One night stand for shale drilling and fracking

Essay by S. Tom Bond, Retired Chemistry Professor and Resident Farmer, Lewis County

Fracking does produce a lot of energy, from one well. And a lot compared to what was produced before in the United States, that is. The frackers like to forget some pretty significant details, though.

Take “energy independence,” for example. Listening to the song in the news papers you’d hardly realize, in spite of the “oil independence thing,” The U. S. had to import an average of 1.9 million barrels of oil each month in the year ending October of 2015. That’s a U. S. Energy Information Administration figure.

And why does the monthly production of gas keep rising? It is true that individual wells keep producing more. Laterals are longer, perforations are closer together, but recovery of gas, compared to what is in the shale is still miserable, usually about 7% relatively as high as 10%, where a conventional oil well gets 35 to 45% and even 5 to 15% more with tertiary recovery. For fracked gas, recovery is 7 to (rarely) 10%, and there is no “secondary recovery” technology as for oil. The celebrated “improvement in efficiency” is improvement in what can be marketed per well, not from the field.

One of the properties of fracking that endears it to investors is the rapid rate of return. Often as much as half the ultimate recovery comes in the first two years. This encouraged the overheated investment which characterized the early stages of fracking. Investors loved getting their investment back in a few years, rather than waiting decades, as is the case with most kinds of investment. Then the well runs out in seven or eight years. Claims to the contrary are fraudulent. This means that production of a field can rise or decline fast. To keep production up the industry must constantly be drilling new wells.

All those new wells means huge quantities of materials are required. Steel, frack sand from Wisconsin (or proppant from China), and truly vast quantities of water, which must be transported far in the summer when it gets dry, and in the winter when it’s frozen.

The water is taken to obscure locations which engineers think have the best prospects. Thousands of truck loads are required per well. All this takes big bucks, $10M is in the middle of the price range for a Marcellus well. These characteristics make fracking expensive, $25 to $45 per barrel of oil more than conventional oil, or gas equivalent to a barrel of oil. Such economic details are not discussed by the industry.

Obtained along with the oil and/or gas is the by-product fluid, sometimes called “frack water” or “brine,” which is a major problem. Originally much of it was spread around the area by spreading on roads for dust control or ice clearing, on fields, or sneaking it to a creek when they thought no one was watching. Now the standard procedure is to pump it down wells, in volume equivalent to several houses day after day, week after week. What is at the bottom of the hole it goes into? Nothing, just almost invisible cracks! No wonder it causes earthquakes. Where will it go in time?

The natives of fracking areas (in this case American citizens) are restless because of waste disposal and a spectrum of other complaints, ranging from ruined aquifers, to sickness due to air and water contamination, property devaluation by an average of $30, 000 for homes within one mile of a frack pad according to one study, and general inconvenience, uglyfication of the surroundings and the tilt of government agencies that should be protecting citizens.

How long will it last? There are several ways to describe reserves of oil and gas. What we need to consider here is the total reserves, all that is in the ground, or “gas in place,” and recoverable reserves, what can be taken out of the ground economically, also called “economically recoverable reserves”. The first is determined by taking samples and multiplying by the volume of the source rock determined by geology, no simple process and subject to errors due to the uneven nature of these deposits. The second is even more difficult to determine, because it increases with improvement of technology which allows a driller to get more from a given area, and with increasing price, allowing more expense in producing a barrel while still making an acceptable profit. Even the best technology doesn’t get near all, though. Some 90 to 93% of fracked gas must be left in the ground.

“We have a supply of natural gas that can last America nearly 100 years,” US President Barack Obama declared in his 2012 State of the Union address. Doubtless this figure comes from the industry, which in turn is using gas in place figures, rather than economically recoverable reserves.

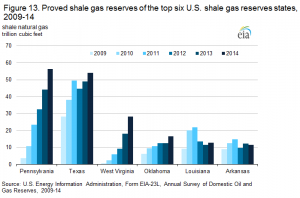

The U. S. Energy Information Administration gives these figures for the United States:

>>> proved reserves: 338,000,000,000 cubic feet. (2014, latest year available)

>>> annual consumption: 26, 698, 000,00 cubic feet (2014, latest year available)

Now, that is twelve and two-thirds years. In testimony before the Natural Resources

Committee of the Parliament of South Australia (a “state” of the country Australia) Anthony Ingraffea of Cornell University said, “So, the US will never be oil energy independent. It never was, it never will be. It can’t be. We consume too much and we can’t produce enough.

“Let’s turn to shale gas. Six years ago the US was producing and consuming 23 trillion cubic feet of gas per year. We’re now producing and consuming almost 26 trillion cubic feet of gas. We are gas energy independent. Before the shale gas we were on our way to becoming gas energy dependent. We were starting to import natural gas from the Middle East and from Canada. We no longer do that. So shale gas has made the US gas independent. The US is not energy independent. We are not fossil fuel independent because we will never produce enough oil, but we are gas independent.

“But, as I pointed out before, the shale gas boom has bust. We produced 26 trillion cubic feet in 2014. Our Energy Information Administration is predicting that by 2016-17 total production of shale gas will start to decline. Most industry analysts are expecting that we will run out of shale gas at the current rate at which we are producing it, without exporting any of it, in about 10 to 12 years. If we start exporting it, we will be out of it in a much shorter period of time. It’s a flash in the pan.”

Who do you believe, the people who work with the actual figures or the people who want to make a fortune and have a timeline where seven years is where infinity begins. That is, they give no consideration beyond five or six years.

Sure, proved reserves will increase, but so will annual consumption, even the traditional uses. Then throw in the generation of electrical power, and worse, export of liquefied natural gas, and what happens? With the rapid decline of shale wells, the low recovery rate, and the huge capital investments which must be attracted, it is hard to justify much optimism. Particularly by the one who ultimately must pay the price, the customer.

Never the less, there has been a barrage of favorable articles by West Virginia legislators. The urban newspapers jump to carry these paeans. This diverges from the facts, but newspaper editors do a lot of reading, and probably don’t have time to check the facts, even those as obviously critical as the one in the second paragraph above. They rely on “Authority” of a speaker, I use a capital A to distinguish Authority of power from authority of seeking out the facts. As for legislators, they have a lot of hands to shake, and a lot of people to please who provide money for campaigns and influence.

Are all these new pipelines necessary when over 26 trillion cubic feet are getting to market now? And who benefits from putting them in, whether they are needed or not? A little labor, and a little more equipment manufacturers. But the big beneficiaries are the megabanks, the ones that almost took the nation’s financial system down in 2008 with the subprime scam.

They get their money if anyone does. And the government bails them out if they get in trouble. The “too-big-to-fail-no-matter-what-they-do” banks. Of course, the E & P (exploration and production) companies, primarily take the risk and then the fall, along with the residents in fracking areas.

Quiet! You can hear the thud now, if you listen closely.