`Monster’ Gas Wells in the Shale Patch Still Flowing at $2.00 per Thousand Cubic Feet

From an Article by Jonathan Crawford, Bloomberg News, November 6, 2015

>> Utica’s share of the natural gas supply in the northeastern US may double in five years

>> Prolific Utica and Marcellus wells paying off even as natural gas prices slump

Prolific natural gas wells in the Utica region are helping drillers in the eastern U.S. survive the worst price collapse in three years.

While producers are choking back gas flows across the U.S., explorers in the Utica are cutting costs and boosting output to increase profits. EQT Corp.’s return from one of the “monster wells” there may reach 47 percent, four times the average in the neighboring Marcellus Shale, according to consultant Bentek Energy LLC.

Output in the Utica, which stretches from Ohio to New York, is “becoming more economic, even in an environment when it’s $2 gas,” said Luke Jackson, an analyst for Denver, Colorado-based Bentek Energy LLC.

U.S. gas suppliers have become more resilient in response to sinking prices that are on pace to average the least this year since 1999. The added production from the Utica threatens to prolong a nationwide glut of the power-plant fuel and keep prices low. Production there may continue to gain at a gas price as low as $1.69 per million British thermal units, according to Bloomberg New Energy Finance.

Magnitude of Utica Well Production

“We’re probably seeing the worst-case scenario right now and these wells are still producing a lot of gas and are still economic to develop,” Maria Cortez, a Houston-based research analyst at Wood Mackenzie Ltd., said by phone Wednesday. “The sheer size of them really outweighs any negative impact from the pricing.”

Natural gas for December delivery rose 1.1 cents to $2.375 per million British thermal units at 12:58 p.m. on the New York Mercantile Exchange. Futures have slipped 12 percent in the past two months.

Rigs targeting gas in the Utica climbed to a six-month high last week. Those in the Marcellus have meanwhile fallen almost 40 percent since April, Baker Hughes Inc. data show. Gas output from a new well in the Utica will surge to 6.15 million cubic feet a day in November, topping all basins except the Marcellus, U.S. government data show.

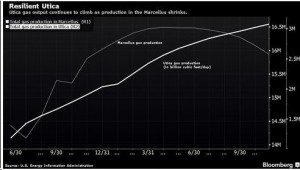

Utica gas output continues to climb as production in the Marcellus shrinks, as seen in the graph above.

EQT is putting expansion on hold in parts of the Marcellus to home in on drilling in the Utica, planning 10 to 15 wells there next year, Chief Executive Officer David Porges said in a call with investors in October. The Utica formation “could be larger than the Marcellus over time,” he said.

“We are encouraged by the early results from our well and others in the Utica and will know even more as we continue testing throughout the rest of the year and into 2016,” David Schlosser, the company’s executive vice president of engineering geology and planning, said in an e-mailed statement Friday. “The Utica certainly has the potential to be more economic than the Marcellus, but it’s too early to make a definitive call.”

Doubling Share as Utica Output Matches Marcellus

Cortez said the Utica’s share of gas production in the Northeast US may double in the next five years and eventually match the output of the Marcellus as costs shrink. Production at an EQT well in the Utica reached an initial rate of 73 million cubic feet, a level of output unheard of in the rival Marcellus basin, Cortez said.

“It was the Marcellus for a long time, 2011, 2012, 2013 — now, I think increasingly more folks are talking about the Utica,” Jackson said at the Platts 17th Annual Financing U.S. Power conference in New York last week. “This is really why we think gas prices will be lower for longer, is because we have so much production coming out of this northeast region.”