Letter to Editor of Morgantown Dominion Post, Jim Kotcon, August 27, 2017

Your August 21st editorial criticizing the proposal by Gov. Jim Justice to use taxpayer dollars to provide a $15 per ton subsidy for coal was correct. Gov. Justice may have changed his registration to Republican, but this proposal illustrates that his “tax and spend” mentality has not changed. Fortunately, it is doubtful that such a crackpot idea will ever be approved.

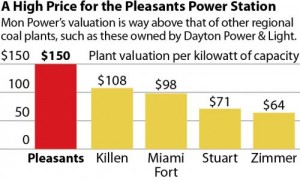

But a more insidious and serious threat looms for West Virginians. Our local utility, Mon Power, is proposing to bail out its Ohio affiliate by purchasing an outdated and uncompetitive power plant.

The Pleasants plant is over 30 years old, and has the highest emissions of sulfur dioxide of any conventional coal-fired plant in West Virginia.

This plant cannot compete on the open market in Ohio, but if the transfer to Mon Power is approved, we ratepayers will be forced to guarantee a profit to Mon Power stockholders, regardless of whether the plant is needed or cost-effective. Good deal for them, bad for us.

This has happened before. In 2009, First Energy installed $700 million scrubbers at the Hatfields Ferry plant, then closed it in 2013. Check your most recent electric bill, and you will find an “Environmental Control Charge” that we are still paying for those costs, even though the plant is closed.

Also in 2013, Mon Power acquired the Harrison plant, promising that it would lower our electric bills. Instead, a recent study found that Mon Power ratepayers have paid more than $160 million more for electricity than if the transfer had not occurred.

The West Virginia Sierra Club and Mountaineers for Progress will host a public forum on this issue at the Mon Arts Center at 7 p.m. September 7th. The state Public Service Commission will hold a hearing on the plant transfer at 6 p.m. September 12th, at the Monongalia County Courthouse.

If you are tired of paying ever-increasing electric bills so that out-of-state investors are guaranteed a profit at your expense, please come to these events and let our public officials know how you feel.

>>> Jim Kotcon, West Virginia Sierra Club, Morgantown

{ 1 comment… read it below or add one }

FirstEnergy drops the price of four Pa. power plants to push their sale

By Anya Litvak / Pittsburgh Post-Gazette, September 6, 2017

FirstEnergy Corp. has dropped the sales price for five natural gas plants and a hydro electric facility in Pennsylvania and Virginia in an effort to close on a drawn-out deal with a New York-based private equity firm.

The Ohio-based power company had announced in January that it would sell four natural gas power plants — the Springdale Generating Facility in Allegheny County; the Gans Generating Facility in Greene County; the Chambersburg Generating Facility in Franklin County; and the Hunlock Green gas power plant in Luzerne County — along with its stake in the Bath County pumped storage facility in Virginia to LS Power Equity Partners III LP for $925 million in cash.

The move was part of FirstEnergy’s goal of transitioning into a completely regulated company and minimizing its exposure to competitive electric generation markets.

But negotiating the finer points of the sale proved a challenge.

By late May, FirstEnergy subsidiaries “exercised a provision in the purchase agreement that allows either party to terminate the purchase agreement without penalty after June 23, 2017,” the company disclosed in its second quarter report to analysts.

FirstEnergy said it was still trying to work out a deal, but the company’s competitive generation division had to record a write-down of $131 million for the second quarter “as a result of the status of these ongoing negotiations” and “reflecting the impact of prevailing market conditions.”

On Wednesday, the company announced that it has amended its original agreement with LS Power to lower the overall price to $825 million and throw in a bonus — its interest in another natural gas plant, the Buchanan Generating Facility in Oakwood, Va.

While FirstEnergy expects the Pennsylvania natural gas plants to be sold by the end of the year, with the Virginia assets being transferred early next year, there are still some debt financing arrangements for Bath that need to fall into place before the deal can close.

“The 20 employees at these plants will be offered employment with the new owner,” FirstEnergy said in a statement.

Power Source: http://www.post-gazette.com/powersource/companies/2017/09/06/FirstEnergy-drops-the-price-of-four-Pa-power-plants-to-push-their-sale-LS-Power-Springdale-Chambersburg-Oakwood-Luzerne-Gans/stories/201709060111