From an Article by Nick Cunningham, OilPrice.com, June 24, 2019

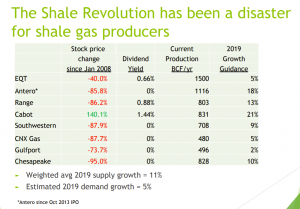

Fracking has been an “unmitigated disaster” for shale companies themselves, according to a prominent former shale executive.

“The shale gas revolution has frankly been an unmitigated disaster for any buy-and-hold investor in the shale gas industry with very few limited exceptions,” Steve Schlotterbeck, former chief executive of EQT, a shale gas giant, said at a petrochemicals conference in Pittsburgh. “In fact, I’m not aware of another case of a disruptive technological change that has done so much harm to the industry that created the change.”

He did not pull any punches. “While hundreds of billions of dollars of benefits have accrued to hundreds of millions of people, the amount of shareholder value destruction registers in the hundreds of billions of dollars,” he said. “The industry is self-destructive.”

The message is not a new one. The shale industry has been burning through capital for years, posting mountains of red ink. One estimate from the Wall Street Journal found that over the past decade, the top 40 independent U.S. shale companies burned through $200 billion more than they earned. A 2017 estimate from the WSJ found $280 billion in negative cash flow between 2010 and 2017. It’s incredible when you think about it – despite the record levels of oil and gas production, the industry is in the hole by roughly a quarter of a trillion dollars.

The red ink has continued right up to the present, and the most recent downturn in oil prices could lead to more losses in the second quarter.

So, questionable economics is not exactly breaking news when it comes to shale. But the fact that a prominent former shale executive – who presided over one of the largest shale gas companies in the country – called out the industry face-to-face, raised some eyebrows, to say the least. “In a little more than a decade, most of these companies just destroyed a very large percentage of their companies’ value that they had at the beginning of the shale revolution,” Schlotterbeck said. “It’s frankly hard to imagine the scope of the value destruction that has occurred. And it continues.”

“Nearly every American has benefited from shale gas, with one big exception,” he said, “the shale gas investors.”’

The industry is at a bit of a crossroads with Wall Street losing faith and interest, finally recognizing the failed dreams of fracking. The Wall Street Journal reports that Pioneer Natural Resources, often cited as one of the strongest shale drillers in Texas, is largely giving up on growth and instead aiming to be a modest-sized driller that can hand money back to shareholders. “We lost the growth investors,” Pioneer’s CEO Scott Sheffield said in a WSJ interview. “Now we’ve got to attract a whole other set of investors.”

Sheffield has decided to slash Pioneer’s workforce and slow down on the pace of drilling. Pioneer has been bedeviled by disappointing production from some of its wells and higher-than-expected costs.

But, as Schlotterbeck told the industry conference in Pittsburgh, the problem with fracking runs deep. While shale E&Ps have succeeded in boosting oil and gas production to levels that were unthinkable only a few years ago, prices have crashed precisely because of the surge of supply. And, because wells decline at a precipitous rate, capital-intensive drilling ultimately leaves companies on a spending treadmill.

Meanwhile, as the financial scrutiny increases on the industry, so does the public health impact. A new report that studied over 1,700 articles from peer-reviewed journals found harmful impacts on health and the environment. Specifically, 69 percent of the studies found potential or actual evidence of water contamination associated with fracking; 87 percent found air quality problems; and 84 percent found harm or potential harm on human health.

The health impacts have been a point of controversy for years, pitting the industry against local communities. The industry largely won the tug-of-war over fracking, beating back federal and state efforts to regulate it. However, the story is not over. Related: Philadelphia Refinery Explosion To Boost Gasoline Prices

In many cases, there is an abundance of anecdotal evidence pointing to serious health impacts, but peer-reviewed research takes time and has lagged behind the incredible rate of drilling. Now, the public health research is starting to catch up. Of the more than 1,700 peer-reviewed studies looking at these issues, more than half have been published since 2016.

One need not be an opponent of fracking to recognize that this presents a threat to the industry. For instance, a spike of a rare form of cancer has cropped up in southwestern Pennsylvania recently. The causes are unclear, but some public health advocates and environmental groups are pointing the finger at shale gas drilling, and have called on the governor to stop issuing new drilling permits. The Marcellus Shale Coalition, an industry group, said the request was “ridiculous.” The region is right at the heart of high levels of shale drilling, so any regulatory action coming in response the public health outcry could impact drilling operations. Time will tell.

