on Appalachian shales.

Southwestern Energy Co., which began as an oil and gas driller in Arkansas, sold the last of its assets there last year to focus on its Appalachian portfolio in Pennsylvania and West Virginia.

Texas-based Range Resources Corp., too, pulled back on its operations in Louisiana after its ill-fated 2016 acquisition and rededicated itself to its program in Appalachia.

As did Downtown-based EQT Corp. when its dalliance with geographic diversification resulted in a $2.3 billion impairment charge — meaning the Permian Basin assets in Texas that EQT bought in 2014 and its holdings in Kentucky’s Huron Shale were actually determined to be worth that much less than what the company had on the books.

The Marcellus Shale, in particular, has taken the mantle as the most productive natural gas play in the U.S., and one of the most cost-efficient. Even so, the current price slump is a result of all that productivity — there is too much supply and not enough demand to soak it up.

Oil and gas price slump hanging around

So, with gas coming out of the ground faster than the U.S. can use it, gas producers are rushing to export their product abroad. Those closest to export terminals — most are on the Gulf Coast — have an advantage, according to Bloomberg Intelligence. Last month, Bloomberg analyst Vincent Piazza predicted that the Haynesville Shale in Oklahoma would see a resurgence because of that dynamic.

The low price of oil and gas — both global commodities at this point — means companies are looking to other aspects of their portfolios to set them apart, and those with more options can get picky.

“Good isn’t good enough,” Chevron’s CEO Michael Wirth said in an interview on CNBC’s show Squawk Box this week, explaining the massive write-down of the company’s Appalachian assets. “The assets in the Northeastern U.S. simply don’t compete as well for our investment dollar as others do,” he said, adding, “some of our assets may work better for others.”

>>>>>>>>>>>>>>>>>>>>>>>>>

See also: Chevron’s $11 billion write-down could hit the entire market, CNBC, December 11, 2019

>>>>>>>>>>>>>>>>>>>>>>>>>

See also the court challenge for farm damages:

Legal Case of Six Counts Seeing Jury Trial ….

Fayette County Court of Common Pleas

Docket # 2176 of 2019 GD, October 4, 2019

Brent G. and Wanda Y. Broadwater v. Chevron Appalachia, LLC et al

https://www.faymarwatch.org/documents/Brent_Broadwater_Chevron_lawsuit.pdf

{ 4 comments… read them below or add one }

PA Permit Violation Issued to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland County

Description: Environmental Health & Safety violation issued on 2019-12-06 to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland county. CSL 402(b) – POTENTIAL POLLUTION – Conducting an activity regulated by a permit issued pursuant to Section 402 of The Clean Streams Law to prevent the potential of pollution to waters of the Commonwealth without a permit or contrary to a permit issued under that authority by the Department.

Incident Date/Time: 2019-12-06 00:00:00

Tags: PADEP, frack, violation, drilling

PA Permit Violation Issued to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland County

Description: Environmental Health & Safety violation issued on 2019-12-06 to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland county. SWMA 301 – MANAGEMENT OF RESIDUAL WASTE – Person operated a residual waste processing or disposal facility without obtaining a permit for such facility from DEP. Person stored, transported, processed, or disposed of residual waste inconsistent with or unauthorized by the rules and regulations of DEP.

Incident Date/Time: 2019-12-06 00:00:00

Tags: PADEP, frack, violation, drilling

PA Permit Violation Issued to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland County

Description: Environmental Health & Safety violation issued on 2019-12-05 to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland county. CSL 402(b) – POTENTIAL POLLUTION – Conducting an activity regulated by a permit issued pursuant to Section 402 of The Clean Streams Law to prevent the potential of pollution to waters of the Commonwealth without a permit or contrary to a permit issued under that authority by the Department.

Incident Date/Time: 2019-12-05 00:00:00

Tags: PADEP, frack, violation, drilling

PA Permit Violation Issued to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland County

Description: Environmental Health & Safety violation issued on 2019-12-05 to Chevron Appalachia Llc in South Huntingdon Twp, Westmoreland county. SWMA 301 – MANAGEMENT OF RESIDUAL WASTE – Person operated a residual waste processing or disposal facility without obtaining a permit for such facility from DEP. Person stored, transported, processed, or disposed of residual waste inconsistent with or unauthorized by the rules and regulations of DEP.

Incident Date/Time: 2019-12-05 00:00:00

Tags: PADEP, frack, violation, drilling

Banks Get Tough on Shale Loans as Fracking Forecasts Flop —

Oil and gas companies face tightened credit after wells produce less than projected

By Christopher M. Matthews, Bradley Olson and Allison Prang, Wall Street Journal, Dec. 22, 2019

Some of the banks that helped fuel the fracking boom are beginning to question the industry’s fundamentals, as many shale wells produce less than companies forecast.

Banks have begun to tighten requirements on revolving lines of credit, an essential lifeline for smaller companies, as these institutions revise estimates on the value of some shale reserves held as collateral for loans to producers, according to people familiar with the matter.

The tightening financial pressure on shale producers is one of the reasons many are facing a reckoning going into next year. Chevron Corp. said Dec. 10 that it plans to take a charge of $10 billion to $11 billion, roughly half of it tied to shale gas assets, which it said won’t be profitable soon. Royal Dutch Shell PLC said Friday it will take a roughly $2 billion impairment, and other companies are expected to follow suit in writing down assets, according to analysts and industry executives.

