Goodies for the oil and gas industry may be the dumbest idea yet

An Essay by S. Tom Bond, Retired Chemistry Professor & Resident Farmer, Lewis County, WV

An article entitled “Oil plunge sparks calls for Congress to act,” published in The Hill on January 10 is making the rounds now. The Hill bills itself “a top US political website, read by the White House and more lawmakers than any other site — vital for policy, politics and election campaigns.” It is considerably overbalanced to the right, and the piece under consideration is found under “opinion.”

The first line give the thesis of the article: As the price of oil plunges to its lowest point in 12 years — and threatens to drag the broader U.S. economy down with it — lawmakers say Congress should consider helping teetering energy companies with policy fixes beyond the decision to lift the oil-export ban.

The kind of fixes suggested include: (1) expediting the process for exporting liquefied natural gas; (2) easing environmental and other regulations; (3) taking retaliatory trade measures against Saudi Arabia; (4) pushing legislation to allow companies to gather natural gas from oil wells on federal land; and (5) help our industry compete by having infrastructure. That means the right mix of pipelines, transmission lines, rail, roads, i. e., have the government build it for them.

Facts listed in the article are essentially correct, it is the unsaid facts that are not taken into account that destroy the argument. There are several facts of overwhelming importance. First is that the U. S. is a huge importer of oil. For the month of October, 2015, our total imports were 273,000,000 barrels. What does export mean when we are importing that much oil?

How can you export fracked oil when fracking entails using so much energy, equipment, materials and chemicals. Facking costs an extra $20 to $40 per barrel, compared to conventional recovery. Deep sea drilling is similar, as is arctic drilling, which hasn’t even been proved feasible. How does this extra cost stack up against the $20 a barrel total extraction cost for Saudi Arabia, mentioned in the article?

“Oil plunge sparks calls for Congress to act” hypothesizes that the Saudi kingdom is keeping up production (world price was below $32 when this was written) in a bid to expand market share and undercut competitors. That’s a strange complaint from a “conservative.” Aren’t the markets supposed to do that sort of thing? If you read around, others have said they want to attack Iran, infringe on Russia (the second leading exporter of natural gas), and the U. S. fracking industry, which is doubtless the least likely target, with its high extraction costs. It already has the $20 – 40 disadvantage.

Now the claim about Russia being in second place. Russia exported 10.5% of the total exported (in 2014), while Saudi Arabia exported 18.5%. Incidentally Canada, in fourth place, exported 6.1% mostly to the U. S. This author thinks Saudi Arabia may have been telling the truth that they were keeping up production because they didn’t want their oil to be “stranded,” left in the ground when hydrocarbons are no longer the main source of energy. The progress of solar and wind power will not be discussed here.

What so many people seem unwilling to realize is that the U. S. covers only about 4 percent of the dry land on Earth. We supplied the rest of the world for decades, being first to develop the technology to remove oil. Now we are getting to the last dregs, and using so much ourselves we really are not is a position to export from the point of view of the public interest. We have relatively more natural gas, but do not stack up well in comparisons with other nations. Russia has five and a half times as much, Iran has nearly four times as much as the U. S. (Yes, we have more gas than Saudi Arabia, 6% more. See the CIA World Fact Book, which is on line.)

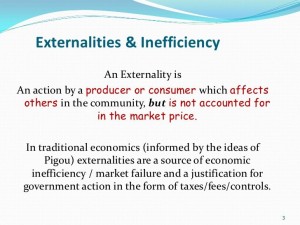

The truth is that fracking’s extra costs are small compared to its vast externalized costs. This includes multiple factors, such as depreciated value of property where fracking takes place, obvious from the beginning, but just now beginning to be documented. More than one of these studies now exist, with comparable conclusions. Losses to other industries such as farming, recreation, forestry, the retirement industry, are ignored. Health effects on the surrounding population is another cost just now being studied and recognized. Long time environmental costs, effects on water quality, loss of aquifers, and the formation of mini-brownfields where the soil is poisoned and treated as if they did not exist.

Then there is the two billion dollar debt mountain that belongs to the industry. As of January 7, 2016, there have been 38 bankruptcies in the exploration and production (E&P) section of the industry, amounting to $18 billion. These have been Chapter 11 bankruptcies (restructuring). These wipe out shareholders, but keep key executives in place to seek funds and go ahead. The last resort are Chapter 7 bankruptcies, which are still to come, which eliminate management so the company is wiped out and gives the remaining value to shareholders. The other 21 E&P companies risk this fate.