In the meantime, poor financials are the largest drag on the shale sector. “And at $2 even the mighty Marcellus does not make economic sense,” Steve Schlotterbeck, the former EQT executive said at the conference. “There will be a reckoning and the only questions is whether it happens in a controlled manner or whether it comes as an unexpected shock to the system.”

{ 6 comments… read them below or add one }

Range Resources sells $634M in Appalachia assets to cut debt

By: Carl Surran, Seeking Alpha, News Editor, July 19, 2019

Range Resources (NYSE:RRC) agrees to sell a 2% proportionately reduced overriding royalty interest in 350K net surface acres in southwest Appalachia for $600M; the properties produced 1.9B net cfe/day in Q1.

RRC also completes the sale of certain non-producing acreage in Pennsylvania for $34M.

The company says the combined $634M in gross proceeds from the deal will reduce total debt by 17%, and it will have cut debt by $1B over the past 12 months.

RRC does not identify the buyers, but Franco-Nevada (NYSE:FNV) says it bought royalty interest on Marcellus Shale acreage from RRC for $300M.

Chesapeake Energy Is In Trouble

From Daniel Jones, Seeking Alpha, August 9, 2019

The market has turned, once again, against oil and gas firm Chesapeake Energy.

Rising debt, bad pricing, and negative free cash flow projected for this year is hurting the business materially.

This clearly overshadows what good news arose, and something big has to change in order for Chesapeake to survive long term.

Looking for a community to discuss ideas with? Crude Value Insights features a chat room of like-minded investors sharing investing ideas and strategies.

Things just keep getting worse for Chesapeake Energy Corp. (CHK), a major oil and gas (mostly gas) E&P (exploration and production) company that recently got slammed by a slew of mixed news. For years, the business has struggled to move from the point of surviving to the point of thriving, and if recent developments tell us anything, there’s still a lot of progress that needs to be done before investors can feel safe with the holding. In all, Chesapeake does seem to offer investors some attractive prospects, but if something major doesn’t change soon, there’s no telling how much longer the firm will be able to survive.

A look at the good news

I have covered Chesapeake closely for a few years now, and while there was a time where I seriously doubted the company’s survival, my general consensus as of late has been that the firm can probably survive, but that it’s tilting on the edge so much and upside (compared to others in the space) is limited to the extent that there are clearly better prospects to consider. Today, however, my thinking is shifting back again, teetering on the edge of thinking the company might just not make it. The reasons here are manifold, but before I dive into those, I should touch on some positive developments management had to share with investors and market watchers alike.

In its second quarter earnings release for its 2019 fiscal year, Chesapeake released guidance for what 2019 as a whole would look like. This can be seen in the image below, with the figures in bold representing categories that have changed compared to prior guidance. Looking into this picture, some things have clearly gotten better for the business. For starters, total production this year, at the mid-point, now looks set to be around 180.5 million boe (barrels of oil equivalent). This is up from the 179 million boe previously anticipated. Not only that, but oil production, which is something management has prioritized in recent months, should now end up coming in at about 43.75 million boe, up from the prior estimate of 43.50 million boe.

*Taken from Chesapeake Energy Corp.

Stronger production figures are great to see, and the move higher comes from strong performance already exhibited during the first two quarters this year. Oil output, for instance, is up 36% year-over-year, or about 10% after adjusted for M&A activity and asset divestitures. However, while production is a big contributor, the amount realized on that production is incredibly important as well. Previously, management had said that the differential for the company on its crude pricing would represent a $0.93 per barrel shortfall compared to WTI crude. This has now changed remarkably, moving to a premium at the mid-point of $2.05 per barrel. Given this year’s projected output, this change should equate to a pre-tax gain on cash flow (assuming oil prices remain unchanged) of $130.38 million.

Not only has the company seen some progress on the production and pricing side, it has seen improvements when it comes to operational stuff as well. According to management, the projected total savings the firm should realize, chalked up to M&A activity, should be between $250 million and $280 million, thanks to a roughly $600,000 per well cost reduction. In addition to this, management exchanged $884 million worth of senior notes due between 2020 and 2021 for new ones now due in 2026, leaving only $600 million, roughly, in maturities coming due before 2022. This significantly improves the business’s chances of being able to outlast the current low-energy price environment.