The heat is greatest for small and midsize shale producers, including many whose wells aren’t producing as much oil and gas as they had projected to lenders and investors. Some of those companies may be forced out of business, said Clark Sackschewsky, the managing principal of accounting firm BDO’s Houston tax practice. Large companies are likely to weather the blow because of their size and global asset diversity, but for some smaller shale operators, tightening access to bank loans could prove disastrous.

“We’ve got another year under our belts with the onshore fracking assets, which includes less than optimistic reserves results, less production than anticipated, a reduction in capital investment into the market,” Mr. Sackschewsky said.

Oil and gas producers expect banks to cut their revolving lines of credit by 10% as a result of the reviews, according to a survey of companies by the law firm Haynes & Boone LLP. The cuts may be more severe, say some people familiar with the reviews.

Banks have extended billions of dollars of reserve-backed loans, though the exact size of the market isn’t known. JPMorgan said in a regulatory filing in September that it has exposure to $44 billion in oil and gas loans, and Capital One said in October it has extended more than $3 billion in oil and gas loans. It wasn’t clear for either bank what proportion of those are backed by reserves.

Banks have typically applied a 10% discount to the value of reserves, meaning a shale company could borrow against 90% of its reserves as collateral. Banks have typically lent as much as 60% of that value. But some are now discounting the value by as much as 20%, the people say.

Meanwhile, some regional banks have begun writing off bad energy loans. Net charge-offs shot up at Huntington Bancshares in the last quarter. The Ohio-based lender attributed the move primarily to two energy loans where the borrowers’ production had not met expectations, Huntington Chief Executive Officer Stephen Steinour said in an interview.

“Geology and the assumptions were just flawed,” Mr. Steinour said.

Many investors have lost faith in the viability of shale drillers, as natural-gas prices stayed low and many companies broke promises on how much their wells would produce and when they would begin to turn a profit.

As investors have retreated, cracks have begun to show. Energy companies accounted for more than 90% of defaults on corporate debt in the third quarter, according to Moody’s Investors Service. There were more than 30 oil-company bankruptcies in 2019, exceeding the number in 2018 and 2017. Exploration and production companies are now carrying more than $100 billion in debt, according to Haynes & Boone.

Skepticism among banks has grown in part because lenders have more closely scrutinized public well data on production and seen that it is falling short of forecasts, as a Wall Street Journal analysis showed earlier this year.

Specifically, banks have begun questioning shale producers’ predictions about their wells’ initial rate of decline, which are proving overly optimistic, according to engineers. If shale wells, which produce rapidly early and then taper off, are declining faster than predicted, questions arise regarding how much they will ultimately produce.

Another Oil Major Bails On Marcellus Shale | OilPrice.com

Your takeaway — By David Messler for Oilprice.com

The Chevron (CVX) write-down of its Marcellus assets surely won’t be the last in this play. There is just too much gas right now.

One of the problems with lower tiers of rock is that there are just less oil and gas contained in the volume of rock as opposed to Tier I acreage. This in part accounts for the sharp drop-off in production a few months after they are brought on line.

What’s next for CVX? It missed out on the Anadarko opportunity earlier this year. When the CEO says “we going to focus on the Permian,” is he talking up the possibility spending some of ~$10 bn in cash CVX has in its coffers? We wouldn’t be surprised.

Chevron will open Monday, the 23rd trading near recent highs. Knowing this charge will hit Q-4 earnings, the stock price will likely fall back toward the $110’s. It has been remarkably resilient in that area bouncing off it twice this year. CVX pays a sweet dividend of $4.76 per share, yielding just under 4 percent currently. By comparison peers Shell and BP are paying in the 6.5 percent range, so pure yield seekers might want to look at them.

Bottom-line. CVX made a misstep in the Marcellus and now must pay for it. None-the-less, it is an extraordinarily well managed company and we think at the sub-$110 level it belongs in every energy portfolio.

https://oilprice.com/Energy/Energy-General/Another-Oil-Major-Bails-On-Marcellus-Shale.html

Press Release from CHEVRON on 01/02/20

Advisory: Chevron Corporation’s 4Q 2019 Earnings Conference Call and Webcast

SAN RAMON, Calif.–(BUSINESS WIRE)–Jan. 2, 2020– Chevron Corporation (NYSE: CVX), one of the world’s leading energy companies, will hold its quarterly earnings conference call on Friday, January 31, 2020 at 11:00 a.m. ET (8:00 a.m. PT).

Conference Call Information:

Date: Friday, January 31, 2020

Time: 11:00 a.m. ET / 8:00 a.m. PT

Dial-in # (Listen-only mode): 706-634-0892 / 877-604-2078

Conference ID #: 4187997

To access the live webcast, visit http://www.chevron.com.

The meeting replay will also be available on the company website under the “Investors” section.

Chevron Corporation is one of the world’s leading integrated energy companies. Through its subsidiaries that conduct business worldwide, the company is involved in virtually every facet of the energy industry. Chevron explores for, produces and transports crude oil and natural gas; refines, markets and distributes transportation fuels and lubricants; manufactures and sells petrochemicals and additives; generates power; and develops and deploys technologies that enhance business value in every aspect of the company’s operations. Chevron is based in San Ramon, Calif. More information about Chevron is available at http://www.chevron.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200102005048/en/

Source: Chevron Corporation, Sean Comey, +1 (925) 842-5509