The industry has been losing money for those who speculate in stored oil. They bought high and have been forced to sell low. And it’s not likely to get better for a while.

All Congress can do is increase these externalized costs. There is no way they can reduce the monetary cost of the fracking process. (It would be against conservative principles to provide government funding for the cost of infrastructure to promote these industries: pipelines, railroads, roads, storage tanks, etc. Those are costs of doing business.)

Businessmen and legislators should accept the fact that fracking is an expensive, dirty, dangerous way to get oil and gas. No amount of propaganda will change that.

{ 2 comments… read them below or add one }

” Fricking Fracking ”

Conglomerates come then they go,

Leaving others with their mess,

It’s a very dodgy dice they throw,

All they do is cause distress.

Oil, diamonds bright shiny gold,

Just to fill their pockets,

Their very souls are what they’ve sold,

To fill in Satans dockets.

It’s all for you is what they tell,

Your lives we will make sunny,

Let them all go rot in Hell,

They’re in it for the money.

Please don’t believe in their false hype,

Their fantasy tales are hollow,

Cancers then illnesses of every type,

Are exactly what will follow.

Earthquakes, poisoned water supplies,

That’s the price you’ll pay,

They don’t care what lives or dies,

Or whomever they betray.

Bribery is their weapon of hope,

They want a positive answer,

Without us they just cannot cope,

In effect they’re like a cancer.

Our planet is under serious threat,

The protesters deserve our backing,

Wanton greed we won’t aid and abet,

You can keep your,

‘’ Fricking Fracking ‘’

Low Gas Prices Cause For Concern

Letter to the Editor, The Journal & Topics, Des Plaines, Illinois, December 31, 2015

The current glut of oil and natural gas has caused fuel prices to drop, which may seem to be something for consumers to celebrate. However, the low prices create the wrong incentives for businesses and consumers. Low prices for fossil fuels weaken the business case for and the returns from investments in renewable energy and energy efficiency. Therefore, the current low gas and oil prices encourage greater reliance on fossil fuels, which in turn means more oil and gas will be fracked and pumped from the earth, and as a result the rate of carbon dioxide being added to the atmosphere will increase.

The occurrence of human-caused global warming is well documented and the science regarding it is settled. Ninety percent of the world’s glaciers are shrinking. The global average temperature is steadily increasing, with 2014 being the warmest year in existing records covering hundreds of years, and 2015 is on track to break that record. Sea levels have risen 8 inches over the last century and the rate of rise is increasing. Ocean acidification due to absorption of carbon dioxide from the atmosphere is killing coral all over the globe.

In addition to global warming, there are many other reasons to de-carbonize our energy system, such as negative health impacts of ozone and particulate pollution, destruction of natural lands by mining and drilling, oil spills, and depletion of finite resources. Exhausting earth’s finite fossil fuel resources as fast as we possibly can, while in the process dramatically warming the climate and swamping the earth’s coastlines with many feet of sea level rise, is an outcome we should do all we can to avoid.

In order to avoid this, the problematic incentives due to low fossil fuel prices need to be fixed by shifting the costs of the “externalities” — damage to our climate, our health and to future generations — onto fossil fuels themselves. The low prices of fossil fuels rely on the fact that carbon dioxide waste from burning them can currently be disposed of free of charge into the atmosphere. This can be corrected by placing a small but rising fee on fossil fuels, based on the amount of carbon they will emit, and imposed at the well, mine or port of entry. The revenues from this fee could be returned to households as a uniform monthly dividend.

The dividend would make the fee revenue-neutral, would cushion the cost to consumers and act as an economic stimulus. This market-based, revenue-neutral approach to pricing carbon is known as Carbon Fee and Dividend. It has been gaining support and recognition among policymakers, including among the heads of state and negotiators right now at the Paris Climate Conference. George Schultz, the former Secretary of State under President Reagan, is an enthusiastic supporter of Carbon Fee and Dividend. Our Congress should enact Carbon Fee and Dividend legislation.

It will efficiently reduce carbon emissions without sacrificing economic growth, will create the right incentives to conserve, to innovate and invest in alternatives, and will position the U.S.A. as a leader in de-carbonization and clean energy.

Wharton Sinkler, Des Plaines, Illinois

Source: http://www.journal-topics.com/opinion/article_2f4d4e52-afd8-11e5-b9fb-6b1e5ea463b2.html