But a lot of bad remains

For all the good that has come up recently, there’s a lot more bad surfacing that should serve to scare investors in Chesapeake. For starters, we have cash flow expectations for the year. Driven by a mix of reduced energy prices and the fact that realized NGL pricing should be around 26.5% of WTI crude pricing vs. management’s prior forecast of 34.5%, the mid-point for EBITDA for 2019 should be about $2.510 billion, down from the $2.605 billion the company thought it would see when it released guidance earlier in the year. With capex still expected to remain unchanged at $2.185 billion at the mid-point, excluding $20 million in capitalized interest, operating cash flow should now be $1.806 billion vs. the $1.907 billion the company previously anticipated, while free cash flow should be -$398.98 million compared to prior guidance of -$298.1 million.

In all, this roughly $100 million decrease in expected free cash flow is bad by itself, but what’s worse is when you pair it up with what’s happening on the debt side of the equation. In its second quarter, the company’s total debt came out to $10.16 billion, up from the $9.98 billion seen at the end of its first quarter. Based on the $853 million in operating cash flow already seen this year and the $1.118 billion in capex allocated in the first two quarters, it’s implied that debt will probably rise a further $133.98 million before 2019 is over, bringing net debt (inclusive of $4 million in cash) up to $10.29 billion. This should translate into a net leverage ratio for the business of about 4.1.

Takeaway

If Chesapeake were in a position where its growth rate were more robust than it is and/or if the company was actually able to see positive free cash flow, I wouldn’t be too concerned over its position, but the fact of the matter is that a mix of high leverage, slow growth (in all but oil) and negative free cash flow looks really bad for the enterprise. Absent something big changing, like energy prices surging higher again and/or material debt and cost reduction caused by asset divestitures, Chesapeake looks to be in a world of hurt moving forward.

https://seekingalpha.com/article/4283857-chesapeake-energy-trouble/

Notice Regarding EQT on Marcellus Shale Development

EQT is having “Landowner Town Halls”: According to EQT, the new President & CEO Toby Rice is going to talk about his mission to realize the full potential of EQT and its “renewed commitment to landowners and communities” and how it will make a difference. We will see.

The West Virginia town hall is Monday August 19, 2019, from 6 to 8 pm at the Bridgeport Conference Center, 300 Conference Center Way, Bridgeport, WV 26330. Also in Bentleyville, PA, on August 20th. These are open to the public.

View the flyer here:

https://wvsoro.org/wp/wp-content/uploads/2019/08/image001.png

Idled frac fleets sold for scrap amid shale drilling slump

By David Wethe, World Oil, 10/30/2019

HOUSTON (Bloomberg) – The downturn in shale drilling has been so steep and brisk that oilfield companies are taking the unprecedented step of scrapping entire fleets of fracing gear.

With almost half of U.S. frac firepower expected to be sitting idle within weeks, shale specialists including Patterson-UTI Energy Inc. and RPC Inc. are retiring truck-mounted pumping units and other equipment used to shatter oil-soaked shale rock. Whereas in previous market slumps, fracers parked unused equipment to await a revival in demand, this time it’s different: Gear is being stripped down for parts or sold for scrap.

As stagnant oil prices and investor pressure discourage new drilling, the fracing industry that was growing so fast it couldn’t find enough workers as recently as two years ago now finds itself buried in a mountain of pumps, pipes and storage tanks. The contagion is spreading beyond fracing specialists to sand miners and the truckers who haul it. U.S. Silica Holdings Inc., the top supplier of frack sand, tumbled 38% on Tuesday after announcing plans to shut mines on the back of disappointing quarterly results.

“We don’t learn from our mistakes in this industry, do we?” said Joseph Triepke, founder of Infill Thinking LLC and a former analyst at Citadel LLC’s Surveyor Capital. “The U.S. oilfield-service sector has overshot the growth cycle again resulting in a capacity glut. There’s too much of everything, from horsepower to sand.”

Fracing an oil well involves surrounding the hole with an array of pumping trucks and other equipment that shoot high-pressure jets of water, sand and chemicals deep underground. For that reason, capacity is measured in horsepower.

About 2.2 million horsepower, or roughly 10% of industry capacity, already has been earmarked for the scrap heap, according to Scott Gruber, an analyst at Citigroup Inc. In addition to Patterson and RPC, Gruber said industry titans Schlumberger Ltd. and Halliburton Co. probably are retiring parts of their fleets, and at least another 1 million horsepower needs to be eliminated to halt the slide in fracing fees.

A spokeswoman for Halliburton declined to comment. A spokesman for Schlumberger referred to comments by CEO Olivier Le Peuch on a third-quarter earnings call, where the executive said it was too early to give specifics about activity levels.

“Much needed attrition is (finally) materializing,” analysts at Tudor Pickering Holt & Co. wrote in a note to clients. “We wouldn’t be surprised to hear other pumpers jump aboard the fleet retirement train in the coming weeks.”

The Philadelphia Oil Services Index has climbed 3% since RPC kicked off the round of pump-scrapping announcements last week.

On a recent day in Odessa, Texas, in the heart of the Permian Basin, more than a dozen well-worn sand-hauling trucks sat parked in a dusty lot owned by RPC’s Cudd Energy unit. It was a similar scene at nearby equipment yards, where everything from drill pipe hooks to rigs sat idle.

Land-based oilfield companies have been more pitiless than their offshore counterparts who stalled and delayed for years before demobilizing some of their most sophisticated and expensive gear. Transocean Ltd. parked deepwater drilling vessels in Caribbean waters at a cost of about $15,000 a day each to await an offshore revival. When it never came, the Swiss-based operator and rivals scrapped rigs that cost billions of dollars to construct.

Estimates for total U.S. fracing capacity vary but Bank of America Merrill Lynch puts the figure at almost 25 million horsepower. Just 13 million of that is forecast to still be at work during the final months of this year, down from 17 million during the second quarter of 2018, according to Bank of America’s Chase Mulvehill.

And next year doesn’t look much brighter. Baker Hughes Co., which owns a stake in the frack provider BJ Services, warned investors Wednesday that explorer spending in North America could drop by a rate that’s in the low double digits.

The number of fracing crews deployed to wellsites across the U.S. already has fallen to the lowest in more than two years, according to Primary Vision Inc.

“We’ll need to see oodles (and oodles) more attrition from other pumpers to clean up this market, absent a notable demand boost,” the Tudor analysts wrote.

https://www.worldoil.com/news/2019/10/30/idled-frac-fleets-sold-for-scrap-amid-shale-drilling-slump/

PA Permit Violation Issued to EQT Prod Co in Nottingham Twp, Washington County

Description: Environmental Health & Safety violation issued on 2019-12-12 to Eqt Prod Co in Nottingham Twp, Washington county. SWMA 301 – MANAGEMENT OF RESIDUAL WASTE – Person operated a residual waste processing or disposal facility without obtaining a permit for such facility from DEP. Person stored, transported, processed, or disposed of residual waste inconsistent with or unauthorized by the rules and regulations of DEP.

Incident Date/Time: 2019-12-12 00:00:00

Tags: PADEP, frack, violation, drilling

PA Permit Violation Issued to EQT Prod Co in Nottingham Twp, Washington County

Description: Environmental Health & Safety violation issued on 2019-12-12 to Eqt Prod Co in Nottingham Twp, Washington county. 91.34(A) – ACTIVITIES UTILIZING POLLUTANTS – Failure to take necessary measures to prevent the substances from directly or indirectly reaching waters of this Commonwealth, through accident, carelessness, maliciousness, hazards of weather or from another cause.

Incident Date/Time: 2019-12-12 00:00:00

Tags: PADEP, frack, violation, drilling

PA Permit Violation Issued to EQT Prod Co in Nottingham Twp, Washington County

Description: Environmental Health & Safety violation issued on 2019-12-12 to Eqt Prod Co in Nottingham Twp, Washington county. 78A57(A)___ – CONTROL, STORAGE AND DISPOSAL OF PRODUCTION FLUIDS – Operator discharged brine and other fluids on or into the ground or into the waters of this Commonwealth.

Incident Date/Time: 2019-12-12 00:00:00

Tags: PADEP, frack, violation, drilling

EQT Pays Big Money to Hire Former CONSOL Exec as CFO

From Marcellus Drilling News, January 6, 2020

EQT has just lured CONSOL Energy’s chief financial officer David Khani (CFO) away and hired him–for BIG money. Big in our book anyway. David Khani was paid a signing bonus of $2 million and will get an annual base salary of $540,000 per year. Plus bonuses. Who says bean counters don’t make big money?

https://marcellusdrilling.com/2020/01/eqt-pays-big-money-to-hire-former-consol-exec-as-cfo/